BlackRock Results Presentation Deck

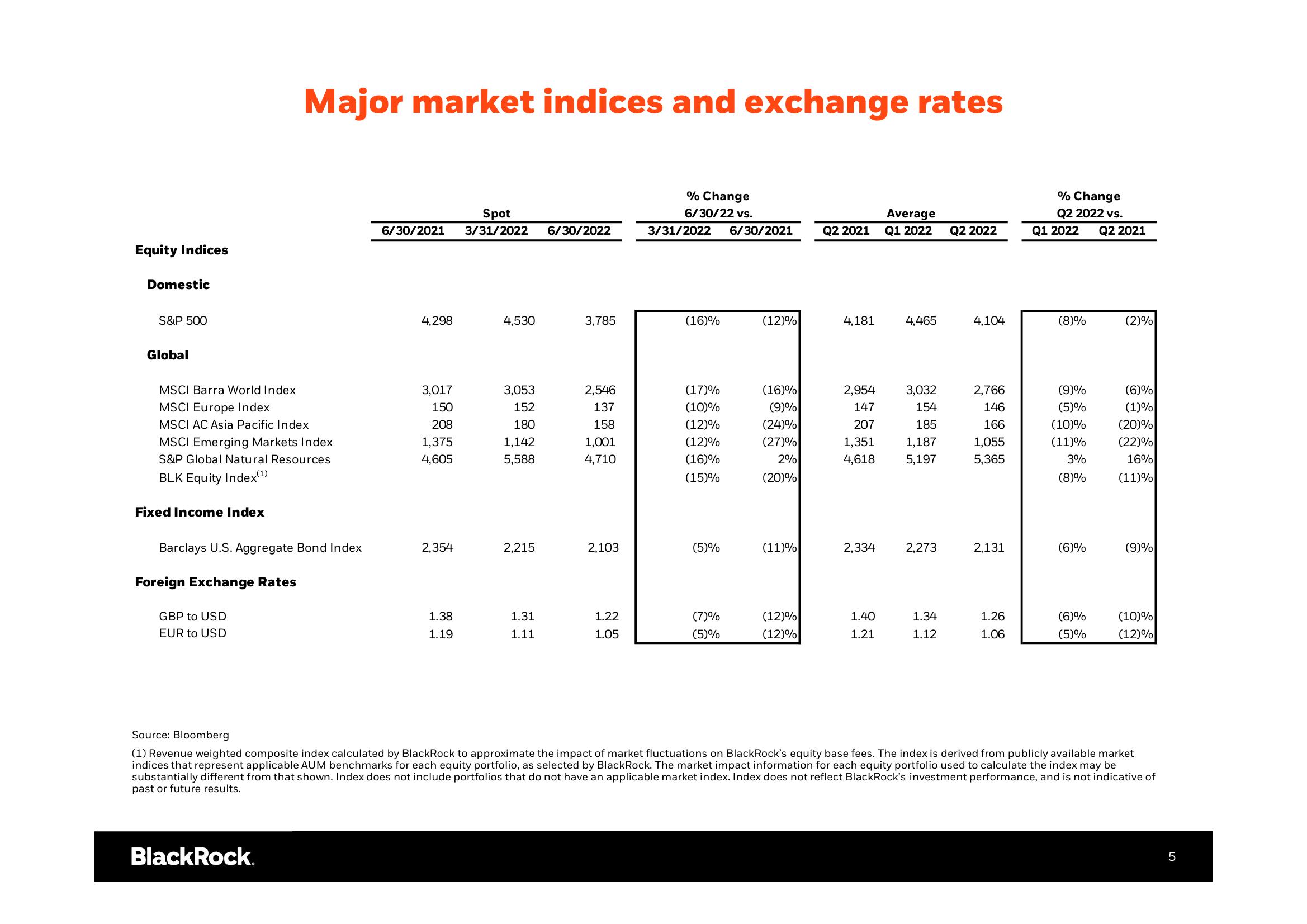

Equity Indices

Domestic

S&P 500

Global

MSCI Barra World Index

MSCI Europe Index

MSCI AC Asia Pacific Index

MSCI Emerging Markets Index

S&P Global Natural Resources

BLK Equity Index(1)

Fixed Income Index

Major market indices and exchange rates

Barclays U.S. Aggregate Bond Index

Foreign Exchange Rates

GBP to USD

EUR to USD

BlackRock.

Spot

6/30/2021 3/31/2022 6/30/2022

4,298

3,017

150

208

1,375

4,605

2,354

1.38

1.19

4,530

3,053

152

180

1,142

5,588

2,215

1.31

1.11

3,785

2,546

137

158

1,001

4,710

2,103

1.22

1.05

% Change

6/30/22 vs.

3/31/2022 6/30/2021

(16)%

(17)%

(10)%

(12)%

(12)%

(16)%

(15)%

(5)%

(7)%

(5)%

(12)%

(16)%

(9)%

(24)%

(27)%

2%

(20)%

(11)%

(12)%

(12)%

Q2 2021

4,181

2,954

147

207

1,351

4,618

2,334

1.40

1.21

Average

Q1 2022

4,465

3,032

154

185

1,187

5,197

2,273

1.34

1.12

Q2 2022

4,104

2,766

146

166

1,055

5,365

2,131

1.26

1.06

% Change

Q2 2022 vs.

Q1 2022 Q2 2021

(8)%

(9)%

(5)%

(10)%

(11)%

3%

(8)%

(6)%

(6)%

(5)%

(2)%

(6)%

(1)%

(20)%

(22)%

16%

(11)%

(9)%

(10)%

(12)%

Source: Bloomberg

(1) Revenue weighted composite index calculated by BlackRock to approximate the impact of market fluctuations on BlackRock's equity base fees. The index is derived from publicly available market

indices that represent applicable AUM benchmarks for each equity portfolio, as selected by BlackRock. The market impact information for each equity portfolio used to calculate the index may be

substantially different from that shown. Index does not include portfolios that do not have an applicable market index. Index does not reflect BlackRock's investment performance, and is not indicative of

past or future results.

5View entire presentation