Vale Investor Day Presentation Deck

48

3

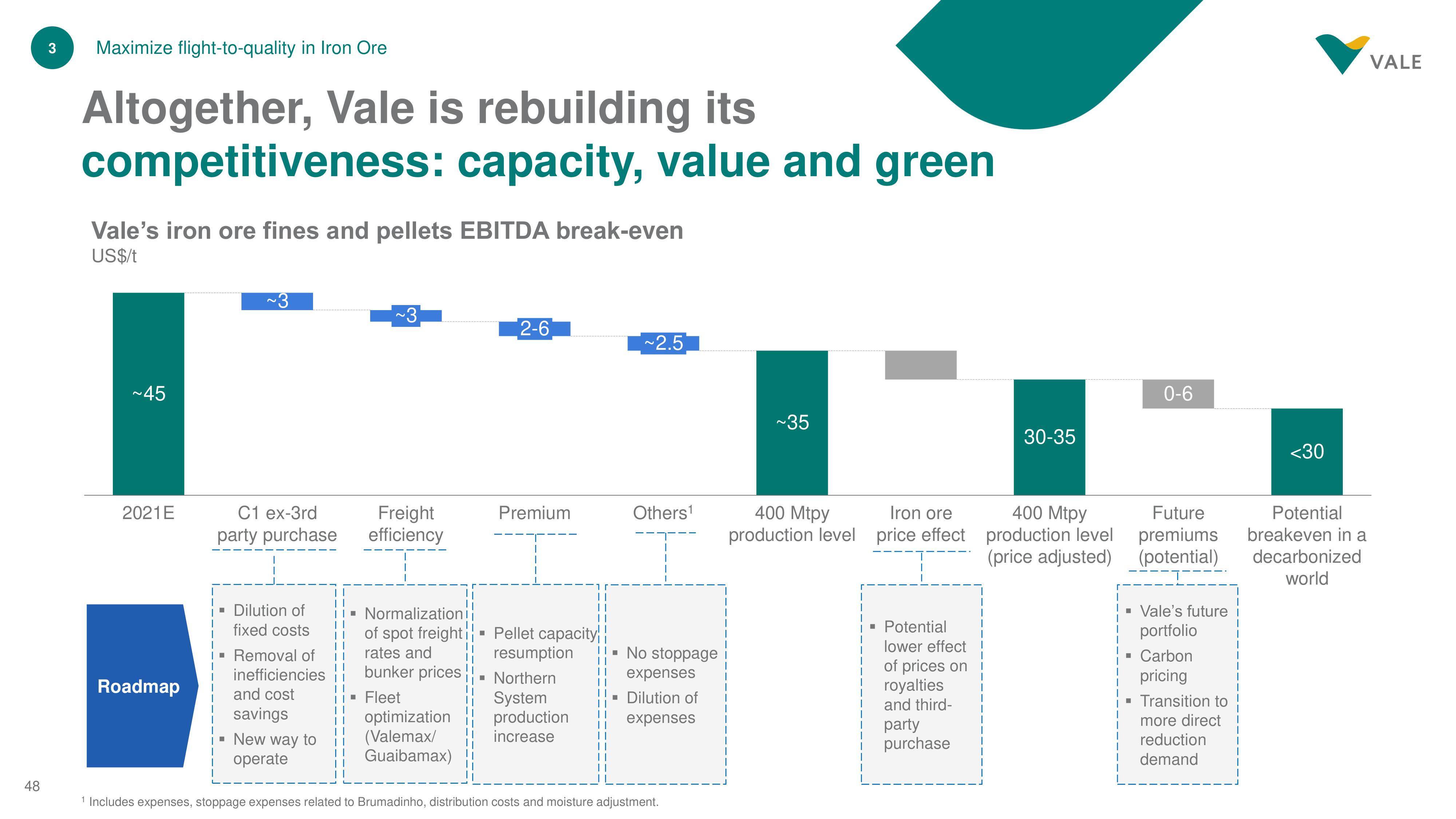

Maximize flight-to-quality in Iron Ore

Altogether, Vale is rebuilding its

competitiveness: capacity, value and green

Vale's iron ore fines and pellets EBITDA break-even

US$/t

~45

2021E

Roadmap

~3

C1 ex-3rd

party purchase

▪ Dilution of

fixed costs

▪ Removal of

inefficiencies

and cost

savings

New way to

operate

||

||

||

||

~3

Freight

efficiency

▪ Normalization

of spot freight

rates and

bunker prices

▪ Fleet

optimization

(Valemax/

Guaibamax)

2-6

Premium

Pellet capacity

resumption

▪ Northern

System

production

increase

||

||

11

11

I

~2.5

Others¹

No stoppage

expenses

- Dilution of

expenses

¹ Includes expenses, stoppage expenses related to Brumadinho, distribution costs and moisture adjustment.

~35

400 Mtpy

production level

Iron ore

price effect

▪ Potential

lower effect

of prices on

royalties

and third-

party

purchase

30-35

400 Mtpy

production level

(price adjusted)

0-6

Future

premiums

(potential)

▪ Vale's future

portfolio

▪ Carbon

pricing

▪ Transition to

more direct

reduction

demand

<30

Potential

breakeven in a

decarbonized

world

VALEView entire presentation