Main Street Capital Investor Day Presentation Deck

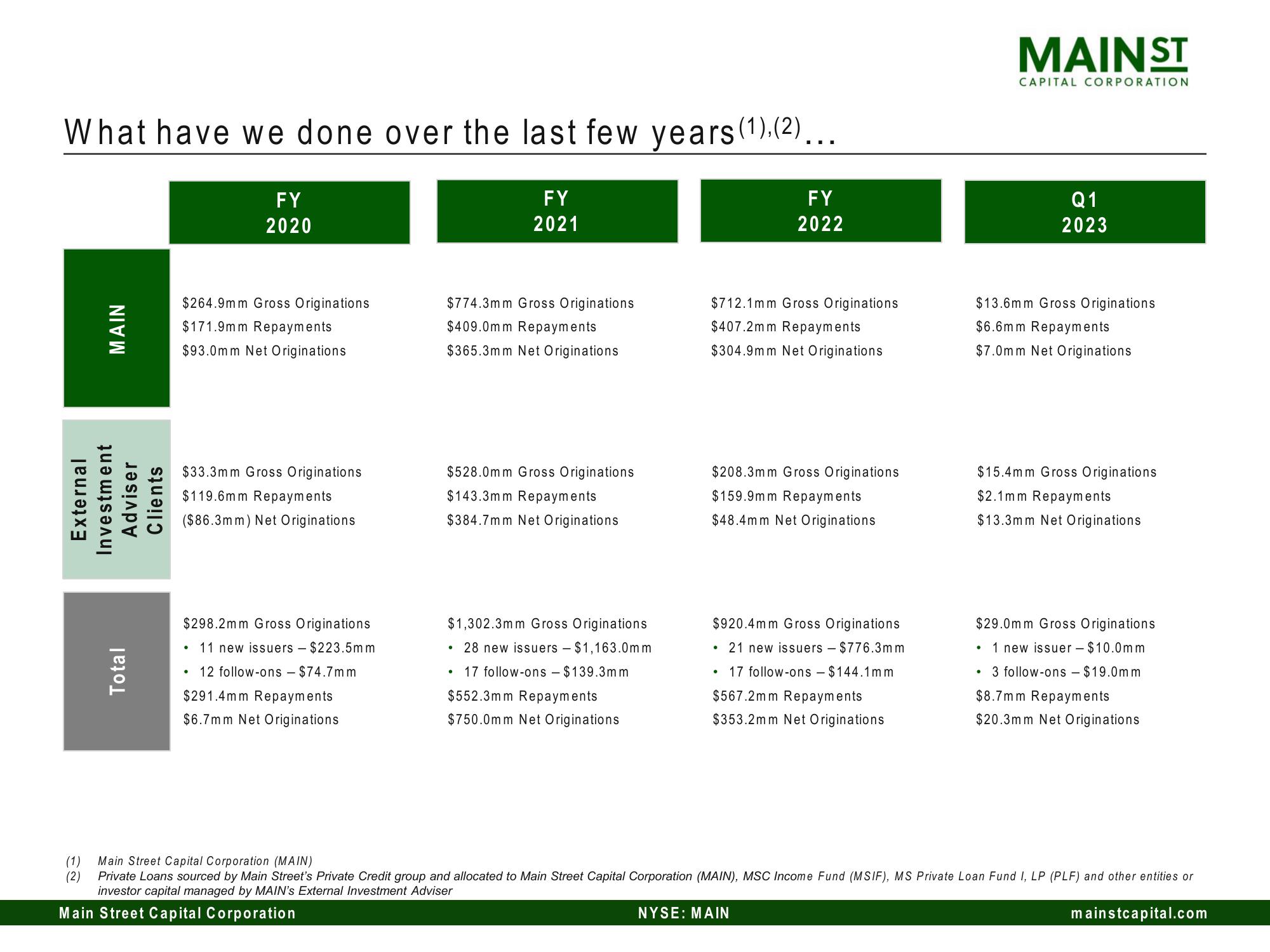

What have we done over the last few years (1),(2)…..

FY

2021

MAIN

External

Investment

Adviser

Clients

Total

FY

2020

$264.9mm Gross Originations

$171.9mm Repayments

$93.0mm Net Originations

$33.3mm Gross Originations

$119.6mm Repayments

($86.3mm) Net Originations

$298.2mm Gross Originations

• 11 new issuers - $223.5mm

• 12 follow-ons - $74.7mm

$291.4mm Repayments

$6.7mm Net Originations

$774.3mm Gross Originations

$409.0mm Repayments

$365.3mm Net Originations

$528.0mm Gross Originations

$143.3mm Repayments

$384.7mm Net Originations

$1,302.3mm Gross Originations

28 new issuers - $1,163.0mm

17 follow-ons - $139.3mm

●

●

$552.3mm Repayments

$750.0mm Net Originations

$712.1 mm Gross Originations

$407.2mm Repayments

$304.9mm Net Originations

FY

2022

$208.3mm Gross Originations

$159.9mm Repayments

$48.4mm Net Originations

$920.4mm Gross Originations

• 21 new issuers - $776.3mm

17 follow-ons - $144.1mm

$567.2mm Repayments

$353.2mm Net Originations

●

NYSE: MAIN

MAINST

CAPITAL CORPORATION

Q1

2023

$13.6mm Gross Originations

$6.6mm Repayments

$7.0mm Net Originations

$15.4mm Gross Originations

$2.1mm Repayments

$13.3mm Net Originations

$29.0mm Gross Originations

1 new issuer - $10.0mm

• 3 follow-ons - $19.0mm

$8.7mm Repayments

$20.3mm Net Originations

(1)

Main Street Capital Corporation (MAIN)

(2) Private Loans sourced by Main Street's Private Credit group and allocated to Main Street Capital Corporation (MAIN), MSC Income Fund (MSIF), MS Private Loan Fund I, LP (PLF) and other entities or

investor capital managed by MAIN's External Investment Adviser

Main Street Capital Corporation

mainstcapital.comView entire presentation