System1 SPAC Presentation Deck

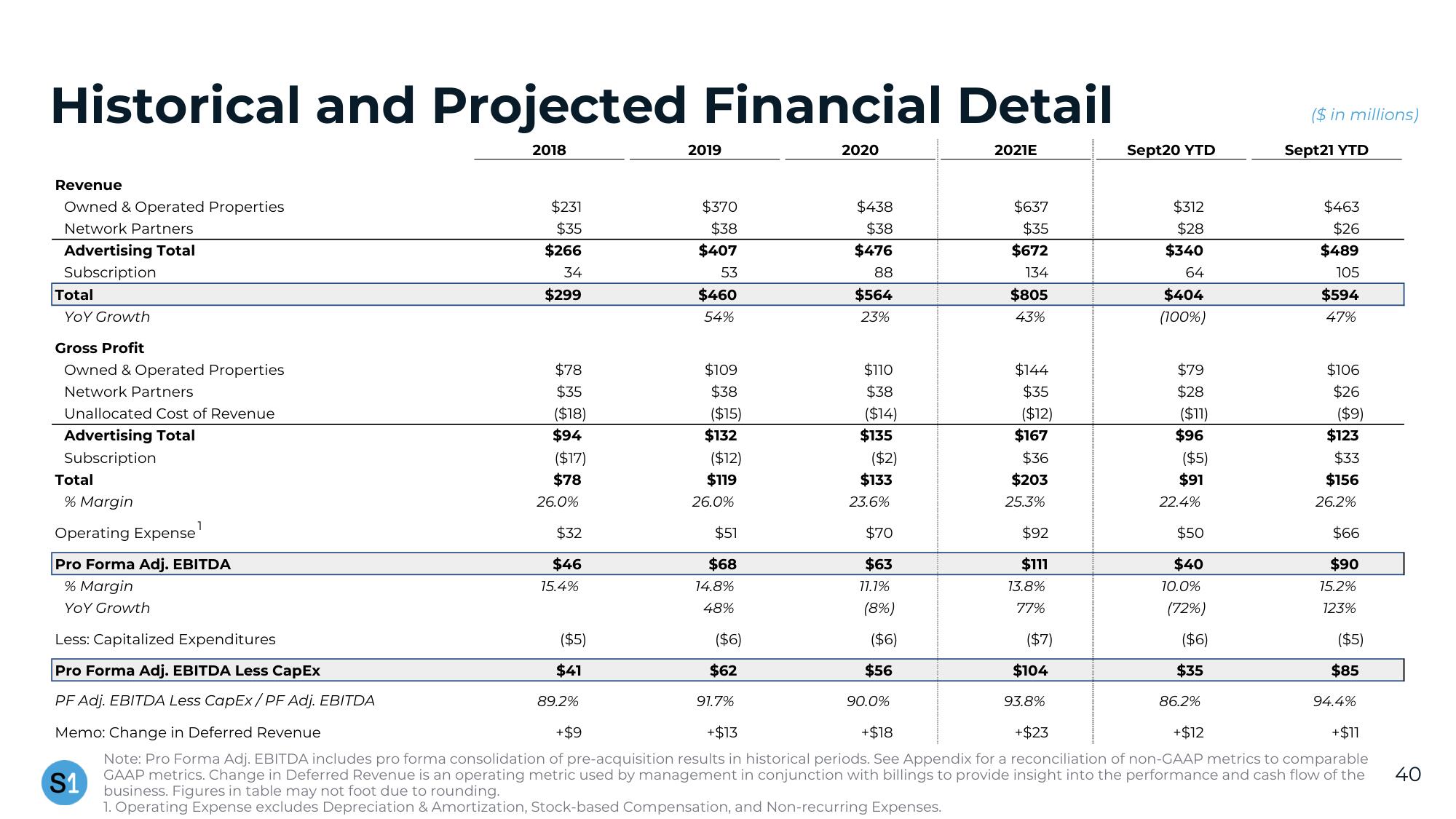

Historical and Projected Financial Detail

2018

2021E

Revenue

Owned & Operated Properties

Network Partners

Advertising Total

Subscription

Total

YOY Growth

Gross Profit

Owned & Operated Properties

Network Partners

Unallocated Cost of Revenue

Advertising Total

Subscription

Total

% Margin

1

Operating Expense

Pro Forma Adj. EBITDA

% Margin

YOY Growth

$231

$35

$266

34

$299

$78

$35

($18)

$94

($17)

$78

26.0%

$32

$46

15.4%

($5)

$41

2019

89.2%

$370

$38

$407

53

$460

54%

$109

$38

($15)

$132

($12)

$119

26.0%

$51

$68

14.8%

48%

($6)

2020

$438

$38

$476

88

$564

23%

$110

$38

($14)

$135

($2)

$133

23.6%

$70

$63

11.1%

(8%)

($6)

$56

$637

$35

$672

134

$805

43%

90.0%

$144

$35

($12)

$167

$36

$203

25.3%

$92

$111

13.8%

77%

($7)

Sept20 YTD

$104

93.8%

+$23

$312

$28

$340

64

$404

(100%)

$79

$28

($11)

$96

($5)

$91

22.4%

$50

$40

10.0%

(72%)

($6)

$35

($ in millions)

Less: Capitalized Expenditures

Pro Forma Adj. EBITDA Less CapEx

$62

PF Adj. EBITDA Less CapEx/PF Adj. EBITDA

Memo: Change in Deferred Revenue

91.7%

+$13

+$9

+$18

+$12

+$11

S1

Note: Pro Forma Adj. EBITDA includes pro forma consolidation of pre-acquisition results in historical periods. See Appendix for a reconciliation of non-GAAP metrics to comparable

GAAP metrics. Change in Deferred Revenue is an operating metric used by management in conjunction with billings to provide insight into the performance and cash flow of the

business. Figures in table may not foot due to rounding.

1. Operating Expense excludes Depreciation & Amortization, Stock-based Compensation, and Non-recurring Expenses.

86.2%

Sept21 YTD

$463

$26

$489

105

$594

47%

$106

$26

($9)

$123

$33

$156

26.2%

$66

$90

15.2%

123%

($5)

$85

94.4%

40View entire presentation