Main Street Capital Investor Day Presentation Deck

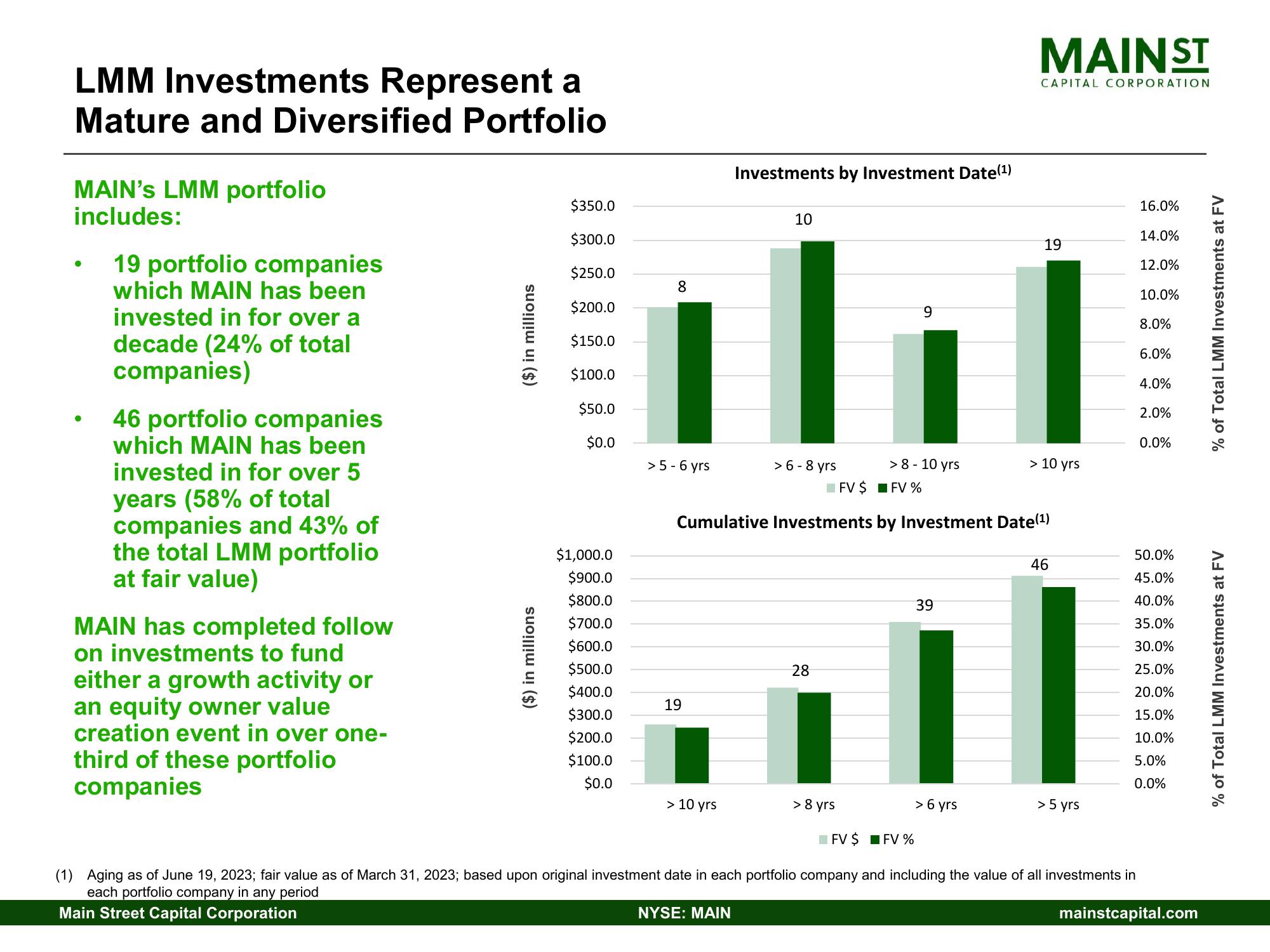

LMM Investments Represent a

Mature and Diversified Portfolio

MAIN'S LMM portfolio

includes:

19 portfolio companies

which MAIN has been

invested in for over a

decade (24% of total

companies)

46 portfolio companies

which MAIN has been

invested in for over 5

years (58% of total

companies and 43% of

the total LMM portfolio

at fair value)

MAIN has completed follow

on investments to fund

either a growth activity or

an equity owner value

creation event in over one-

third of these portfolio

companies

($) in millions

($) in millions

$350.0

$300.0

$250.0

$200.0

$150.0

$100.0

$50.0

$0.0

$1,000.0

$900.0

$800.0

$700.0

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

8

> 5-6 yrs

19

Investments by Investment Date(¹)

> 10 yrs

10

> 6-8 yrs

> 8-10 yrs

FV %

Cumulative Investments by Investment Date(¹)

28

> 8 yrs

9

FV $

39

MAINST

> 6 yrs

CAPITAL CORPORATION

19

> 10 yrs

46

> 5 yrs

16.0%

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

50.0%

45.0%

40.0%

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

FV $ FV %

(1) Aging as of June 19, 2023; fair value as of March 31, 2023; based upon original investment date in each portfolio company and including the value of all investments in

each portfolio company in any period

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

% of Total LMM Investments at FV

% of Total LMM Investments at FVView entire presentation