Yelp Investor Presentation Deck

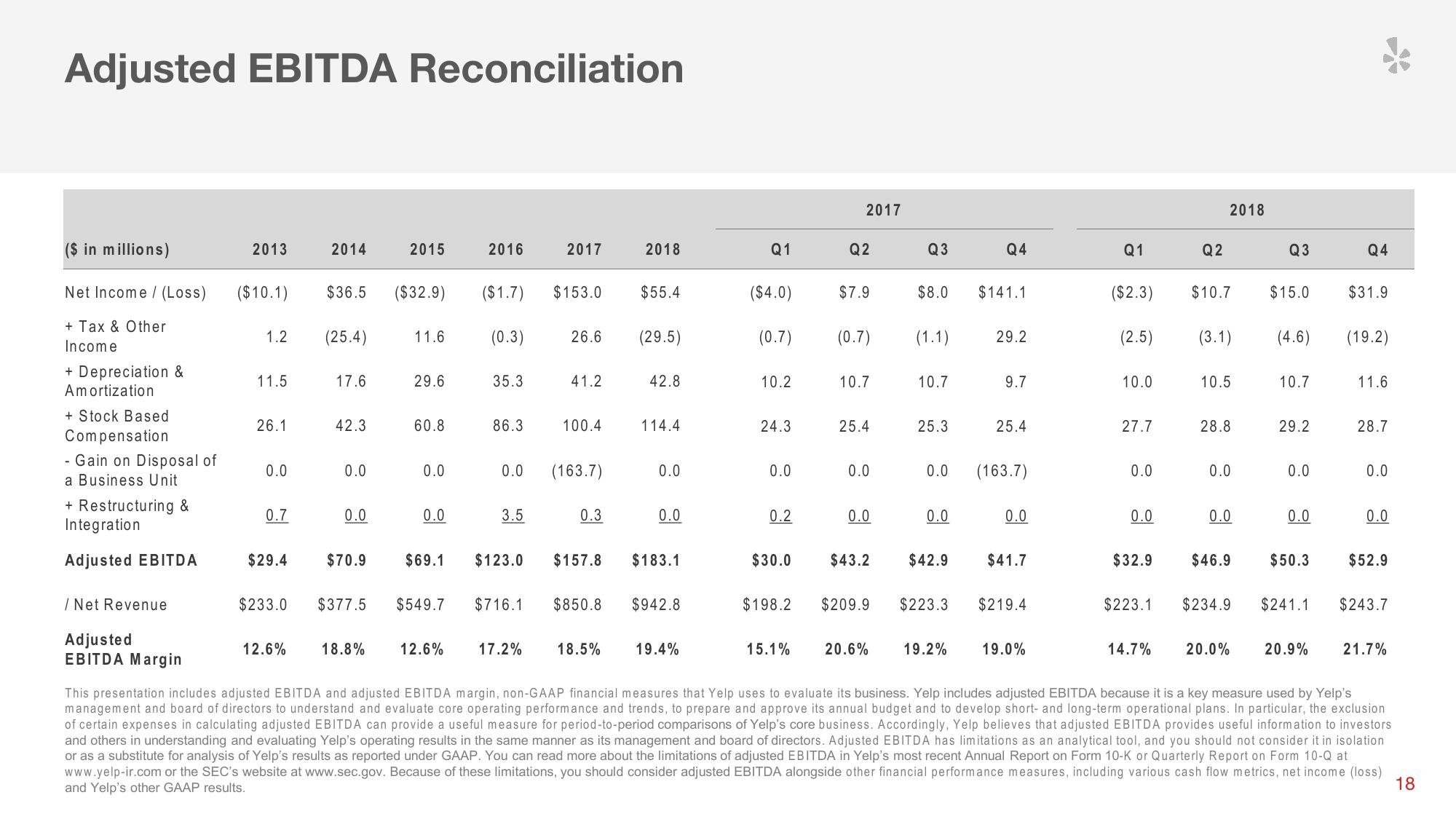

Adjusted EBITDA Reconciliation

($ in millions)

Net Income (Loss)

+ Tax & Other

Income

+ Depreciation &

Amortization

+ Stock Based

Compensation

- Gain on Disposal of

a Business Unit

+ Restructuring &

Integration

Adjusted EBITDA

/ Net Revenue

Adjusted

EBITDA Margin

2013

($10.1)

1.2

11.5

26.1

0.0

0.7

$29.4

2014

12.6%

$36.5 ($32.9)

(25.4)

17.6

42.3

0.0

0.0

2015

11.

18.8%

29.6

60.8

0.0

0.0

2016

12.6%

(0.3)

($1.7) $153.0 $55.4

35.3

86.3

0.0

$233.0 $377.5 $549.7 $716.1

3.5

2017

17.2%

26.6 (29.5)

41.2

$70.9 $69.1 $123.0 $157.8

100.4

(163.7)

0.3

2018

18.5%

42.8

114.4

0.0

0.0

$183.1

$850.8 $942.8

19.4%

Q1

($4.0)

(0.7)

10.2

24.3

0.0

0.2

$30.0

$198.2

15.1%

2017

Q2

$7.9

(0.7)

10.7

25.4

0.0

0.0

$43.2

Q3

$8.0

10.7

(1.1) 29.2

25.3

0.0

0.0

$42.9

Q4

$141.1

20.6% 19.2%

9.7

25.4

(163.7)

0.0

$41.7

$209.9 $223.3 $219.4

19.0%

Q1

10.0

($2.3)

(2.5) (3.1)

27.7

0.0

0.0

Q2

$32.9

2018

$10.7

10.5

28.8

0.0

0.0

$46.9

Q3

$15.0

10.7

(4.6) (19.2)

29.2

0.0

0.0

$50.3

Q4

$223.1 $234.9 $241.1

$31.9

11.6

28.7

0.0

0.0

$52.9

$243.7

14.7% 20.0% 20.9% 21.7%

This presentation includes adjusted EBITDA and adjusted EBITDA margin, non-GAAP financial measures that Yelp uses to evaluate its business. Yelp includes adjusted EBITDA because it is a key measure used by Yelp's

management and board of directors to understand and evaluate core operating performance and trends, to prepare and approve its annual budget and to develop short- and long-term operational plans. In particular, the exclusion

of certain expenses in calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of Yelp's core business. Accordingly, Yelp believes that adjusted EBITDA provides useful information to investors

and others in understanding and evaluating Yelp's operating results in the same manner as its management and board of directors. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation

or as a substitute for analysis of Yelp's results as reported under GAAP. You can read more about the limitations of adjusted EBITDA in Yelp's most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q at

www.yelp-ir.com or the SEC's website at www.sec.gov. Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net income (loss)

and Yelp's other GAAP results.

18View entire presentation