Masterworks Investor Presentation Deck

Index (1995 = 1)

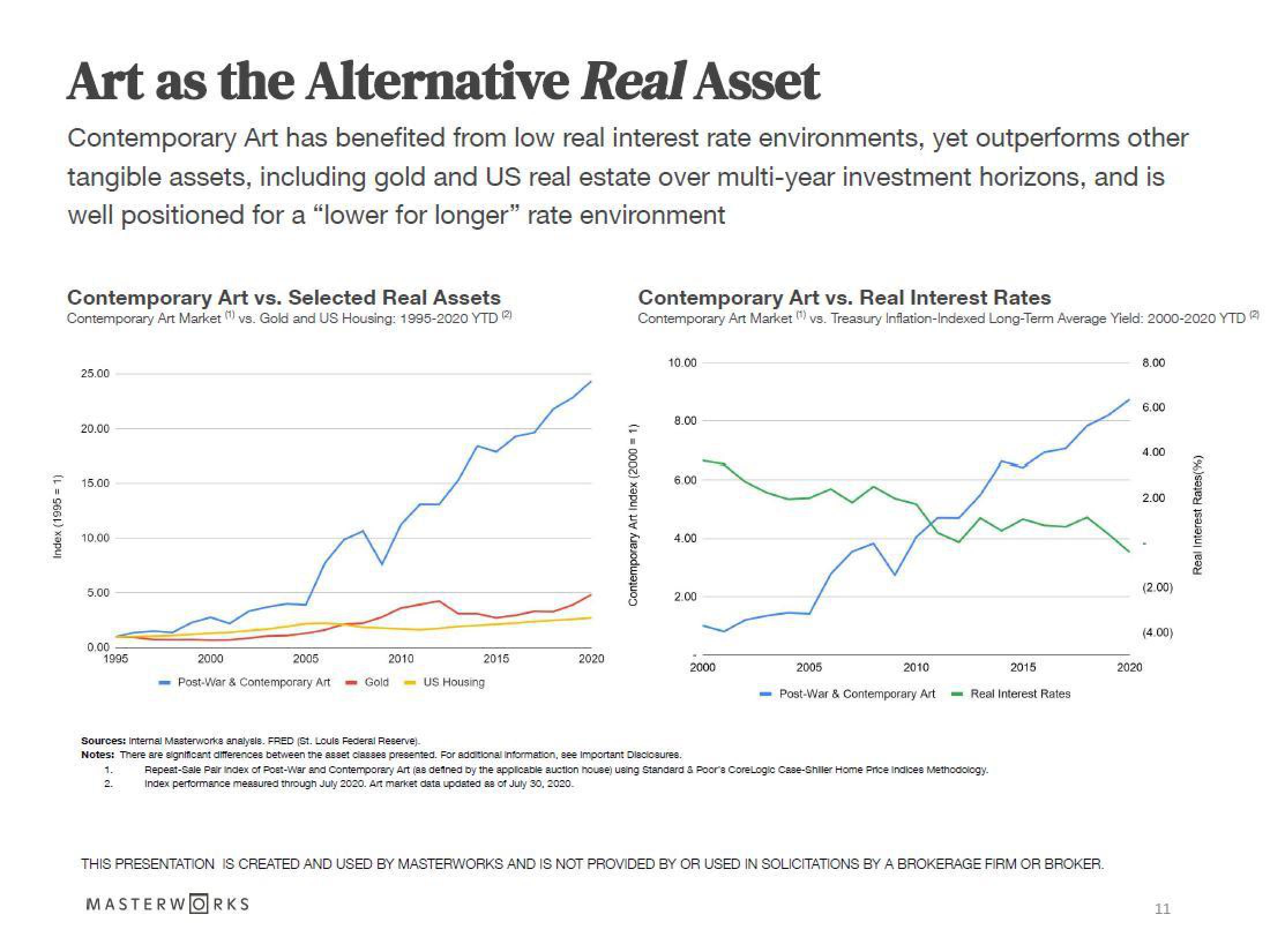

Art as the Alternative Real Asset

Contemporary Art has benefited from low real interest rate environments, yet outperforms other

tangible assets, including gold and US real estate over multi-year investment horizons, and is

well positioned for a "lower for longer" rate environment

Contemporary Art vs. Selected Real Assets

Contemporary Art Market (¹) vs. Gold and US Housing: 1995-2020 YTD

25.00

20.00

15.00

10.00

5.00

0.00

1995

2000

Post-War & Contemporary Art

1.

2.

2005

2010

2015

MASTERWORKS

Gold - US Housing

2020

Contemporary Art vs. Real Interest Rates

Contemporary Art Market vs. Treasury Inflation-Indexed Long-Term Average Yield: 2000-2020 YTD (²)

Contemporary Art Index (2000= 1)

10.00

8.00

6.00

4.00

Sources: Internal Masterworks analysis. FRED (St. Louls Federal Reserve).

Notes: There are significant differences between the asset classes presented. For additional Information, see Important Disclosures.

2.00

2000

2005

2010

Post-War & Contemporary Art

Repeat-Sale Pair Index of Post-War and Contemporary Art (as defined by the applicable auction house) using Standard & Poor's CoreLogic Case-Shller Home Price Indices Methodology.

Index performance measured through July 2020. Art market data updated as of July 30, 2020.

2015

Real Interest Rates

THIS PRESENTATION IS CREATED AND USED BY MASTERWORKS AND IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A BROKERAGE FIRM OR BROKER.

8.00

6,00

4.00

2020

2.00

(2.00)

(4.00)

11

Real Interest Rates(%)View entire presentation