Docebo Investor Presentation Deck

Adjusted EBITDA

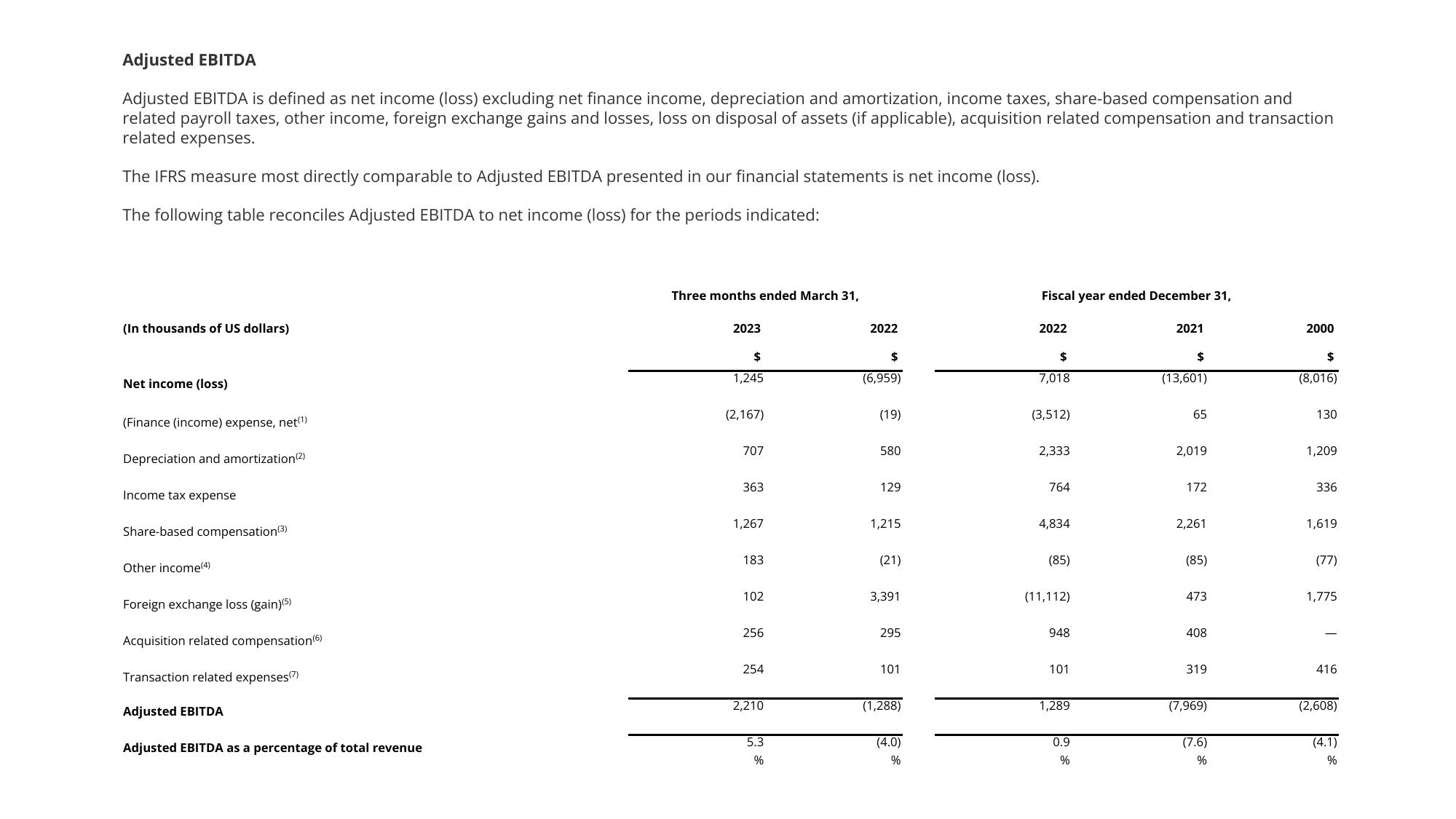

Adjusted EBITDA is defined as net income (loss) excluding net finance income, depreciation and amortization, income taxes, share-based compensation and

related payroll taxes, other income, foreign exchange gains and losses, loss on disposal of assets (if applicable), acquisition related compensation and transaction

related expenses.

The IFRS measure most directly comparable to Adjusted EBITDA presented in our financial statements is net income (loss).

The following table reconciles Adjusted EBITDA to net income (loss) for the periods indicated:

(In thousands of US dollars)

Net income (loss)

(Finance (income) expense, net(¹)

Depreciation and amortization (2)

Income tax expense

Share-based compensation (3)

Other income (4)

Foreign exchange loss (gain)(5)

Acquisition related compensation (6)

Transaction related expenses(7)

Adjusted EBITDA

Adjusted EBITDA as a percentage of total revenue

Three months ended March 31,

2023

2022

2022

$

$

(6,959)

7,018

(2,167)

(19)

(3,512)

707

580

2,333

363

129

764

III

1,267

1,215

4,834

183

(21)

(85)

102

3,391

(11,112)

295

948

101

101

(1,288)

$

1,245

256

254

2,210

5.3

%

Fiscal year ended December 31,

(4.0)

%

1,289

0.9

%

2021

$

(13,601)

65

2,019

172

2,261

(85)

473

408

319

(7,969)

(7.6)

%

2000

$

(8,016)

130

1,209

336

1,619

(77)

1,775

416

(2,608)

(4.1)

%View entire presentation