SoftBank Results Presentation Deck

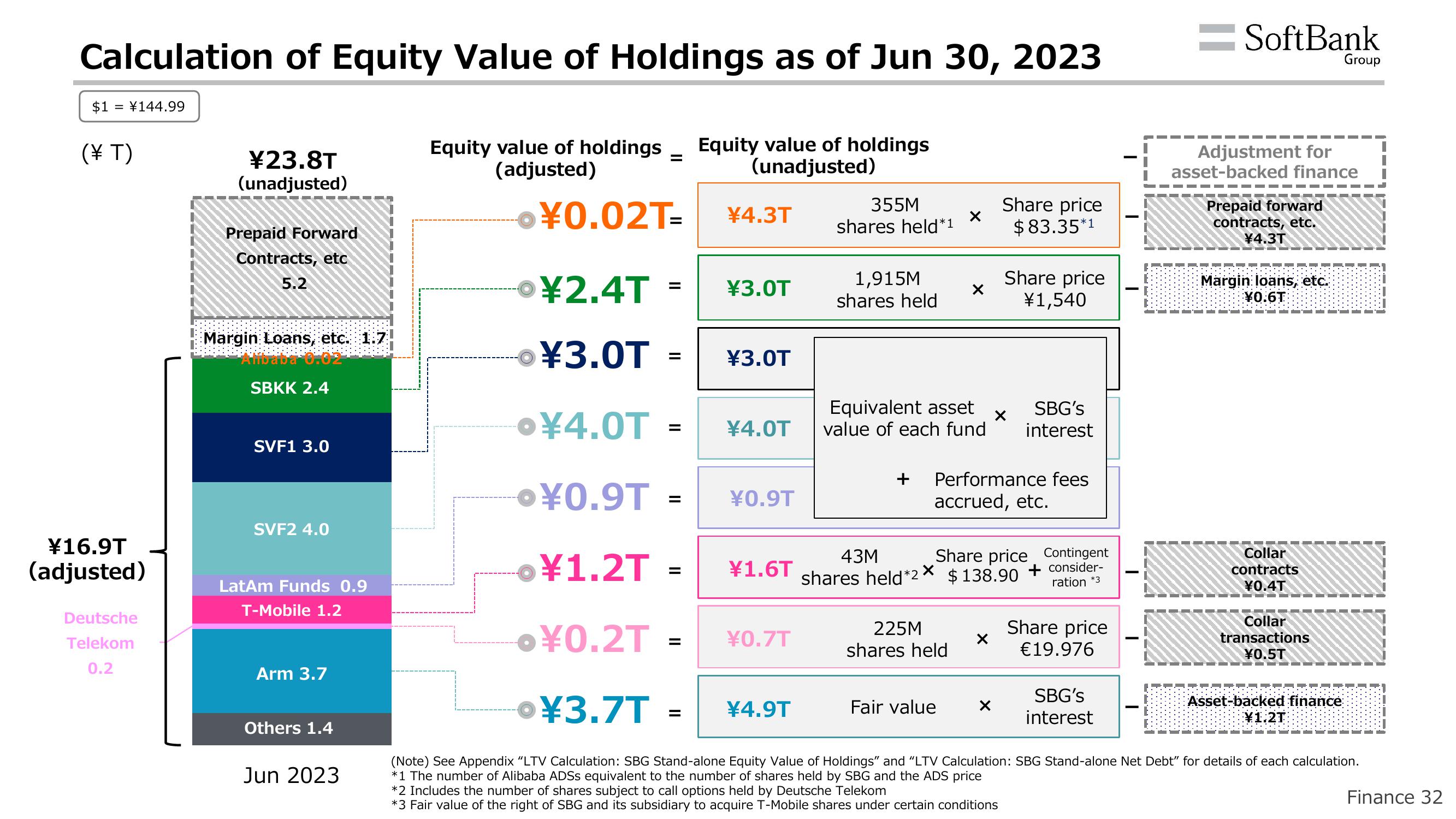

Calculation of Equity Value of Holdings as of Jun 30, 2023

$1

= ¥144.99

(¥T)

¥16.9T

(adjusted)

Deutsche

Telekom

0.2

¥23.8T

(unadjusted)

Prepaid Forward

Contracts, etc

5.2

Margin Loans, etc. 1.7

SBKK 2.4

SVF1 3.0

SVF2 4.0

LatAm Funds 0.9

T-Mobile 1.2

Arm 3.7

Others 1.4

Jun 2023

Equity value of holdings Equity value of holdings

(adjusted)

(unadjusted)

•¥0.02T-

¥2.4T

¥3.0T =

¥4.0T

¥0.9T =

¥1.2T =

•¥0.2T

=

=

¥4.3T

¥3.0T

¥3.0T

¥4.0T

¥0.9T

¥1.6T

¥0.7T

355M

shares held*1

¥4.9T

1,915M

shares held

X

Equivalent asset

value of each fund

X

225M

shares held

Fair value

Share price

$83.35*1

Share price

¥1,540

Performance fees

accrued, etc.

X

X

43M

Share price Contingent

shares held *2* $138.90

+ consider-

ration *3

SBG's

interest

Share price

€19.976

SBG's

interest

=SoftBank

Adjustment for

asset-backed finance

Prepaid forward

contracts, etc.

¥4.3T

Margin loans, etc.

¥0.6T

d' w '▬ ▬ ▬ min

Collar

contracts

¥0.4T

BO▬▬▬▬▬▬▬

Collar

transactions

¥0.5T

Asset-backed finance

¥3.7T =

(Note) See Appendix "LTV Calculation: SBG Stand-alone Equity Value of Holdings" and "LTV Calculation: SBG Stand-alone Net Debt" for details of each calculation.

*1 The number of Alibaba ADSS equivalent to the number of shares held by SBG and the ADS price

*2 Includes the number of shares subject to call options held by Deutsche Telekom

*3 Fair value of the right of SBG and its subsidiary to acquire T-Mobile shares under certain conditions

Group

¥1.2T

Finance 32View entire presentation