WeWork Investor Presentation Deck

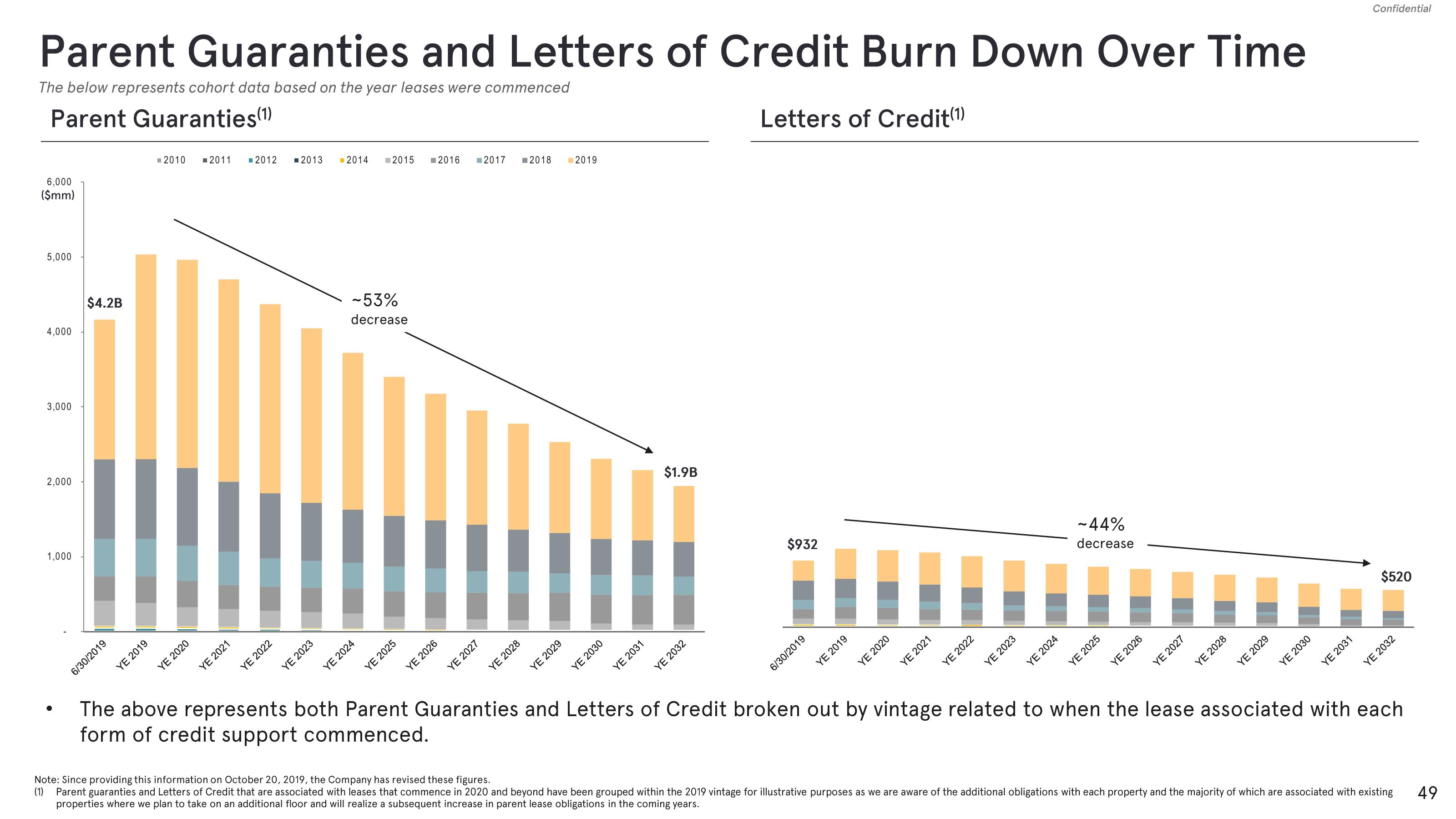

Parent Guaranties and Letters of Credit Burn Down Over Time

The below represents cohort data based on the year leases were commenced

Parent Guaranties (1)

6,000

($mm)

5,000

4,000

3,000

2,000

1,000

$4.2B

6/30/2019

YE 2019

2010

YE 2020

2011 ■2012 ■2013

YE 2021

YE 2022

YE 2023

2014

2015

-53%

decrease

YE 2024

YE 2025

2016

YE 2026

2017

YE 2027

YE 2028

2018

YE 2029

2019

YE 2030

YE 2031

$1.9B

YE 2032

Letters of Credit(1)

$932

6/30/2019

YE 2019

YE 2020

YE 2021

YE 2022

YE 2023

YE 2024

~44%

decrease

YE 2025

YE 2026

YE 2027

YE 2028

YE 2029

YE 2030

YE 2031

Confidential

$520

YE 2032

The above represents both Parent Guaranties and Letters of Credit broken out by vintage related to when the lease associated with each

form of credit support commenced.

Note: Since providing this information on October 20, 2019, the Company has revised these figures.

(1) Parent guaranties and Letters of Credit that are associated with leases that commence in 2020 and beyond have been grouped within the 2019 vintage for illustrative purposes as we are aware of the additional obligations with each property and the majority of which are associated with existing

properties where we plan to take on an additional floor and will realize a subsequent increase in parent lease obligations in the coming years.

49View entire presentation