Third-Quarter 2018 Earnings Call

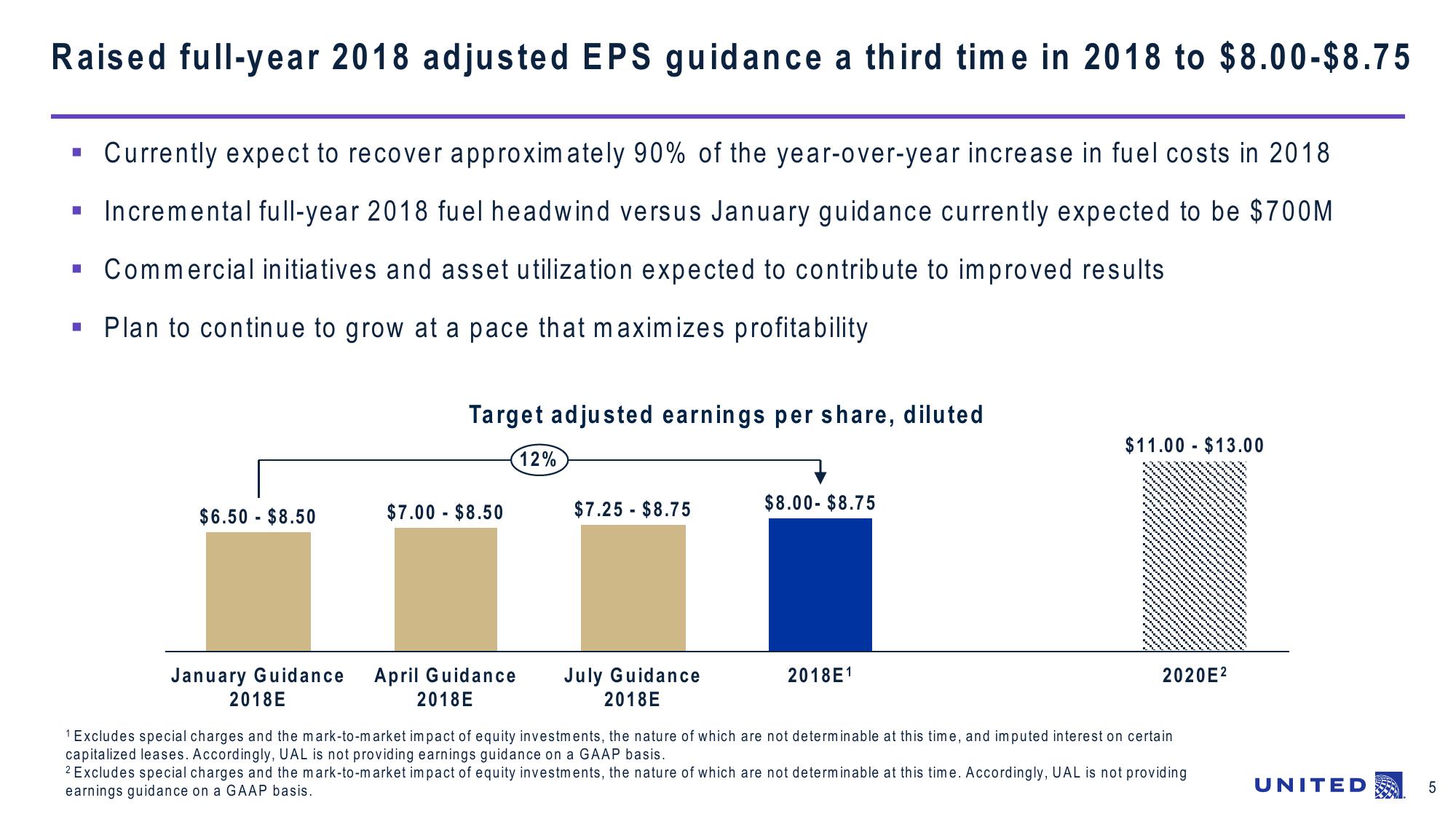

Raised full-year 2018 adjusted EPS guidance a third time in 2018 to $8.00-$8.75

Currently expect to recover approximately 90% of the year-over-year increase in fuel costs in 2018

Incremental full-year 2018 fuel headwind versus January guidance currently expected to be $700M

Commercial initiatives and asset utilization expected to contribute to improved results

Plan to continue to grow at a pace that maximizes profitability

■

$6.50 - $8.50

January Guidance

Target adjusted earnings per share, diluted

$7.00 - $8.50

April Guidance

2018E

12%

$7.25 $8.75

July Guidance

2018E

$8.00-$8.75

2018E1

$11.00 $13.00

2020E²

2018E

1 Excludes special charges and the mark-to-market impact of equity investments, the nature of which are not determinable at this time, and imputed interest on certain

capitalized leases. Accordingly, UAL is not providing earnings guidance on a GAAP basis.

2 Excludes special charges and the mark-to-market impact of equity investments, the nature of which are not determinable at this time. Accordingly, UAL is not providing

earnings guidance on a GAAP basis.

UNITED

5View entire presentation