Ryanair Low Fares Made Simple

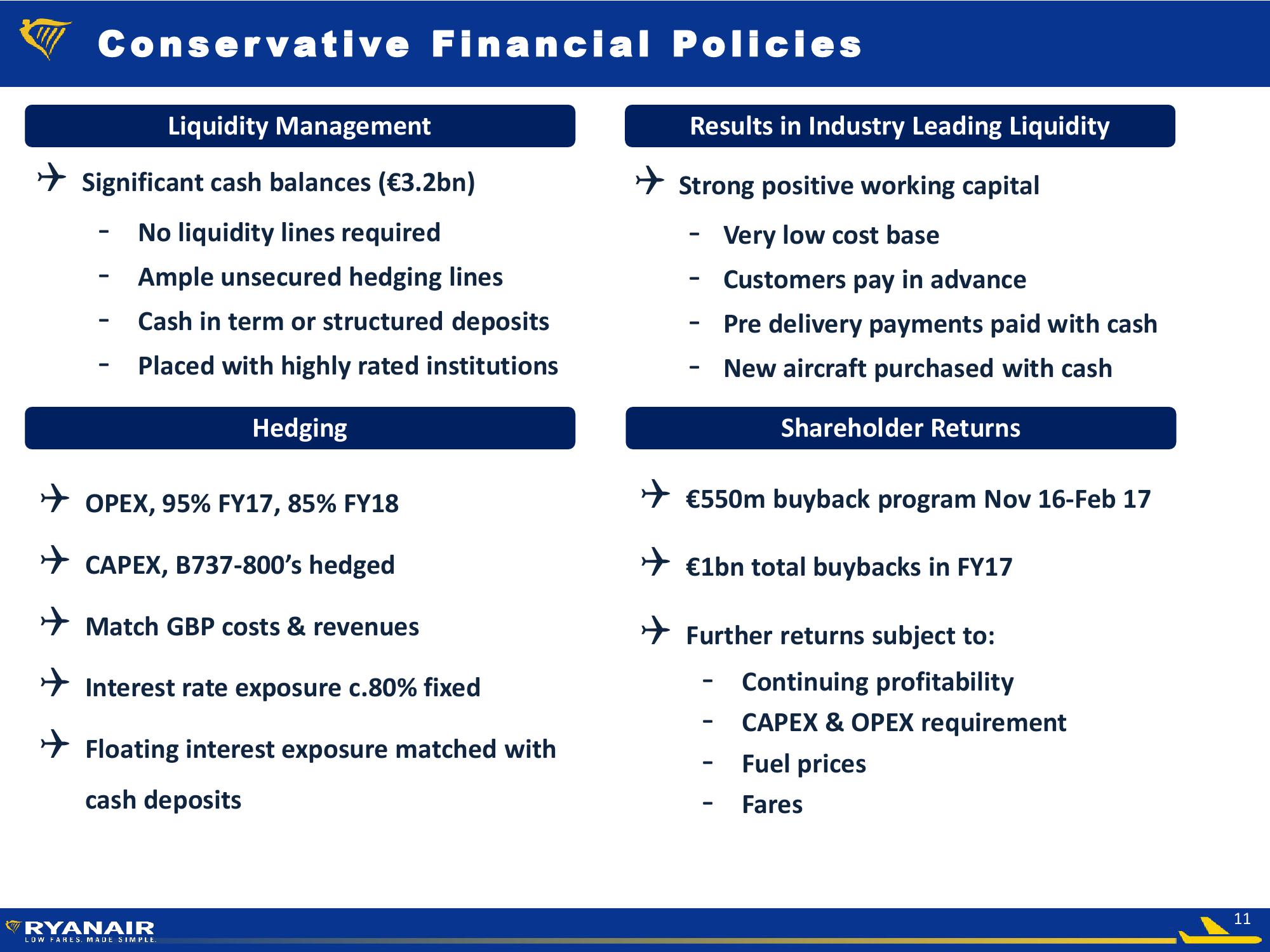

Conservative Financial Policies

Liquidity Management

✈ Significant cash balances (€3.2bn)

No liquidity lines required

Ample unsecured hedging lines

Cash in term or structured deposits

Placed with highly rated institutions

Hedging

-

-

-

✈ OPEX, 95% FY17, 85% FY18

CAPEX, B737-800's hedged

✈ Match GBP costs & revenues

✈ Interest rate exposure c.80% fixed

✈ Floating interest exposure matched with

cash deposits

RYANAIR

LOW FARES. MADE SIMPLE.

Results in Industry Leading Liquidity

✈ Strong positive working capital

Very low cost base

Customers pay in advance

Pre delivery payments paid with cash

New aircraft purchased with cash

-

-

-

Shareholder Returns

✈ €550m buyback program Nov 16-Feb 17

✈ €1bn total buybacks in FY17

✈ Further returns subject to:

Continuing profitability

CAPEX & OPEX requirement

Fuel prices

Fares

-

11View entire presentation