Nerdy SPAC Presentation Deck

TPG Pace 2021 Forecast by Quarter¹

1.

$ in Millions

Total Revenue (100% Online)

% YoY Growth

Gross Profit

% Margin

(-) Sales Marketing Expense

(-) Operations & Fulfillment

(-) Tech & Product

(-) G&A

Total Opex

Other Income (Expense)²

Net Income

% Margin

Adjusted EBITDA³

% Margin

Q1 2021F

$

$

$

$

32 $

41%

22 $

67%

(14)

(3)

(3)

(4)

(11)

(1)

Q2 2021F Q3 2021F Q4 2021F

28 $

30%

35 $

31%

(4) $

(14%)

(1) $

(4%)

19 $

68%

(12)

(4)

(4)

(6)

(14)

7

0 $

1%

(5) $

(16%)

24 $

70%

(16)

(4)

(4)

(7)

(15)

0

(7) $

(19%)

(4) $

(12%)

43

30%

31

71%

(15)

(4)

(5)

(7)

(16)

0

0

0%

3

6%

$

$

$

$

2021F

138

33%

96

70%

(57)

(14)

(17)

(25)

(56)

6

(11)

(8%)

(8)

(5%)

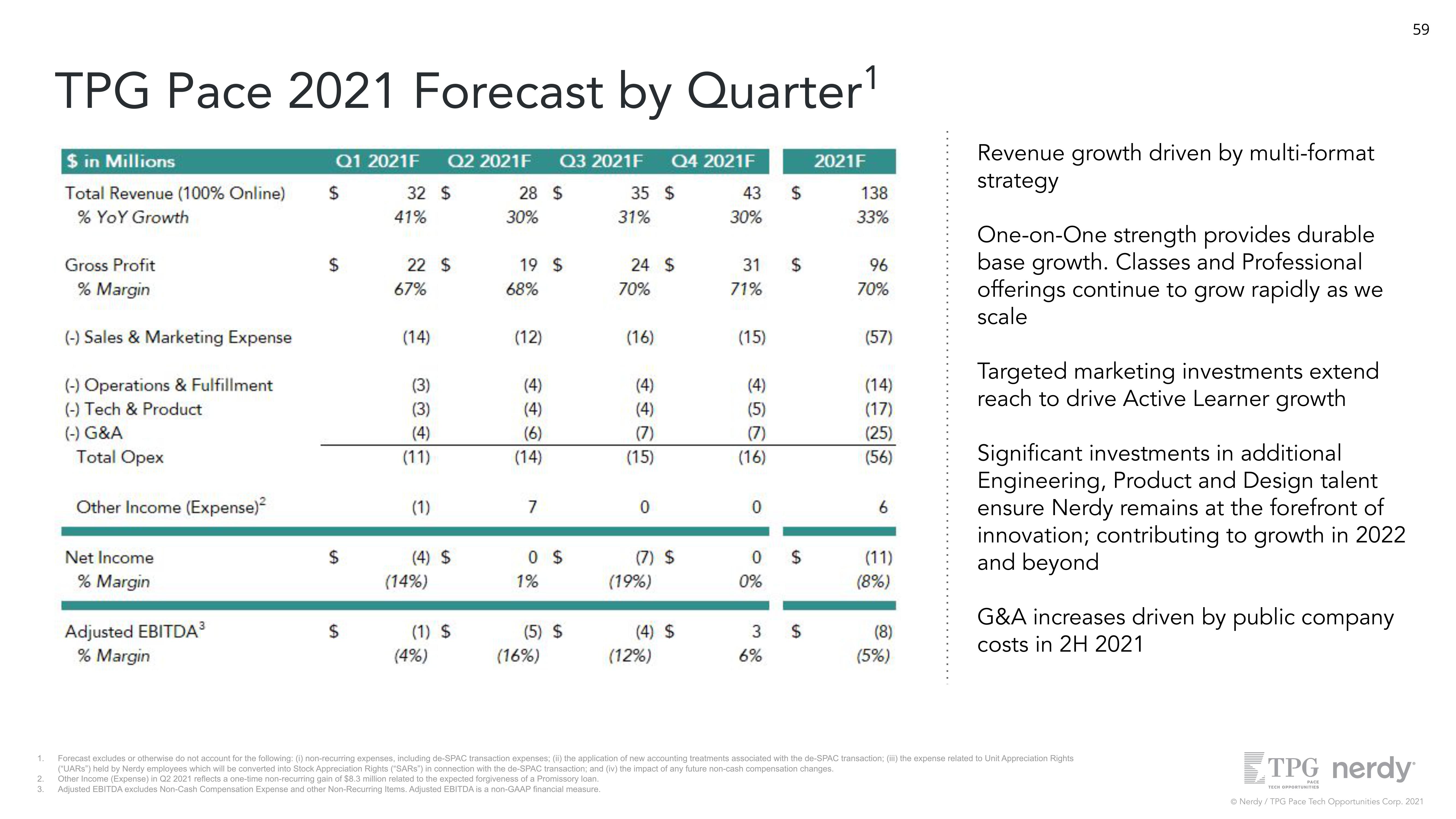

Revenue growth driven by multi-format

strategy

One-on-One strength provides durable

base growth. Classes and Professional

offerings continue to grow rapidly as we

scale

Targeted marketing investments extend

reach to drive Active Learner growth

Significant investments in additional

Engineering, Product and Design talent

ensure Nerdy remains at the forefront of

innovation; contributing to growth in 2022

and beyond

G&A increases driven by public company

costs in 2H 2021

Forecast excludes or otherwise do not account for the following: (i) non-recurring expenses, including de-SPAC transaction expenses; (ii) the application of new accounting treatments associated with the de-SPAC transaction; (iii) the expense related to Unit Appreciation Rights

("UARS") held by Nerdy employees which will be converted into Stock Appreciation Rights ("SARS") in connection with the de-SPAC transaction; and (iv) the impact of any future non-cash compensation changes.

2

Other Income (Expense) in Q2 2021 reflects a one-time non-recurring gain of $8.3 million related to the expected forgiveness of a Promissory loan.

3. Adjusted EBITDA excludes Non-Cash Compensation Expense and other Non-Recurring Items. Adjusted EBITDA is a non-GAAP financial measure.

59

TPG nerdy

PACE

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation