Bakkt Results Presentation Deck

FINANCIAL RESULTS/4Q SUMMARY

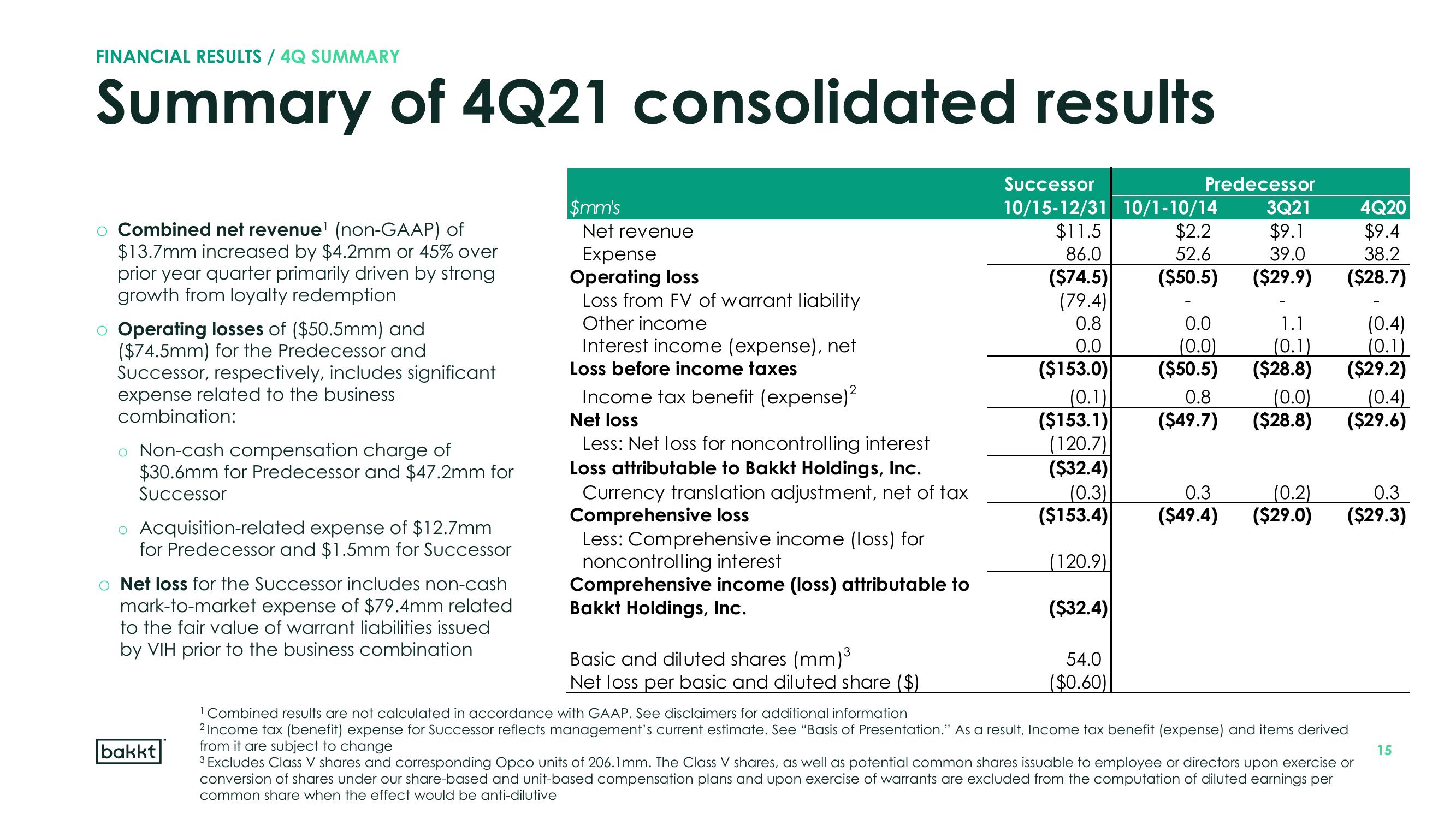

Summary of 4Q21 consolidated results

Combined net revenue¹ (non-GAAP) of

$13.7mm increased by $4.2mm or 45% over

prior year quarter primarily driven by strong

growth from loyalty redemption

Operating losses of ($50.5mm) and

($74.5mm) for the Predecessor and

Successor, respectively, includes significant

expense related to the business

combination:

Non-cash compensation charge of

$30.6mm for Predecessor and $47.2mm for

Successor

Acquisition-related expense of $12.7mm

for Predecessor and $1.5mm for Successor

Net loss for the Successor includes non-cash

mark-to-market expense of $79.4mm related

to the fair value of warrant liabilities issued

by VIH prior to the business combination

bakkt

$mm's

Net revenue

Expense

Operating loss

Loss from FV of warrant liability

Other income

Interest income (expense), net

Loss before income taxes

Income tax benefit (expense)²

Net loss

Less: Net loss for noncontrolling interest

Loss attributable to Bakkt Holdings, Inc.

Currency translation adjustment, net of tax

Comprehensive loss

Less: Comprehensive income (loss) for

noncontrolling interest

Comprehensive income (loss) attributable to

Bakkt Holdings, Inc.

Basic and diluted shares (mm) ³

Net loss per basic and diluted share ($)

Successor

10/15-12/31 10/1-10/14

$11.5

$2.2

52.6

86.0

($74.5)

(79.4)

($50.5)

0.8

0.0

($153.0)

(0.1)

($153.1)

(120.7)

($32.4)

(0.3)

($153.4)

(120.9)

($32.4)

Predecessor

3Q21

$9.1

39.0

($29.9)

54.0

($0.60)

1.1

0.0

(0.0) (0.1)

($50.5) ($28.8)

0.8 (0.0)

($49.7) ($28.8)

0.3

(0.2)

($49.4) ($29.0)

4Q20

$9.4

38.2

($28.7)

(0.4)

(0.1)

($29.2)

(0.4)

($29.6)

0.3

($29.3)

¹ Combined results are not calculated in accordance with GAAP. See disclaimers for additional information

2 Income tax (benefit) expense for Successor reflects management's current estimate. See "Basis of Presentation." As a result, Income tax benefit (expense) and items derived

from it are subject to change

3 Excludes Class V shares and corresponding Opco units of 206.1mm. The Class V shares, as well as potential common shares issuable to employee or directors upon exercise or

conversion of shares under our share-based and unit-based compensation plans and upon exercise of warrants are excluded from the computation of diluted earnings per

common share when the effect would be anti-dilutive

15View entire presentation