Melrose Results Presentation Deck

Dowlais¹: overview

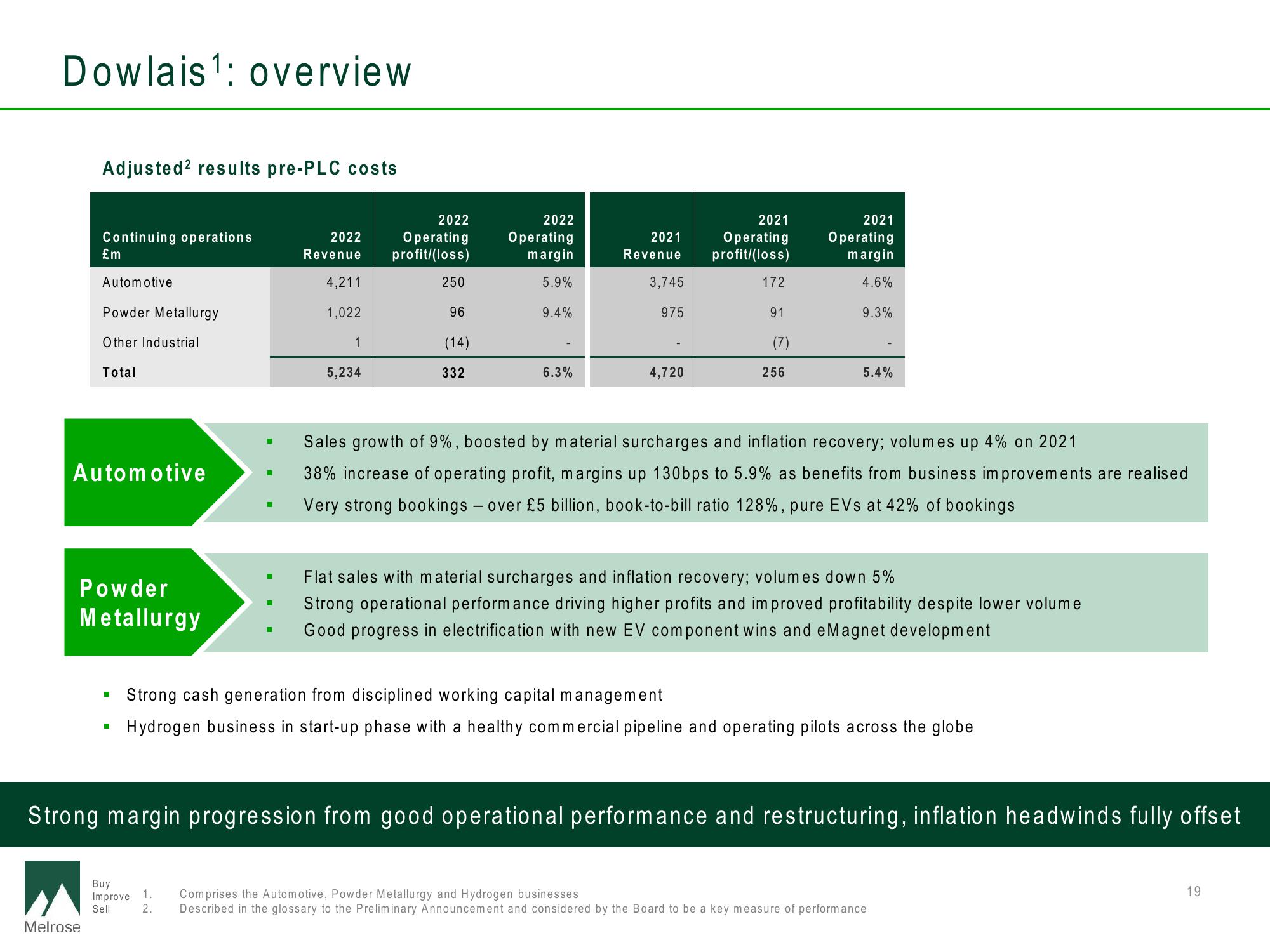

Adjusted ² results pre-PLC costs

Continuing operations

£m

Melrose

Automotive

Powder Metallurgy

Other Industrial

Total

Automotive

Powder

Metallurgy

■

■

2022

Revenue

4,211

1,022

Buy

Improve 1.

Sell

2.

1

5,234

2022

Operating

profit/(loss)

250

96

(14)

332

2022

Operating

margin

5.9%

9.4%

6.3%

2021

Revenue

3,745

975

4,720

2021

Operating

profit/(loss)

172

91

(7)

256

2021

Operating

margin

4.6%

9.3%

5.4%

Sales growth of 9%, boosted by material surcharges and inflation recovery; volumes up 4% on 2021

38% increase of operating profit, margins up 130bps to 5.9% as benefits from business improvements are realised

Very strong bookings - over £5 billion, book-to-bill ratio 128%, pure EVs at 42% of bookings

Flat sales with material surcharges and inflation recovery; volumes down 5%

Strong operational performance driving higher profits and improved profitability despite lower volume

Good progress in electrification with new EV component wins and eMagnet development

Strong cash generation from disciplined working capital management

Hydrogen business in start-up phase with a healthy commercial pipeline and operating pilots across the globe

Strong margin progression from good operational performance and restructuring, inflation headwinds fully offset

Comprises the Automotive, Powder Metallurgy and Hydrogen businesses

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

19View entire presentation