Pershing Square Investor Presentation Deck

Unwind of CDS Index Hedges

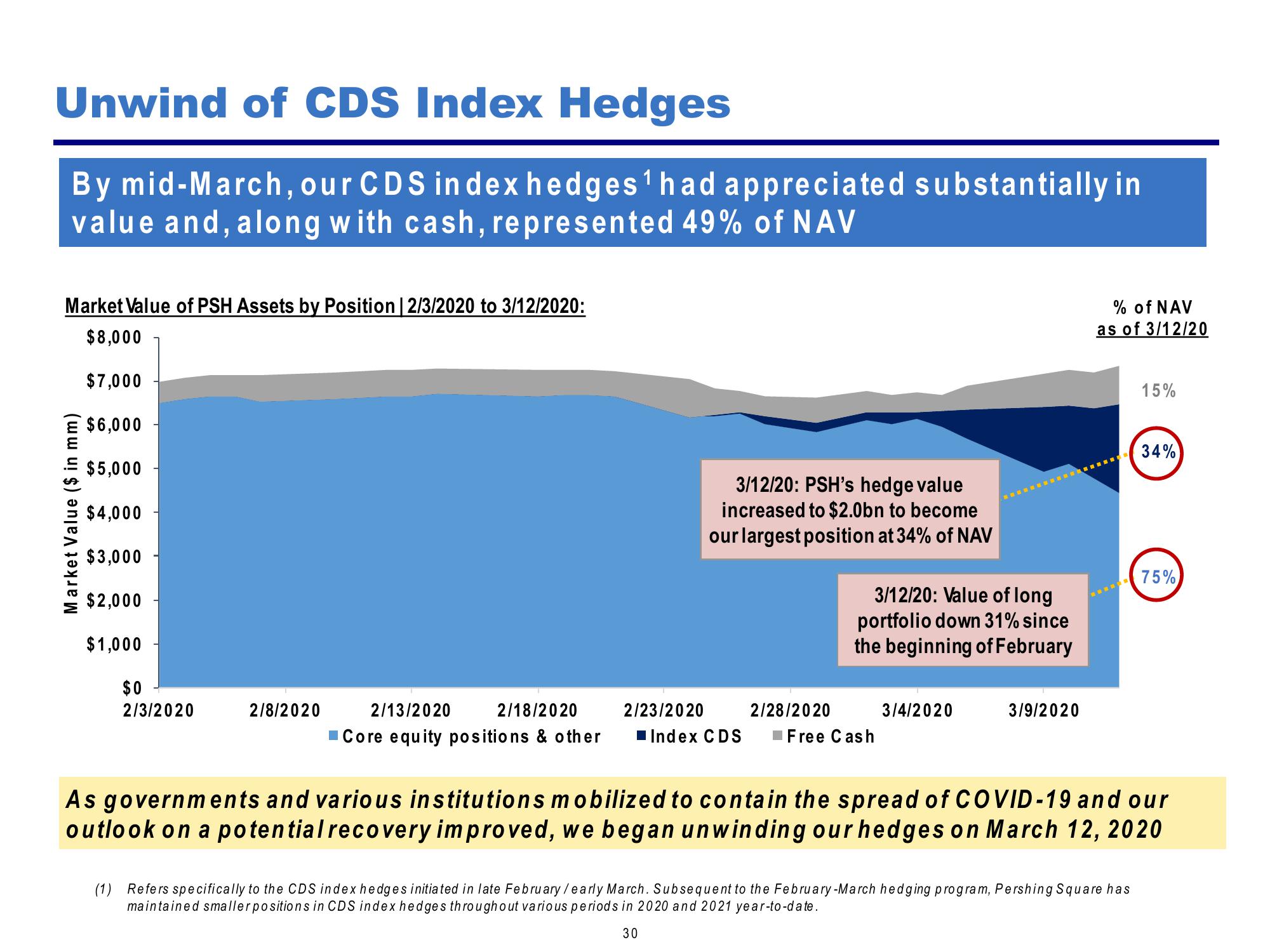

By mid-March, our CDS index hedges¹ had appreciated substantially in

value and, along with cash, represented 49% of NAV

Market Value of PSH Assets by Position | 2/3/2020 to 3/12/2020:

$8,000

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

Market Value ($ in mm)

$0

2/3/2020

2/8/2020

2/13/2020 2/18/2020

Core equity positions & other

3/12/20: PSH's hedge value

increased to $2.0bn to become

our largest position at 34% of NAV

2/23/2020

Index CDS

3/12/20: Value of long

portfolio down 31% since

the beginning of February

2/28/2020

Free Cash

3/4/2020

3/9/2020

% of NAV

as of 3/12/20

15%

(1) Refers specifically to the CDS index hedges initiated in late February / early March. Subsequent to the February-March hedging program, Pershing Square has

maintained smaller positions in CDS index hedges throughout various periods in 2020 and 2021 year-to-date.

30

34%

75%

As governments and various institutions mobilized to contain the spread of COVID-19 and our

outlook on a potential recovery improved, we began unwinding our hedges on March 12, 2020View entire presentation