Marti Investor Presentation Deck

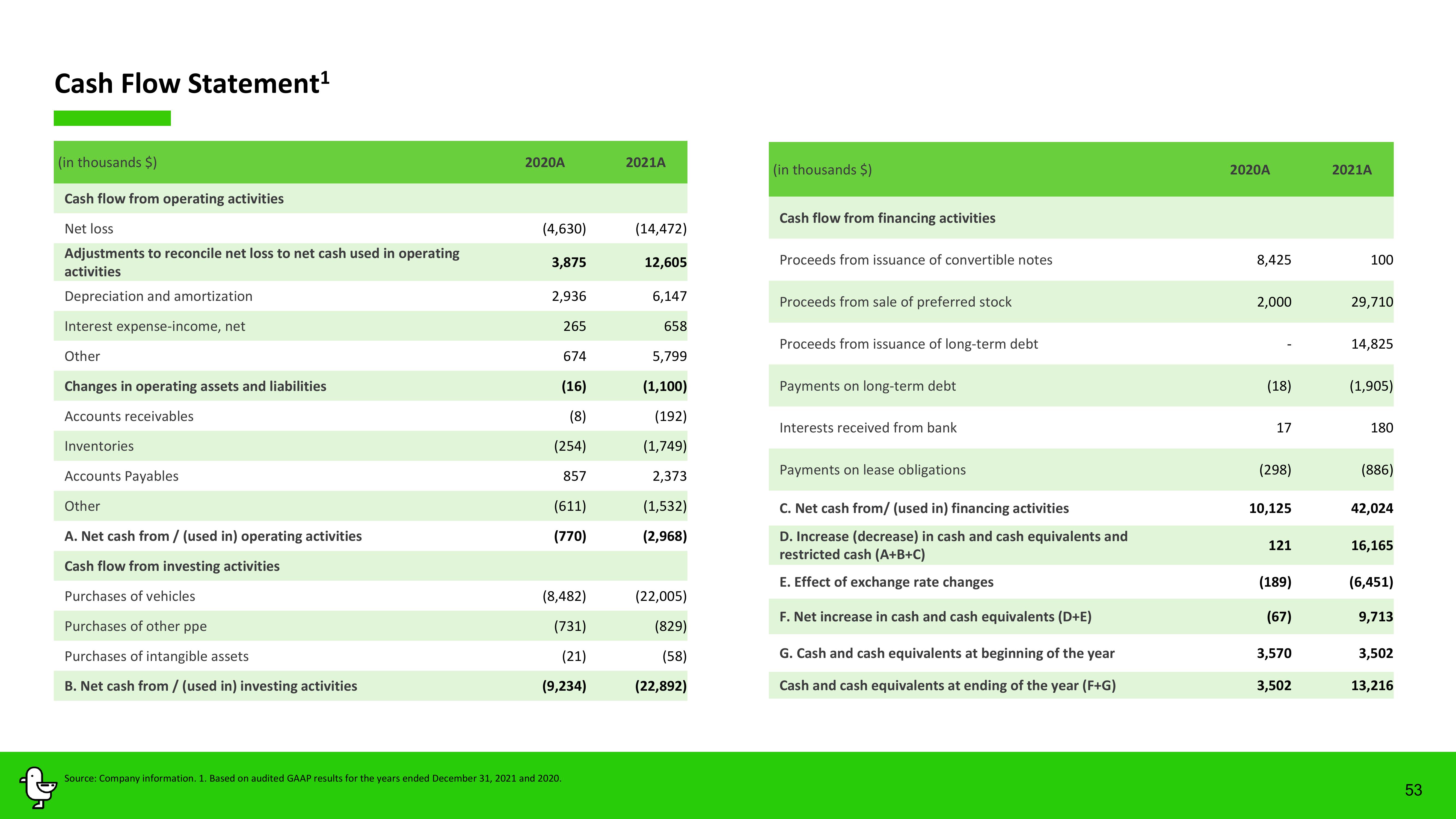

Cash Flow Statement¹

(in thousands $)

Cash flow from operating activities

Net loss

Adjustments to reconcile net loss to net cash used in operating

activities

Depreciation and amortization

Interest expense-income, net

Other

Changes in operating assets and liabilities

Accounts receivables

Inventories

Accounts Payables

Other

A. Net cash from / (used in) operating activities

Cash flow from investing activities

Purchases of vehicles

Purchases of other ppe

Purchases of intangible assets

B. Net cash from / (used in) investing activities

2020A

(4,630)

3,875

2,936

265

674

(16)

(8)

(254)

857

(611)

(770)

(8,482)

(731)

(21)

(9,234)

Source: Company information. 1. Based on audited GAAP results for the years ended December 31, 2021 and 2020.

2021A

(14,472)

12,605

6,147

658

5,799

(1,100)

(192)

(1,749)

2,373

(1,532)

(2,968)

(22,005)

(829)

(58)

(22,892)

(in thousands $)

Cash flow from financing activities

Proceeds from issuance of convertible notes

Proceeds from sale of preferred stock

Proceeds from issuance of long-term debt

Payments on long-term debt

Interests received from bank

Payments on lease obligations

C. Net cash from/ (used in) financing activities

D. Increase (decrease) in cash and cash equivalents and

restricted cash (A+B+C)

E. Effect of exchange rate changes

F. Net increase in cash and cash equivalents (D+E)

G. Cash and cash equivalents at beginning of the year

Cash and cash equivalents at ending of the year (F+G)

2020A

8,425

2,000

(18)

17

(298)

10,125

121

(189)

(67)

3,570

3,502

2021A

100

29,710

14,825

(1,905)

180

(886)

42,024

16,165

(6,451)

9,713

3,502

13,216

53View entire presentation