Factset Investor Presentation Deck

FACTSET

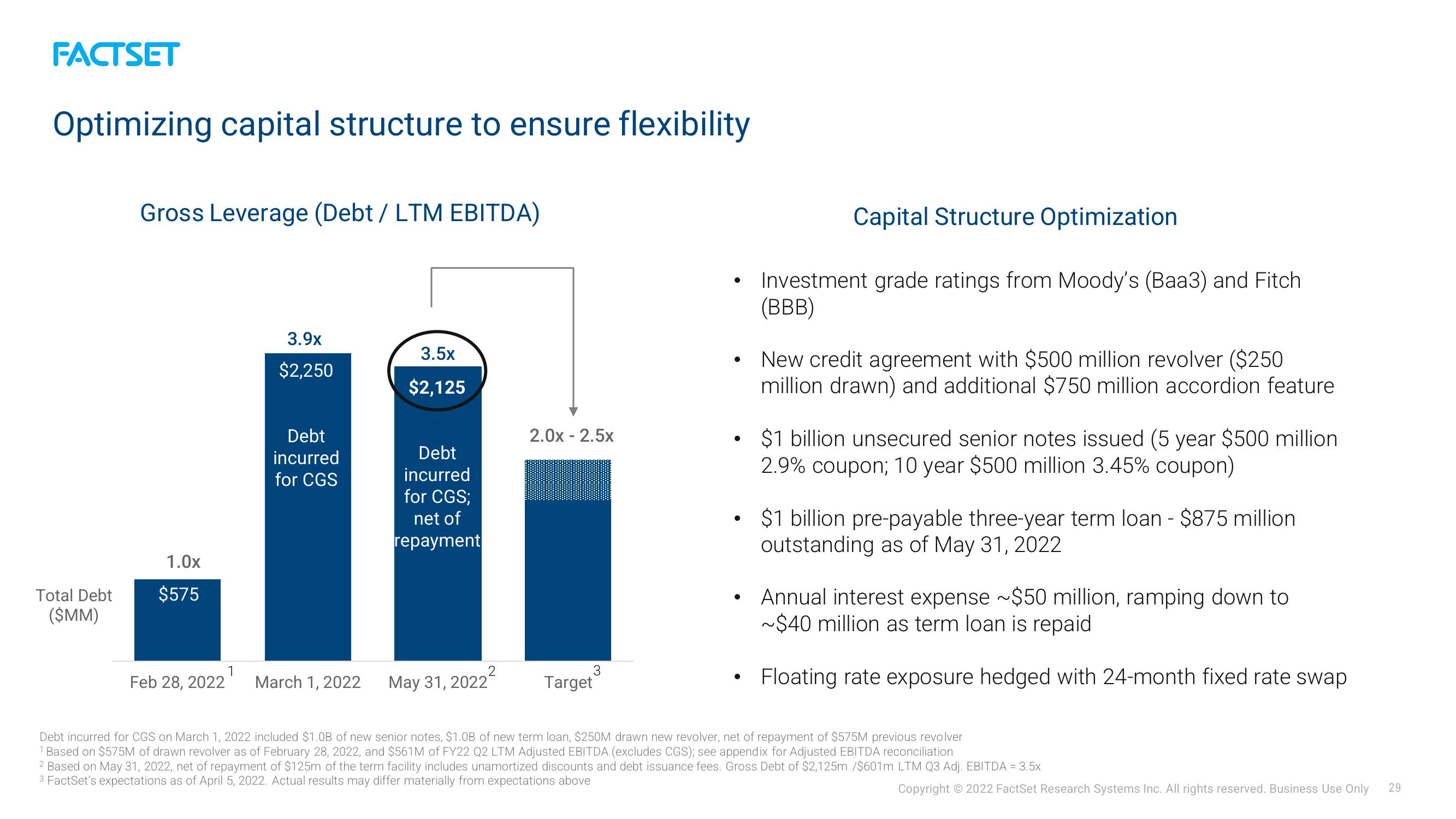

Optimizing capital structure to ensure flexibility

Total Debt

($MM)

Gross Leverage (Debt / LTM EBITDA)

1.0x

$575

1

Feb 28, 2022

3.9x

$2,250

Debt

incurred

for CGS

March 1, 2022

3.5x

$2,125

Debt

incurred

for CGS;

net of

repayment

May 31, 2022

2

2.0x - 2.5x

3

Target

●

●

●

●

Capital Structure Optimization

Investment grade ratings from Moody's (Baa3) and Fitch

(BBB)

New credit agreement with $500 million revolver ($250

million drawn) and additional $750 million accordion feature

$1 billion unsecured senior notes issued (5 year $500 million

2.9% coupon; 10 year $500 million 3.45% coupon)

$1 billion pre-payable three-year term loan - $875 million

outstanding as of May 31, 2022

Annual interest expense ~$50 million, ramping down to

~$40 million as term loan is repaid

Floating rate exposure hedged with 24-month fixed rate swap

Debt incurred for CGS on March 1, 2022 included $1.0B of new senior notes, $1.0B of new term loan, $250M drawn new revolver, net of repayment of $575M previous revolver

1 Based on $575M of drawn revolver as of February 28, 2022, and $561M of FY22 Q2 LTM Adjusted EBITDA (excludes CGS); see appendix for Adjusted EBITDA reconciliation

2 Based on May 31, 2022, net of repayment of $125m of the term facility includes unamortized discounts and debt issuance fees. Gross Debt of $2,125m /$601m LTM Q3 Adj. EBITDA = 3.5x

3 FactSet's expectations as of April 5, 2022. Actual results may differ materially from expectations above

Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

29View entire presentation