BAT Results Presentation Deck

Resilient Combustible volumes

Outperforming the industry (+30bps volume share*)

Strong performance in DMs

●

Robust pricing

Robust pricing environment

No accelerated downtrading

+7.6% 3 year average price/mix

●

●

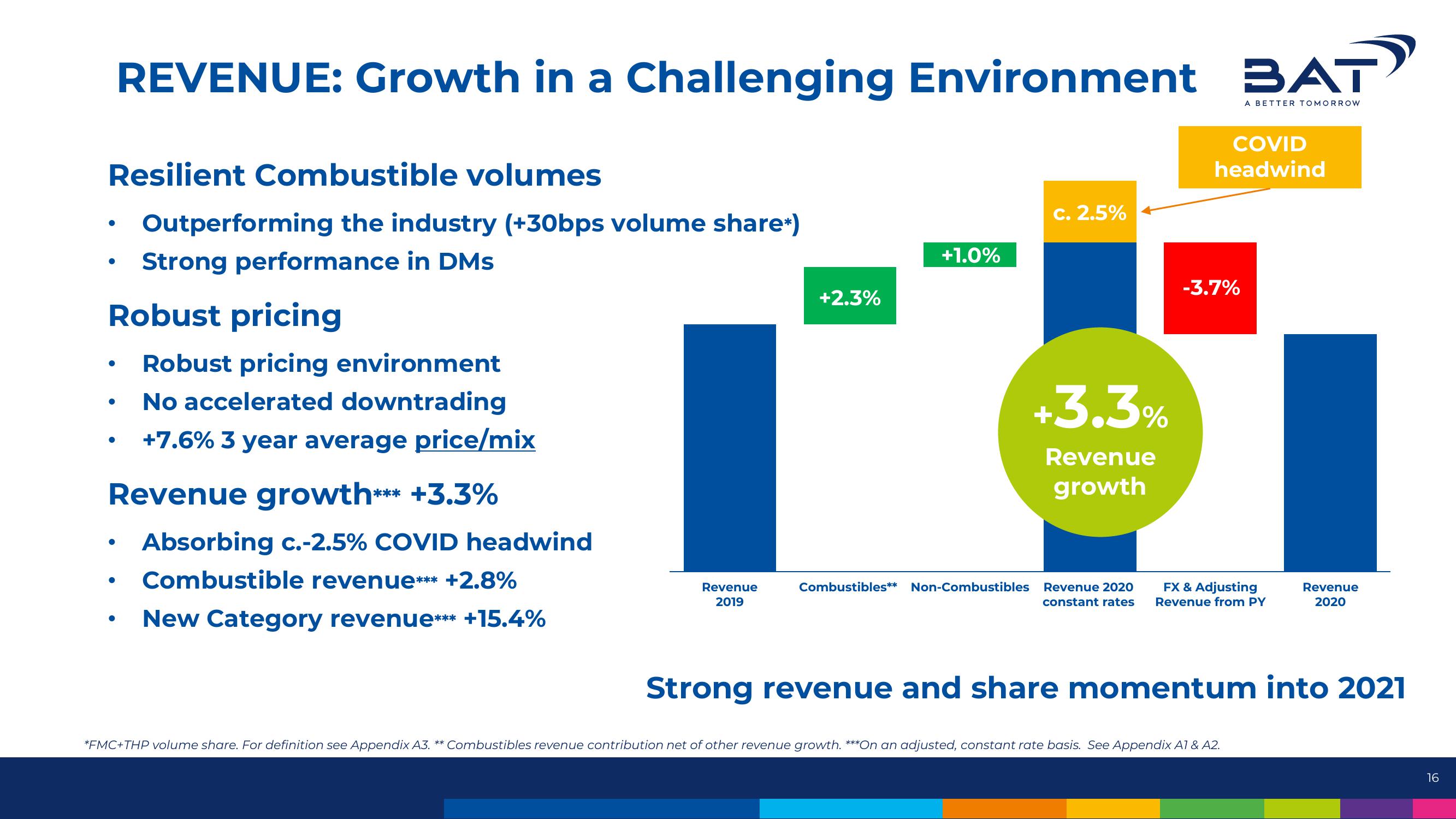

REVENUE: Growth in a Challenging Environment BAT

A BETTER TOMORROW

●

Revenue growth*** +3.3%

Absorbing c.-2.5% COVID headwind

Combustible revenue*** +2.8%

New Category revenue*** +15.4%

●

Revenue

2019

+2.3%

+1.0%

Combustibles** Non-Combustibles

c. 2.5%

+3.3%

Revenue

growth

Revenue 2020

constant rates

COVID

headwind

-3.7%

FX & Adjusting

Revenue from PY

Revenue

2020

Strong revenue and share momentum into 2021

*FMC+THP volume share. For definition see Appendix A3. ** Combustibles revenue contribution net of other revenue growth. ***On an adjusted, constant rate basis. See Appendix A1 & A2.

16View entire presentation