Barclays Capital 2010 Global Financial Services Conference

Funding - Consistent access to wholesale markets RBS

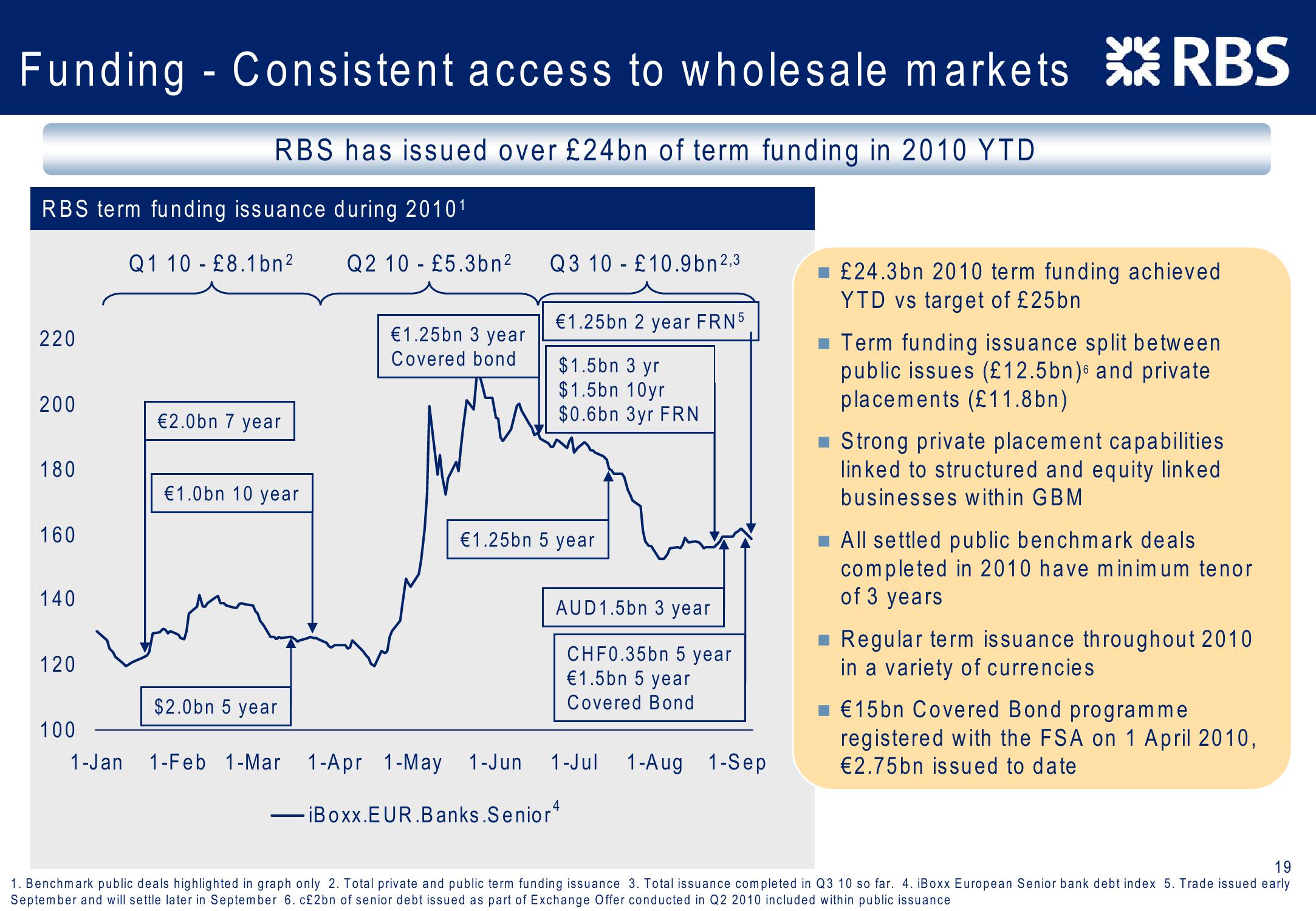

RBS has issued over £24bn of term funding in 2010 YTD

RBS term funding issuance during 20101

220

Q1 10 £8.1bn²

-

Q2 10 £5.3bn²

-

Q3 10 £10.9bn 2,3

€1.25bn 3 year

Covered bond

€1.25bn 2 year FRN5

$1.5bn 3 yr

$1.5bn 10yr

$0.6bn 3yr FRN

200

€2.0bn 7 year

180

€1.0bn 10 year

160

€1.25bn 5 year

140

AUD1.5bn 3 year

CHF0.35bn 5 year

€1.5bn 5 year

Covered Bond

120

$2.0bn 5 year

100

1-Jan

1-Feb 1-Mar 1-Apr 1-May 1-Jun 1-Jul

1-Aug 1-Sep

– iBoxx.EUR.Banks.Senior4

£24.3bn 2010 term funding achieved

YTD vs target of £25bn

Term funding issuance split between

public issues (£12.5bn) and private

placements (£11.8bn)

■Strong private placement capabilities

linked to structured and equity linked

businesses within GBM

All settled public benchmark deals

completed in 2010 have minimum tenor

of 3 years

■Regular term issuance throughout 2010

in a variety of currencies

■■ €15bn Covered Bond programme

registered with the FSA on 1 April 2010,

€2.75bn issued to date

19

1. Benchmark public deals highlighted in graph only 2. Total private and public term funding issuance 3. Total issuance completed in Q3 10 so far. 4. iBoxx European Senior bank debt index 5. Trade issued early

September and will settle later in September 6. c£2bn of senior debt issued as part of Exchange Offer conducted in Q2 2010 included within public issuanceView entire presentation