Netstreit Investor Presentation Deck

1

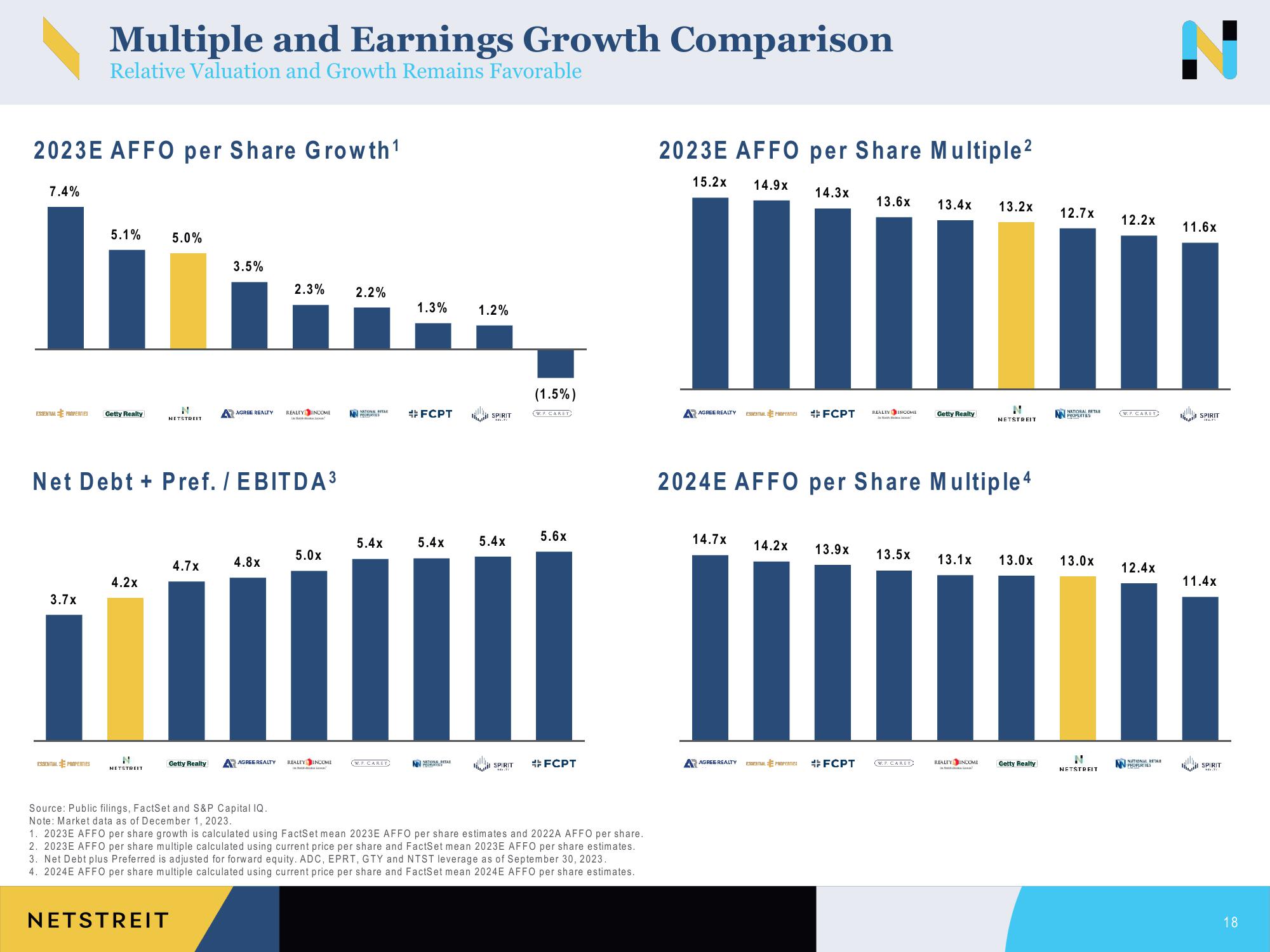

2023E AFFO per Share Growth ¹

7.4%

ESSENTIAL PROPERTIES

Multiple and Earnings Growth Comparison

Relative Valuation and Growth Remains Favorable

3.7x

ESSENTIAL PROPERTIES

5.1%

Getty Realty

4.2x

5.0%

NETSTREIT

N

NETSTREIT

Net Debt + Pref. / EBITDA ³

4.7x

3.5%

Getty Realty

A AGREE REALTY

4.8x

2.3%

REALTY INCOME

Source: Public filings, FactSet and S&P Capital IQ.

Note: Market data as of December 1, 2023.

5.0x

AGREE REALTY REALTY INCOME

-

2.2%

NATIONAL BETAE

MORRIS

5.4x

(W.P. CAREY

1.3%

#FCPT

5.4x

NINA

1.2%

ISPIRIT

5.4x

SPIRIT

(1.5%)

(W.P. CAREY

5.6x

FCPT

1. 2023E AFFO per share growth is calculated using FactSet mean 2023E AFFO per share estimates and 2022A AFFO per share.

2. 2023E AFFO per share multiple calculated using current price per share and FactSet mean 2023E AFFO per share estimates.

3. Net Debt plus Preferred is adjusted for forward equity. ADC, EPRT, GTY and NTST leverage as of September 30, 2023.

4. 2024E AFFO per share multiple calculated using current price per share and FactSet mean 2024E AFFO per share estimates.

NETSTREIT

2023E AFFO per Share Multiple ²

15.2x 14.9x

AGREE REALTY

14.3x

14.7x

ESSENTIAL PROPERTIES #FCPT

13.6x

14.2x 13.9x

REALTY INCOME

2024E AFFO per Share Multiple 4

13.5x

13.4x 13.2x

AGREE REALTY ESSENTIAL PROPERTIES #FCPT (W.P. CAREY

Getty Realty

NETSTREIT

13.1x 13.0x

REALTY INCOME

Getty Realty

12.7x 12.2x 11.6x

I

NATIONAL RETAIL

PROPERTES

13.0x

N

NETSTREIT

W.P. CAREY

12.4x

NATIONAL RETAIL

PROPERTIES

SPIRIT

11.4x

SPIRIT

18View entire presentation