Kimco and Weingarten Strategic Merger investor presentaton

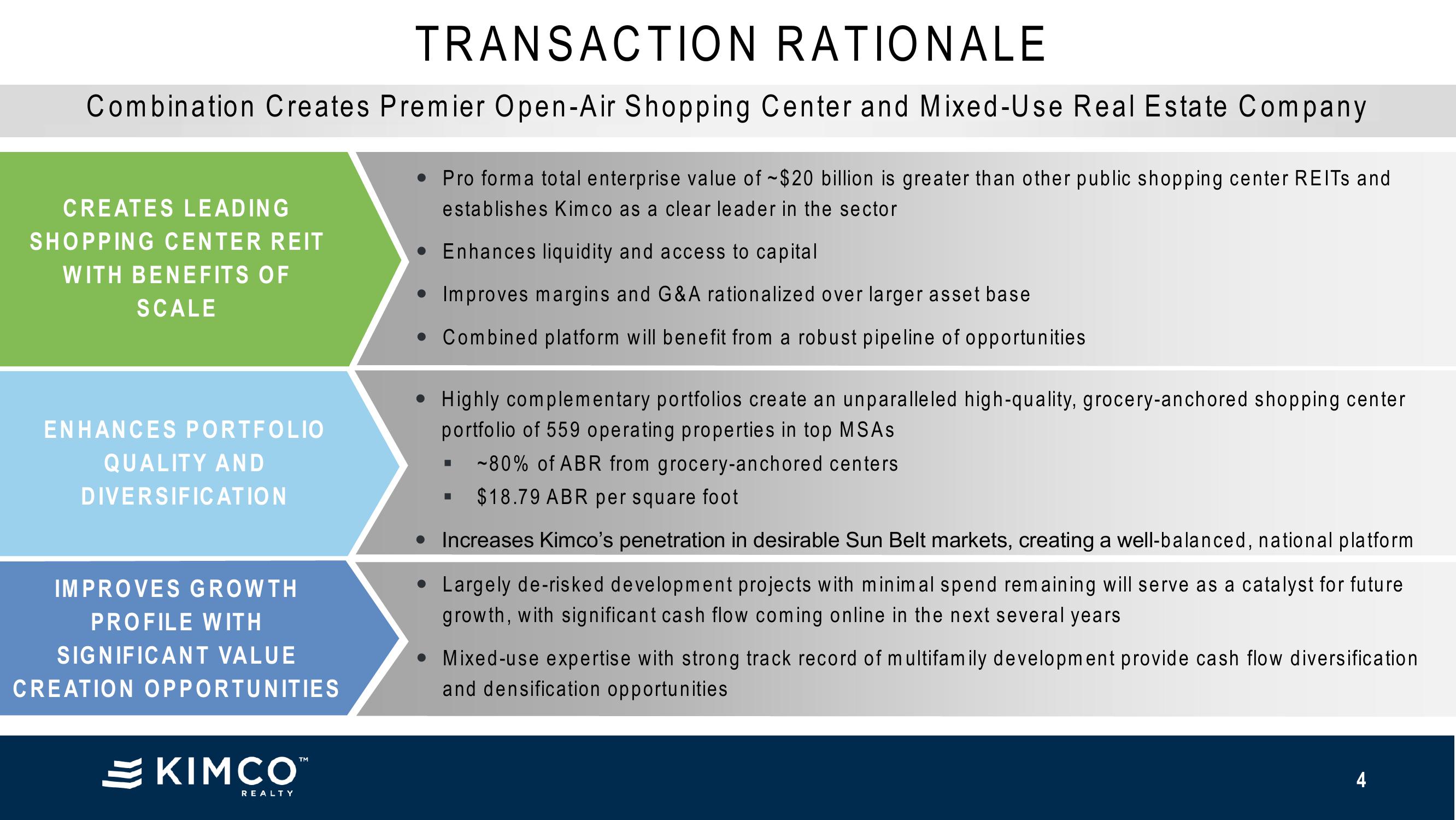

TRANSACTION

RATIONALE

Combination Creates Premier Open-Air Shopping Center and Mixed-Use Real Estate Company

CREATES LEADING

SHOPPING CENTER REIT

WITH BENEFITS OF

SCALE

ENHANCES PORTFOLIO

QUALITY AND

DIVERSIFICATION

IMPROVES GROWTH

PROFILE WITH

SIGNIFICANT VALUE

CREATION OPPORTUNITIES

KIMCO™

REALTY

• Pro forma total enterprise value of $20 billion is greater than other public shopping center REITs and

establishes Kimco as a clear leader in the sector

• Enhances liquidity and access to capital

• Improves margins and G&A rationalized over larger asset base

• Combined platform will benefit from a robust pipeline of opportunities

• Highly complementary portfolios create an unparalleled high-quality, grocery-anchored shopping center

portfolio of 559 operating properties in top MSAS

-~80% of ABR from grocery-anchored centers

$18.79 ABR per square foot

■

• Increases Kimco's penetration in desirable Sun Belt markets, creating a well-balanced, national platform

Largely de-risked development projects with minimal spend remaining will serve as a catalyst for future

growth, with significant cash flow coming online in the next several years

Mixed-use expertise with strong track record of multifamily development provide cash flow diversification

and densification opportunities

4View entire presentation