LionTree Investment Banking Pitch Book

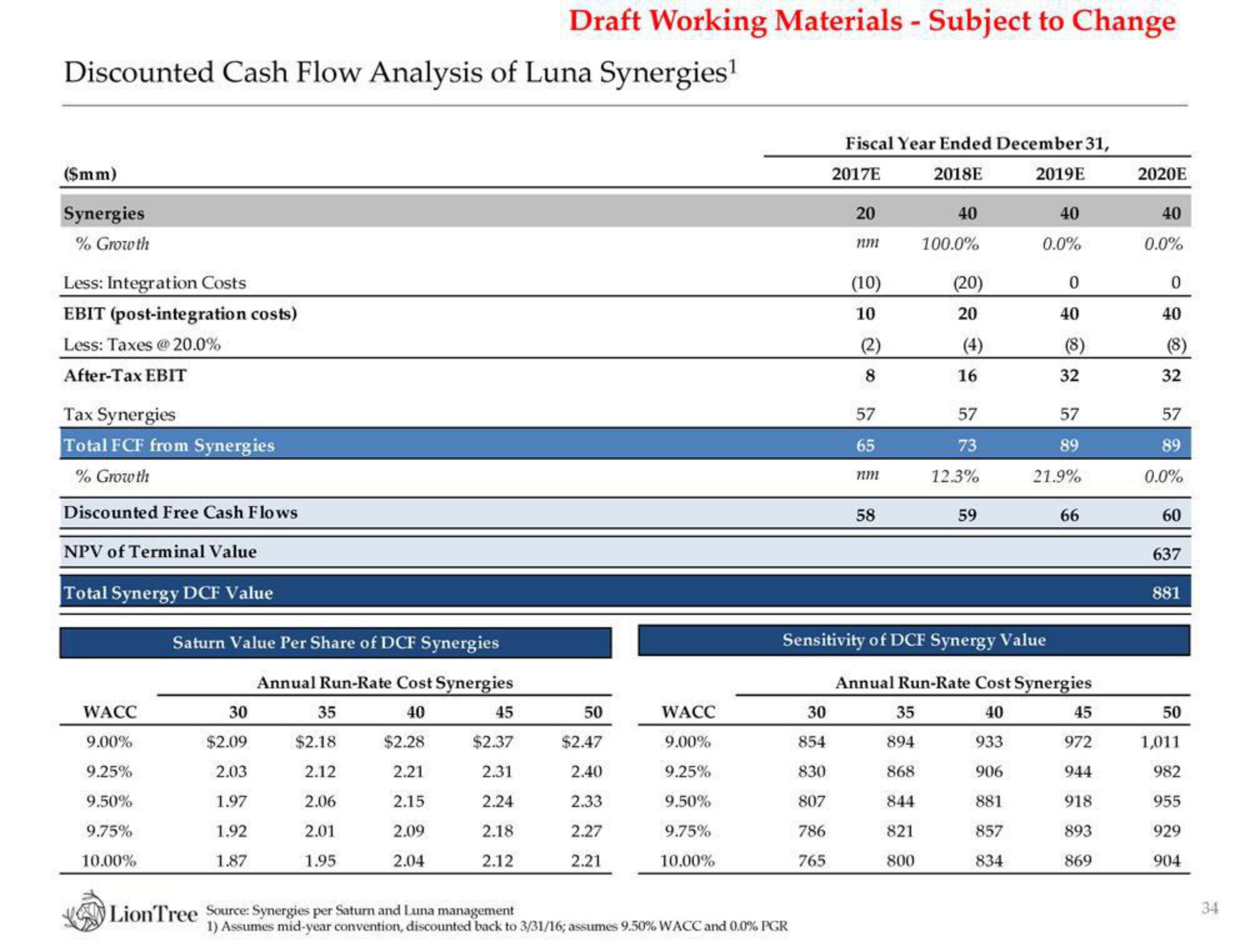

Discounted Cash Flow Analysis of Luna Synergies¹

($mm)

Synergies

% Growth

Less: Integration Costs

EBIT (post-integration costs)

Less: Taxes @ 20.0%

After-Tax EBIT

Tax Synergies

Total FCF from Synergies

% Growth

Discounted Free Cash Flows

NPV of Terminal Value

Total Synergy DCF Value

WACC

9.00%

9.25%

9.50%

9.75%

10.00%

Saturn Value Per Share of DCF Synergies

Annual Run-Rate Cost Synergies

40

$2.28

2.21

2.15

2.09

2.04

30

$2.09

2.03

1.97

1.92

1.87

35

$2.18

2.12

2.06

2.01

1.95

45

$2.37

2.31

2.24

2.18

2.12

Draft Working Materials - Subject to Change

LionTree Source: Synergies per Saturn and Luna management

50

$2.47

2.40

2.33

2.27

2.21

WACC

9.00%

9.25%

9.50%

9.75%

10.00%

1) Assumes mid-year convention, discounted back to 3/31/16; assumes 9.50% WACC and 0.0% PGR

Fiscal Year Ended December 31,

2018E

2017E

2019E

30

854

830

807

786

765

20

nm

(10)

10

(2)

8

57

65

58

40

100.0%

(20)

20

35

894

868

844

821

800

16

57

73

12.3%

59

Sensitivity of DCF Synergy Value

40

0.0%

0

40

(8)

32

57

89

21.9%

66

Annual Run-Rate Cost Synergies

40

933

906

881

857

834

45

972

944

918

893

869

2020E

40

0.0%

0

40

(8)

32

57

89

0.0%

60

637

881

50

1,011

982

955

929

904

34View entire presentation