BlackSky SPAC Presentation Deck

Transaction

Size

Capital

Structure

Pro Forma

Ownership ¹

1

+

Expected

Timeline

•

4E

•

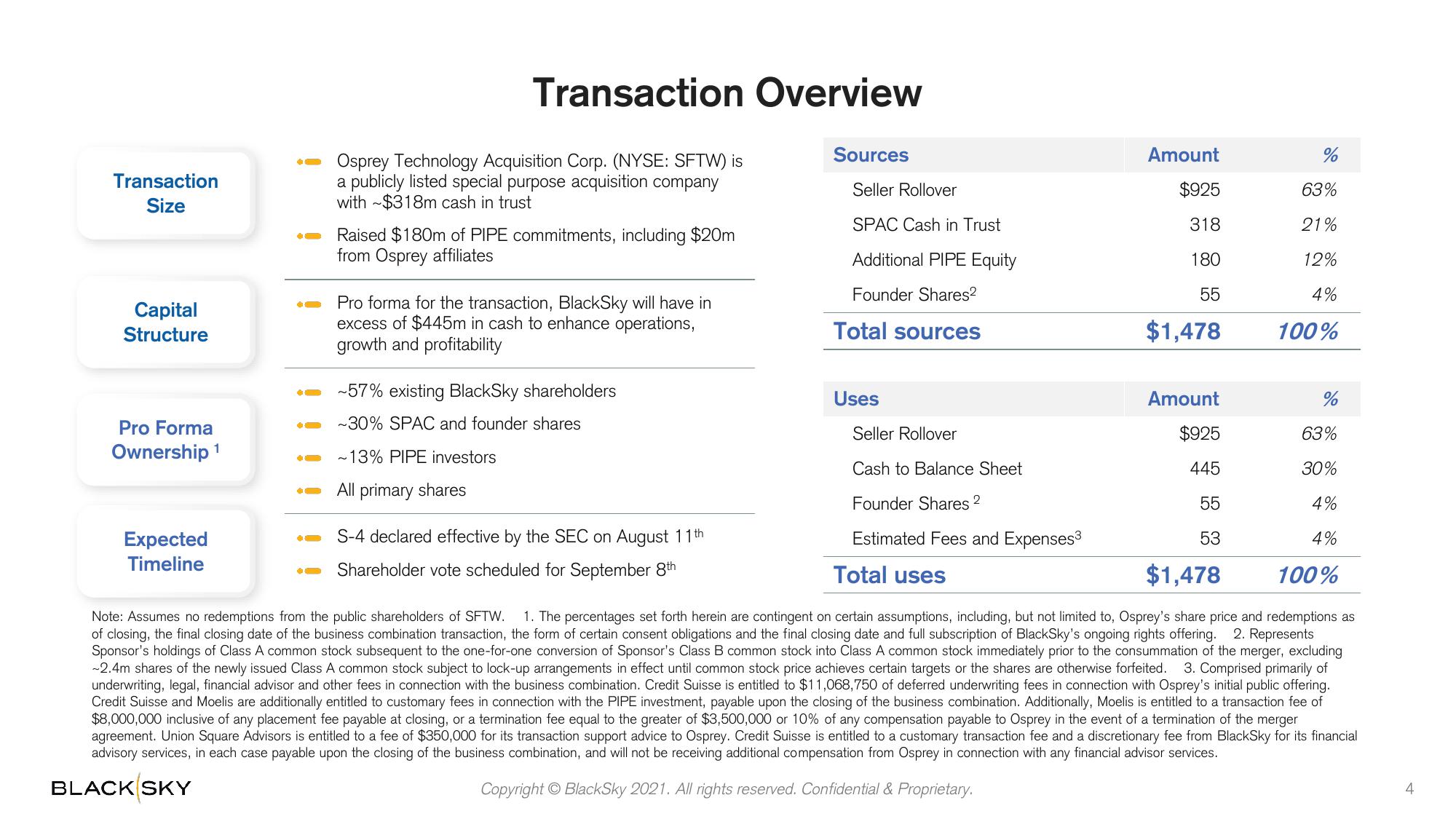

Transaction Overview

Osprey Technology Acquisition Corp. (NYSE: SFTW) is

a publicly listed special purpose acquisition company

with $318m cash in trust

●C

Raised $180m of PIPE commitments, including $20m

from Osprey affiliates

Pro forma for the transaction, BlackSky will have in

excess of $445m in cash to enhance operations,

growth and profitability

• -30% SPAC and founder shares

-57% existing BlackSky shareholders

~ 13% PIPE investors

All primary shares

Sources

S-4 declared effective by the SEC on August 11th

Shareholder vote scheduled for September 8th

Seller Rollover

SPAC Cash in Trust

Additional PIPE Equity

Founder Shares²

Total sources

Uses

Amount

$925

318

180

55

$1,478

Seller Rollover

Cash to Balance Sheet

Founder Shares 2

Estimated Fees and Expenses³

Total uses

$1,478

Note: Assumes no redemptions from the public shareholders of SFTW. 1. The percentages set forth herein are contingent on certain assumptions, including, but not limited to, Osprey's share price and redemptions as

of closing, the final closing date of the business combination transaction, the form of certain consent obligations and the final closing date and full subscription of BlackSky's ongoing rights offering. 2. Represents

Sponsor's holdings of Class A common stock subsequent to the one-for-one conversion of Sponsor's Class B common stock into Class A common stock immediately prior to the consummation of the merger, excluding

-2.4m shares of the newly issued Class A common stock subject to lock-up arrangements in effect until common stock price achieves certain targets or the shares are otherwise forfeited. 3. Comprised primarily of

underwriting, legal, financial advisor and other fees in connection with the business combination. Credit Suisse is entitled to $11,068,750 of deferred underwriting fees in connection with Osprey's initial public offering.

Credit Suisse and Moelis are additionally entitled to customary fees in connection with the PIPE investment, payable upon the closing of the business combination. Additionally, Moelis is entitled to a transaction fee of

$8,000,000 inclusive of any placement fee payable at closing, or a termination fee equal to the greater of $3,500,000 or 10% of any compensation payable to Osprey in the event of a termination of the merger

agreement. Union Square Advisors is entitled to a fee of $350,000 for its transaction support advice to Osprey. Credit Suisse is entitled to a customary transaction fee and a discretionary fee from BlackSky for its financial

advisory services, in each case payable upon the closing of the business combination, and will not be receiving additional compensation from Osprey in connection with any financial advisor services.

BLACK SKY

Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary.

Amount

$925

445

55

53

%

63%

21%

12%

4%

100%

%

63%

30%

4%

4%

100%

4View entire presentation