Stem SPAC Presentation Deck

stem

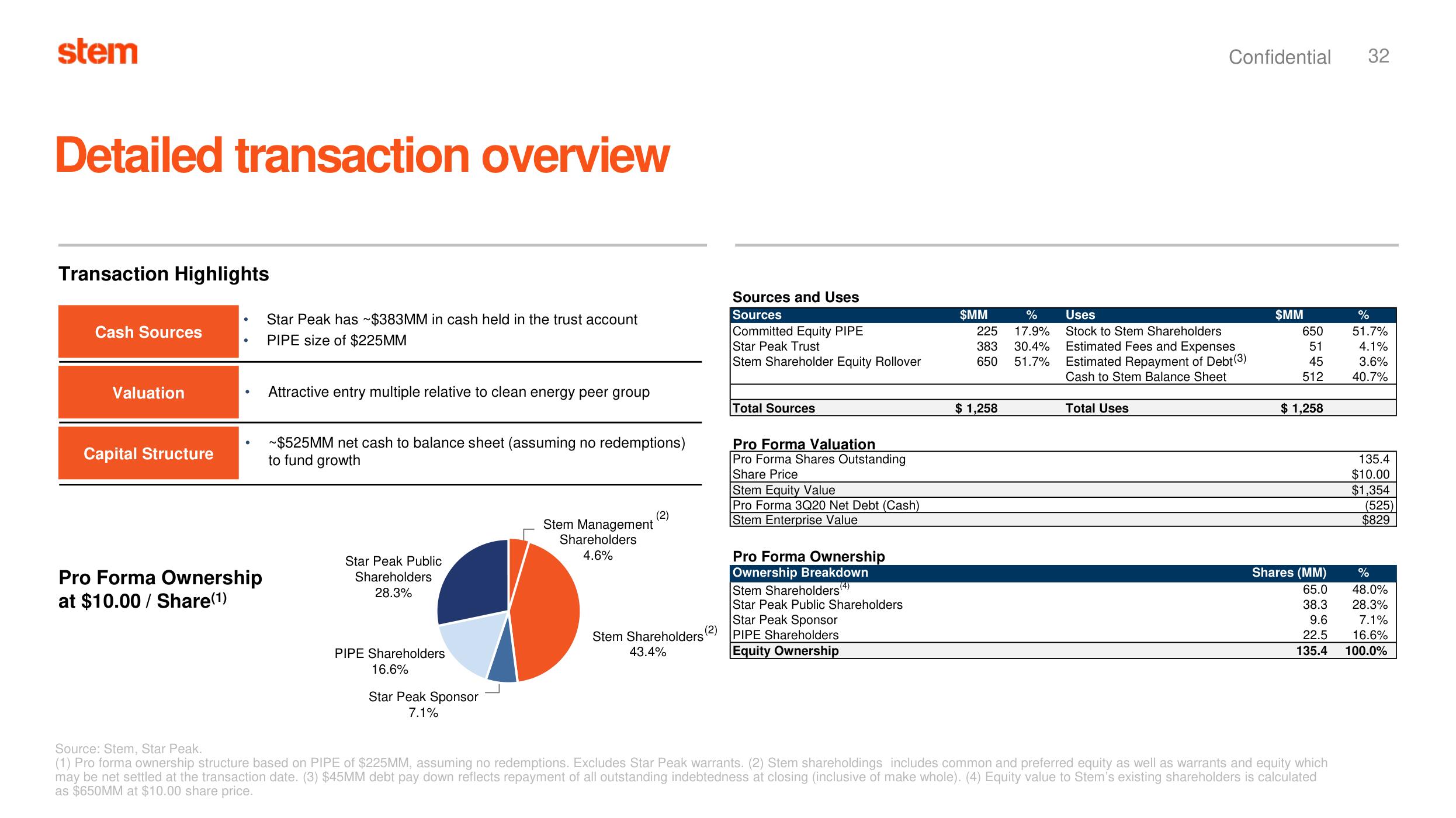

Detailed transaction overview

Transaction Highlights

Cash Sources

Valuation

Capital Structure

●

Pro Forma Ownership

at $10.00/Share(1)

Star Peak has ~$383MM in cash held in the trust account

PIPE size of $225MM

Attractive entry multiple relative to clean energy peer group

~$525MM net cash to balance sheet (assuming no redemptions)

to fund growth

Star Peak Public

Shareholders

28.3%

PIPE Shareholders

16.6%

Star Peak Sponsor

7.1%

Stem Management

Shareholders

4.6%

(2)

Stem Shareholders (2)

43.4%

Sources and Uses

Sources

Committed Equity PIPE

Star Peak Trust

Stem Shareholder Equity Rollover

Total Sources

Pro Forma Valuation

Pro Forma Shares Outstanding

Share Price

Stem Equity Value

Pro Forma 3Q20 Net Debt (Cash)

Stem Enterprise Value

Pro Forma Ownership

Ownership Breakdown

Stem Shareholders(4)

Star Peak Public Shareholders

Star Peak Sponsor

PIPE Shareholders

Equity Ownership

$MM

%

225 17.9%

383 30.4%

650 51.7%

$ 1,258

Confidential 32

Uses

Stock to Stem Shareholders

Estimated Fees and Expenses

Estimated Repayment of Debt (3)

Cash to Stem Balance Sheet

Total Uses

$MM

650

51

45

512

$ 1,258

Shares (MM)

65.0

38.3

9.6

22.5

135.4

Source: Stem, Star Peak.

(1) Pro forma ownership structure based on PIPE of $225MM, assuming no redemptions. Excludes Star Peak warrants. (2) Stem shareholdings includes common and preferred equity as well as warrants and equity which

may be net settled at the transaction date. (3) $45MM debt pay down reflects repayment of all outstanding indebtedness at closing (inclusive of make whole). (4) Equity value to Stem's existing shareholders is calculated

as $650MM at $10.00 share price.

%

51.7%

4.1%

3.6%

40.7%

135.4

$10.00

$1,354

(525)

$829

%

48.0%

28.3%

7.1%

16.6%

100.0%View entire presentation