LanzaTech SPAC Presentation Deck

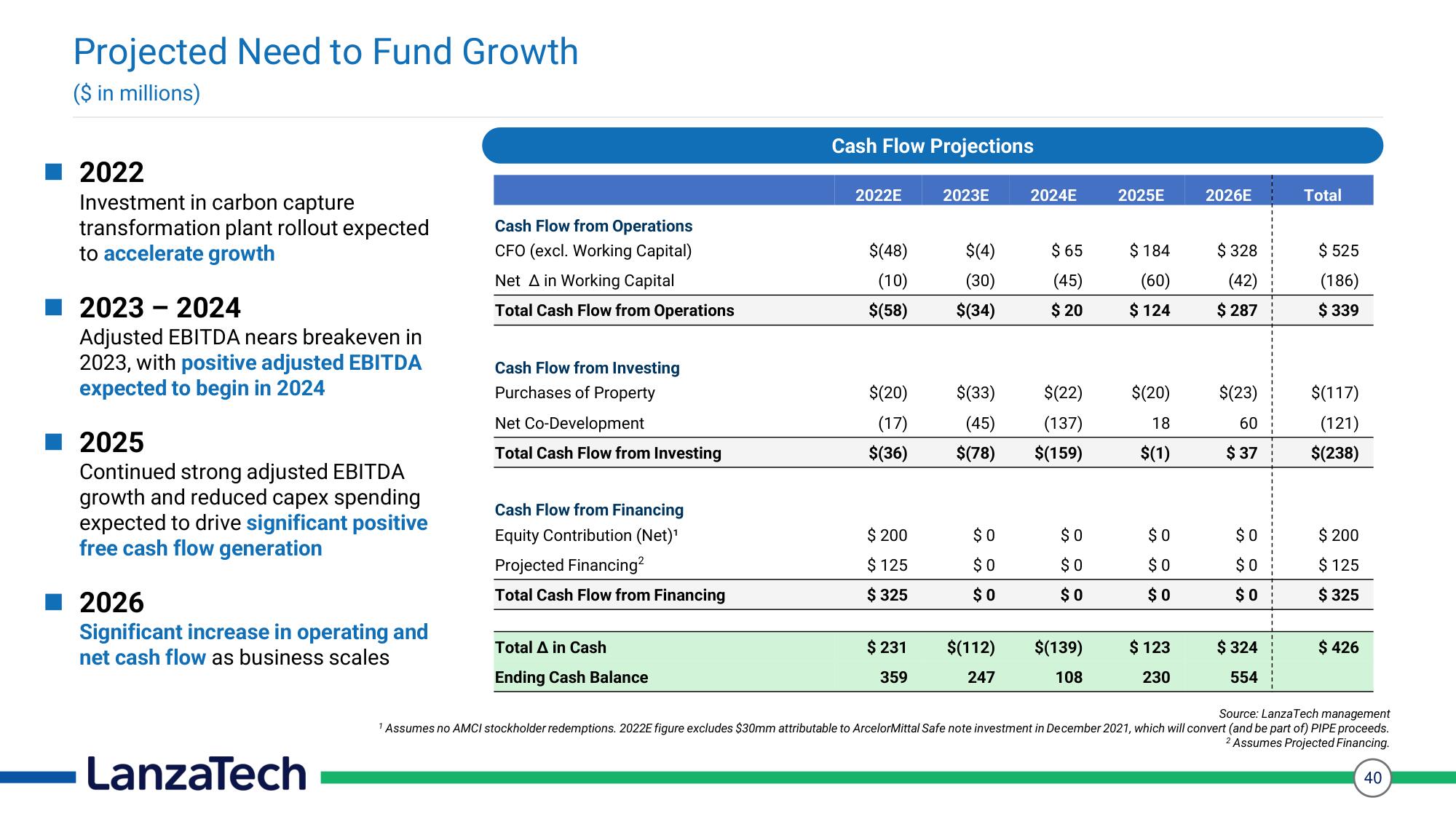

Projected Need to Fund Growth

($ in millions)

2022

Investment in carbon capture

transformation plant rollout expected

to accelerate growth

2023 2024

Adjusted EBITDA nears breakeven in

2023, with positive adjusted EBITDA

expected to begin in 2024

2025

Continued strong adjusted EBITDA

growth and reduced capex spending

expected to drive significant positive

free cash flow generation

2026

Significant increase in operating and

net cash flow as business scales

LanzaTech

Cash Flow from Operations

CFO (excl. Working Capital)

Net A in Working Capital

Total Cash Flow from Operations

Cash Flow from Investing

Purchases of Property

Net Co-Development

Total Cash Flow from Investing

Cash Flow from Financing

Equity Contribution (Net)¹

Projected Financing²

Total Cash Flow from Financing

Total A in Cash

Ending Cash Balance

Cash Flow Projections

2022E

$(48)

(10)

$(58)

$(20)

(17)

$(36)

$ 200

$ 125

$ 325

$ 231

359

2023E

$(4)

(30)

$(34)

$(33)

(45)

$(78)

$0

$0

$0

$(112)

247

2024E

$ 65

(45)

$ 20

$(22)

(137)

$(159)

$0

$0

$0

$(139)

108

2025E

$ 184

(60)

$ 124

$(20)

18

$(1)

$0

$0

$0

$ 123

230

2026E

$ 328

(42)

$ 287

$(23)

60

$ 37

$0

$0

$0

$ 324

554

Total

$ 525

(186)

$ 339

$(117)

(121)

$(238)

$ 200

$ 125

$325

$ 426

Source: LanzaTech management

¹ Assumes no AMCI stockholder redemptions. 2022E figure excludes $30mm attributable to ArcelorMittal Safe note investment in December 2021, which will convert (and be part of) PIPE proceeds.

2 Assumes Projected Financing.

40View entire presentation