AngloAmerican Results Presentation Deck

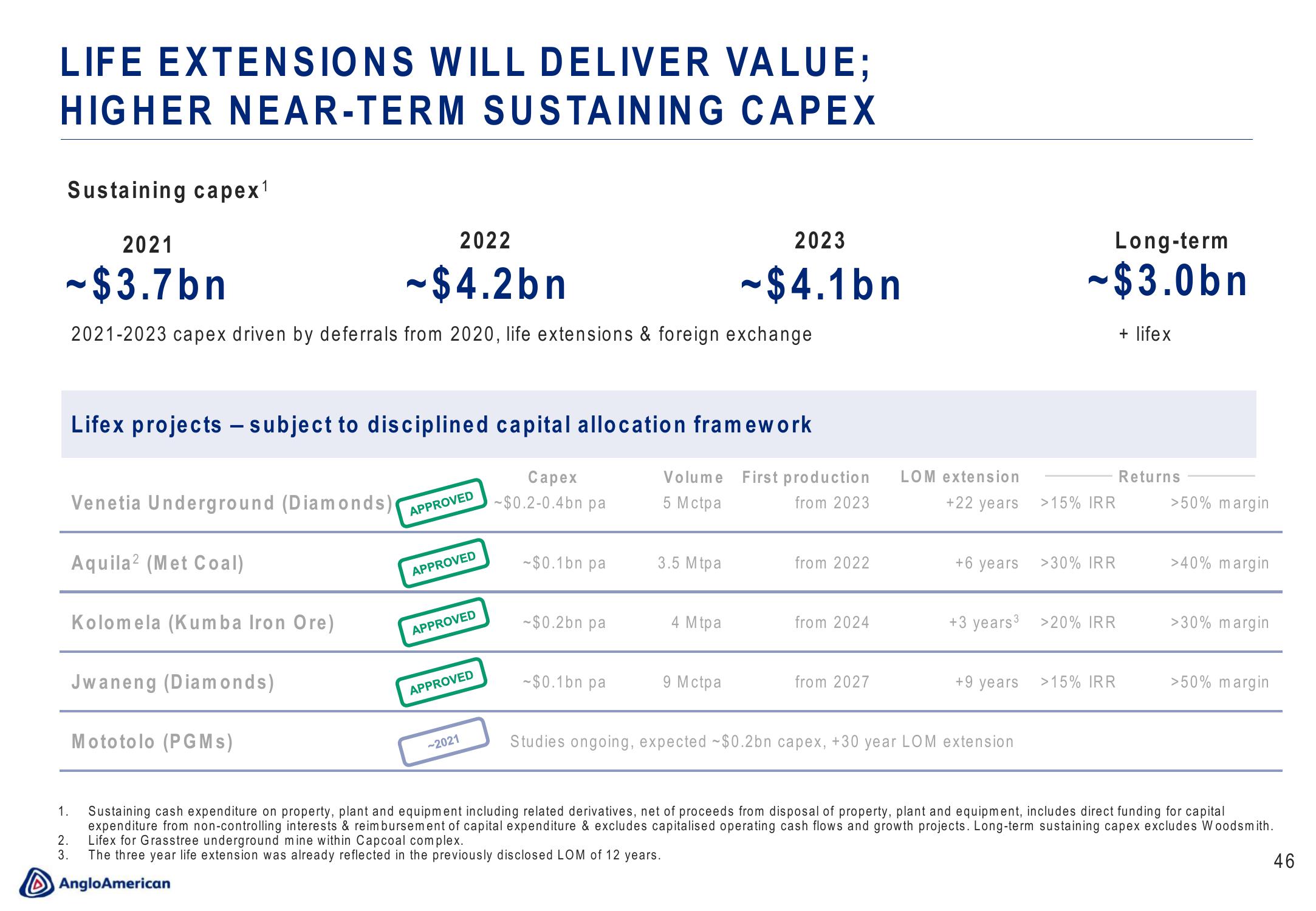

LIFE EXTENSIONS WILL DELIVER VALUE;

HIGHER NEAR-TERM SUSTAINING CAPEX

Sustaining capex¹

2021

-$3.7bn

2022

~$4.2bn

2021-2023 capex driven by deferrals from 2020, life extensions & foreign exchange

1.

Lifex projects - subject to disciplined capital allocation framework

Venetia Underground (Diamonds)

Aquila2 (Met Coal)

Kolomela (Kumba Iron Ore)

Jwaneng (Diamonds)

Mototolo (PGMs)

APPROVED

APPROVED

APPROVED

APPROVED

-2021

Capex

~$0.2-0.4bn pa

-$0.1bn pa

~$0.2bn pa

-$0.1bn pa

2023

-$4.1bn

Volume First production LOM extension

5 Mctpa

from 2023

+22 years

3.5 Mtpa

4 Mtpa

9 Mctpa

from 2022

from 2024

from 2027

+6 years

+9 years

Long-term

- $3.0bn

Studies ongoing, expected ~$0.2bn capex, +30 year LOM extension

>15% IRR

+3 years³ >20% IRR

>30% IRR

>15% IRR

+ lifex

Returns

>50% margin

>40% margin

>30% margin

>50% margin

Sustaining cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment, includes direct funding for capital

expenditure from non-controlling interests & reimbursement of capital expenditure & excludes capitalised operating cash flows and growth projects. Long-term sustaining capex excludes Woodsmith.

2. Lifex for Grasstree underground mine within Capcoal complex.

3. The three year life extension was already reflected in the previously disclosed LOM of 12 years.

AngloAmerican

46View entire presentation