Fiverr Investor Presentation Deck

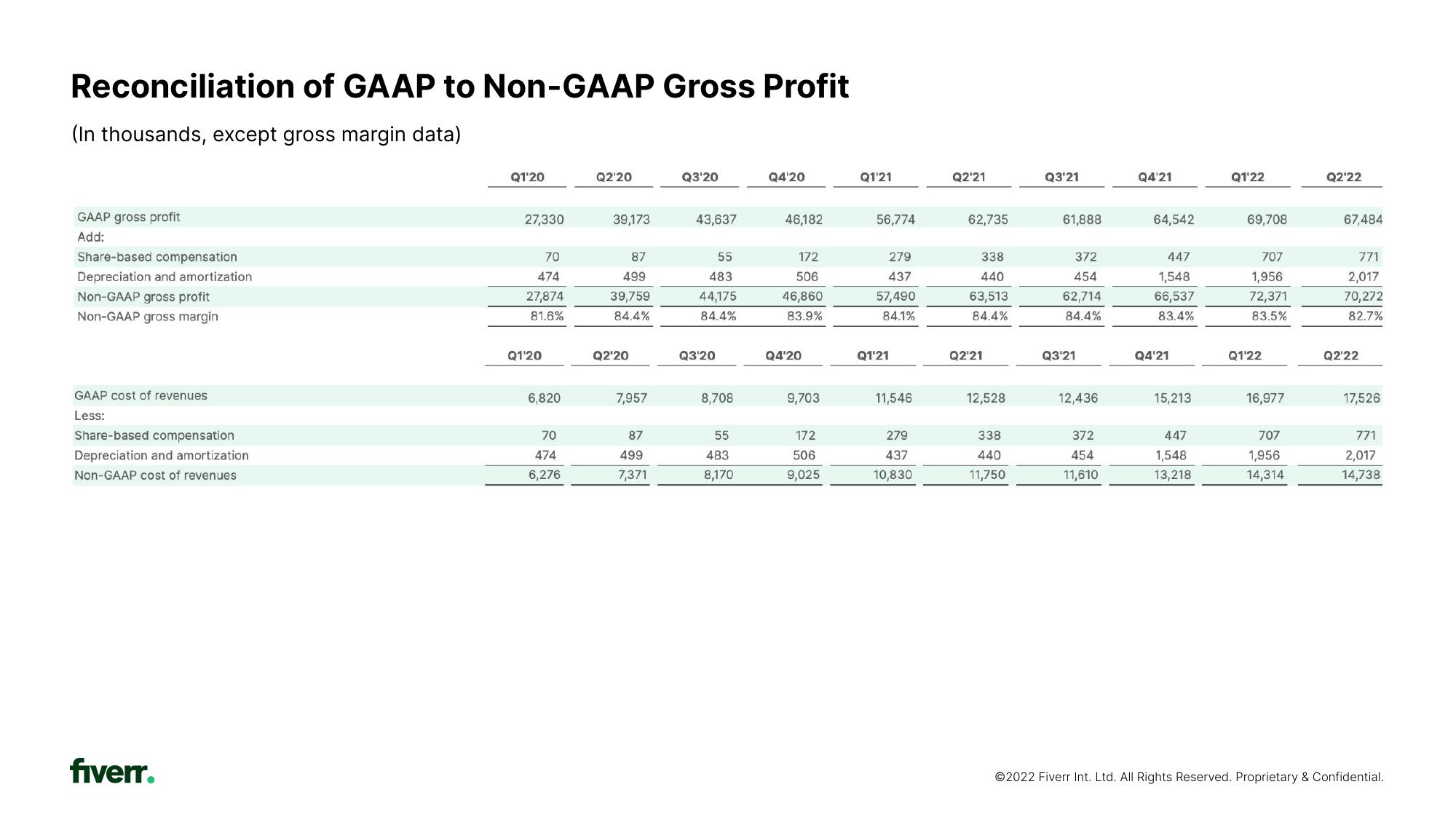

Reconciliation of GAAP to Non-GAAP Gross Profit

(In thousands, except gross margin data)

GAAP gross profit

Add:

Share-based compensation

Depreciation and amortization

Non-GAAP gross profit

Non-GAAP gross margin

GAAP cost of revenues

Less:

Share-based compensation

Depreciation and amortization

Non-GAAP cost of revenues

fiverr.

Q1'20

27,330

70

474

27,874

81.6%

Q1'20

6,820

70

474

6,276

Q2'20

39,173

87

499

39,759

84.4%

Q2'20

7,957

87

499

7,371

Q3'20

43,637

55

483

44,175

84,4%

Q3'20

8,708

55

483

8,170

Q4'20

46,182

172

506

46,860

83.9%

Q4'20

9,703

172

506

9,025

Q1'21

56,774

279

437

57,490

84.1%

Q1'21

11,546

279

437

10,830

Q2'21

62,735

338

440

63,513

84.4%

Q2¹21

12,528

338

440

11,750

Q3'21

61,888

372

454

62,714

84,4%

Q3'21

12,436

372

454

11,610

Q4'21

64,542

447

1,548

66,537

83.4%

Q4'21

15,213

447

1,548

13,218

Q1'22

69,708

707

1,956

72,371

83.5%

Q1'22

16,977

707

1,956

14,314

Q2'22

67,484

771

2,017

70,272

82.7%

Q2'22

17,526

771

2,017

14,738

Ⓒ2022 Fiverr Int. Ltd. All Rights Reserved. Proprietary & Confidential.View entire presentation