Nuvei Results Presentation Deck

12

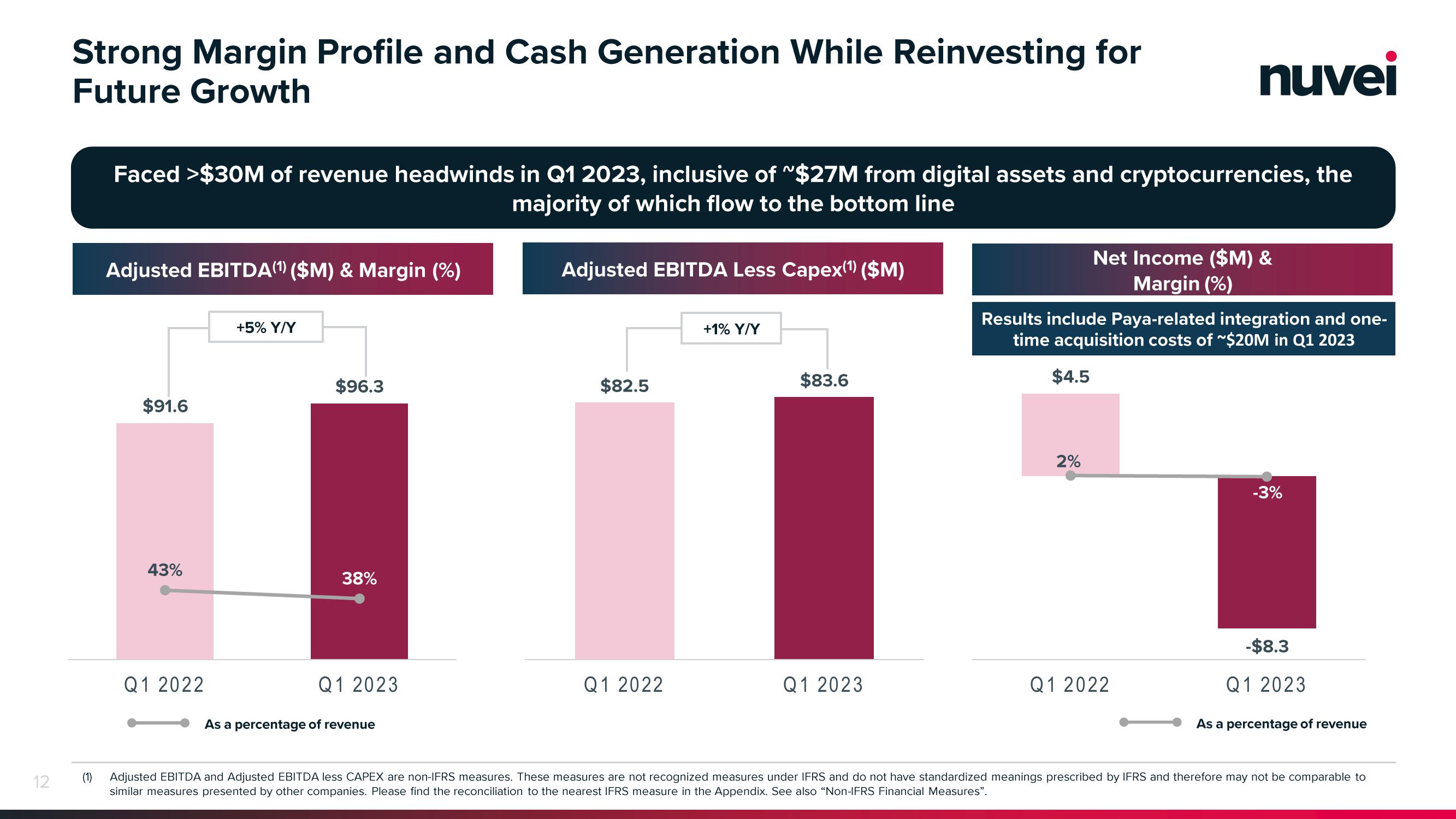

Strong Margin Profile and Cash Generation While Reinvesting for

Future Growth

(1)

nuvei

Faced >$30M of revenue headwinds in Q1 2023, inclusive of ~$27M from digital assets and cryptocurrencies, the

majority of which flow to the bottom line

Adjusted EBITDA(¹) ($M) & Margin (%)

$91.6

43%

Q1 2022

+5% Y/Y

$96.3

38%

Q1 2023

As a percentage of revenue

Adjusted EBITDA Less Capex(¹) ($M)

$82.5

Q1 2022

+1% Y/Y

$83.6

Q1 2023

Results include Paya-related integration and one-

time acquisition costs of ~$20M in Q1 2023

$4.5

Net Income ($M) &

Margin (%)

2%

Q1 2022

-3%

-$8.3

Q1 2023

As a percentage of revenue

Adjusted EBITDA and Adjusted EBITDA less CAPEX are non-IFRS measures. These measures are not recognized measures under IFRS and do not have standardized meanings prescribed by IFRS and therefore may not be comparable to

similar measures presented by other companies. Please find the reconciliation to the nearest IFRS measure in the Appendix. See also "Non-IFRS Financial Measures".View entire presentation