J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

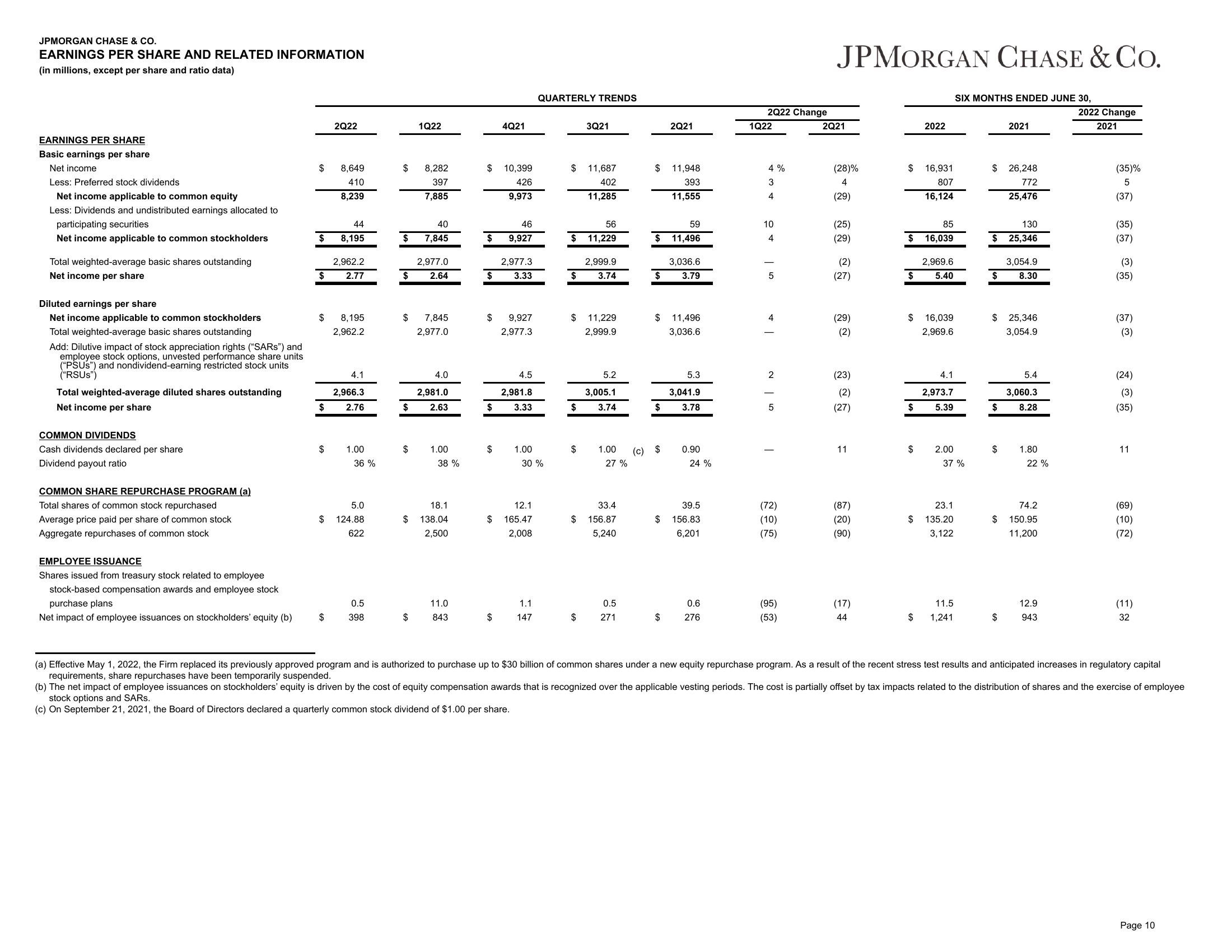

EARNINGS PER SHARE AND RELATED INFORMATION

(in millions, except per share and ratio data)

EARNINGS PER SHARE

Basic earnings per share

Net income

Less: Preferred stock dividends

Net income applicable to common equity

Less: Dividends and undistributed earnings allocated to

participating securities

Net income applicable to common stockholders

Total weighted-average basic shares outstanding

Net income per share

Diluted earnings per share

Net income applicable to common stockholders

Total weighted-average basic shares outstanding

Add: Dilutive impact of stock appreciation rights ("SARS") and

employee stock options, unvested performance share units

("PSUS") and nondividend-earning restricted stock units

("RSUS")

Total weighted-average diluted shares outstanding

Net income per share

COMMON DIVIDENDS

Cash dividends declared per share

Dividend payout ratio

COMMON SHARE REPURCHASE PROGRAM (a)

Total shares of common stock repurchased

Average price paid per share of common stock

Aggregate repurchases of common stock

EMPLOYEE ISSUANCE

Shares issued from treasury stock related to employee

stock-based compensation awards and employee stock

purchase plans

Net impact of employee issuances on stockholders' equity (b)

$

$

$

$

$

2Q22

$

8,649

410

8,239

44

8,195

2,962.2

2.77

8,195

2,962.2

4.1

2,966.3

2.76

1.00

36 %

5.0

$ 124.88

622

0.5

398

$

$

40

$ 7,845

1Q22

$

8,282

397

7,885

$

2,977.0

2.64

4.0

2,981.0

$ 2.63

7,845

2,977.0

1.00

38 %

18.1

$138.04

2,500

11.0

843

$

$

$

4Q21

$

10,399

426

9,973

2,977.3

$ 3.33

46

9,927

9,927

2,977.3

4.5

2,981.8

3.33

1.00

30%

12.1

$ 165.47

2,008

QUARTERLY TRENDS

1.1

147

$

56

$ 11,229

$

$

3Q21

11,687

402

11,285

$

2,999.9

3.74

11,229

2,999.9

5.2

3,005.1

3.74

1.00

27%

33.4

$ 156.87

5,240

0.5

271

$ 11,948

393

11,555

$

$

$

$

(c) $

2Q21

$

59

11,496

3,036.6

3.79

11,496

3,036.6

5.3

3,041.9

3.78

0.90

24 %

39.5

$ 156.83

6,201

0.6

276

2Q22 Change

1Q22

4%

3

4

10

4

5

4

2

5

(72)

(10)

(75)

(95)

(53)

JPMORGAN CHASE & CO.

2Q21

(28)%

4

(29)

(25)

(29)

(27)

(29)

(2)

(23)

(2)

(27)

11

(87)

(20)

(90)

(17)

44

$ 16,931

807

16,124

$

$

2022

$

$ 16,039

2,969.6

85

16,039

$

2,969.6

5.40

4.1

2,973.7

5.39

23.1

$ 135.20

3,122

2.00

37%

SIX MONTHS ENDED JUNE 30,

11.5

1,241

$ 26,248

772

25,476

130

$ 25,346

2021

$

$ 25,346

3,054.9

$

3,054.9

8.30

$

5.4

3,060.3

8.28

1.80

22 %

74.2

$ 150.95

11,200

12.9

943

2022 Change

2021

(35)%

5

(37)

(35)

(37)

(3)

(35)

(37)

(3)

(24)

(3)

(35)

11

(69)

(10)

(72)

(11)

32

(a) Effective May 1, 2022, the Firm replaced its previously approved program and is authorized to purchase up to $30 billion of common shares under a new equity repurchase program. As a result of the recent stress test results and anticipated increases in regulatory capital

requirements, share repurchases have been temporarily suspended.

(b) The net impact of employee issuances on stockholders' equity is driven by the cost of equity compensation awards that is recognized over the applicable vesting periods. The cost is partially offset by tax impacts related to the distribution of shares and the exercise of employee

stock options and SARS.

(c) On September 21, 2021, the Board of Directors declared a quarterly common stock dividend of $1.00 per share.

Page 10View entire presentation