Blackwells Capital Activist Presentation Deck

1

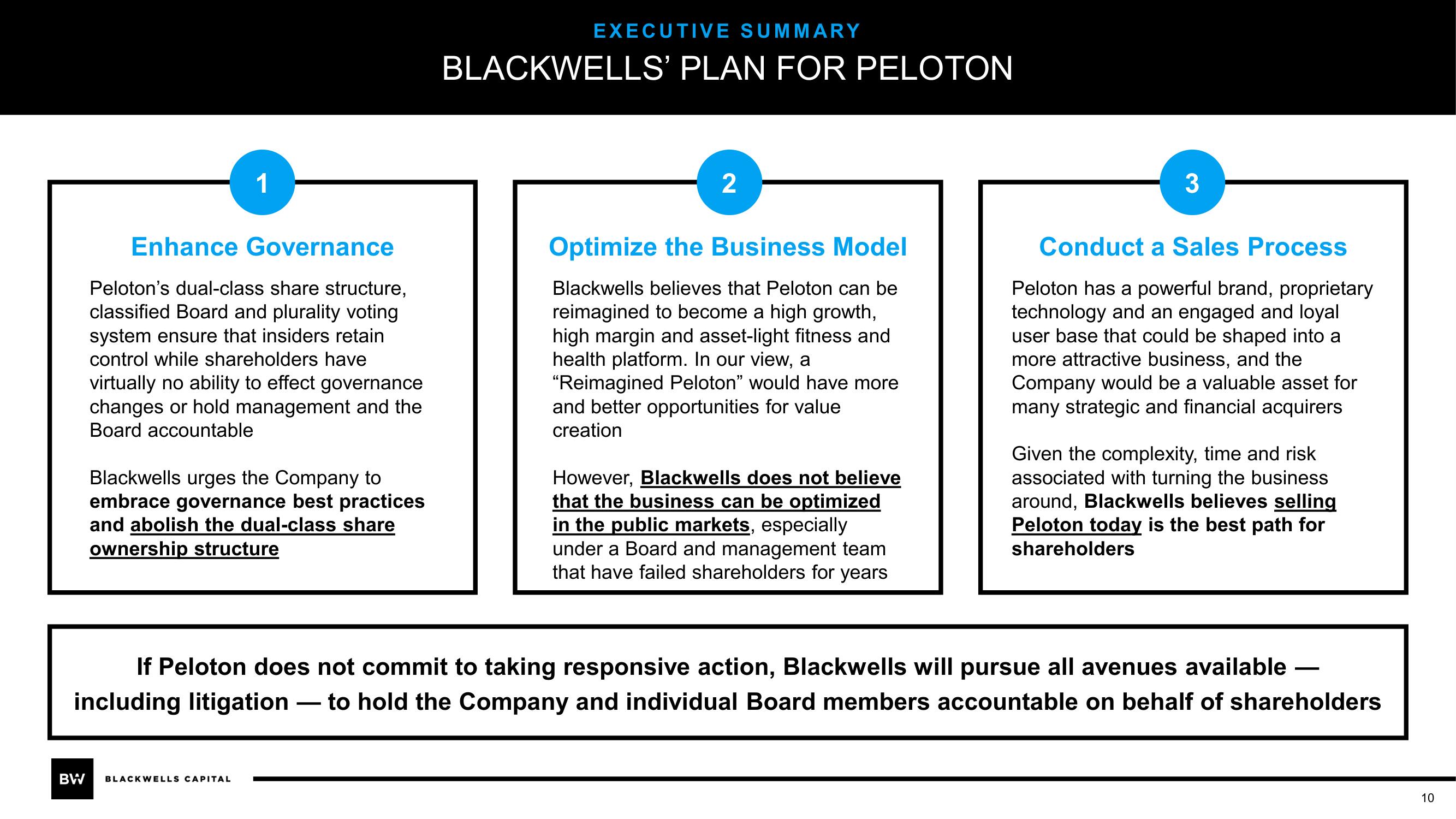

Enhance Governance

Peloton's dual-class share structure,

classified Board and plurality voting

system ensure that insiders retain

control while shareholders have

virtually no ability to effect governance

changes or hold management and the

Board accountable

Blackwells urges the Company to

embrace governance best practices

and abolish the dual-class share

ownership structure

BW BLACKWELLS CAPITAL

EXECUTIVE SUMMARY

BLACKWELLS' PLAN FOR PELOTON

-

2

Optimize the Business Model

Blackwells believes that Peloton can be

reimagined to become a high growth,

high margin and asset-light fitness and

health platform. In our view, a

"Reimagined Peloton" would have more

and better opportunities for value

creation

However, Blackwells does not believe

that the business can be optimized

in the public markets, especially

under a Board and management team

that have failed shareholders for years

3

Conduct a Sales Process

Peloton has a powerful brand, proprietary

technology and an engaged and loyal

user base that could be shaped into a

more attractive business, and the

Company would be a valuable asset for

many strategic and financial acquirers

If Peloton does not commit to taking responsive action, Blackwells will pursue all avenues available -

including litigation to hold the Company and individual Board members accountable on behalf of shareholders

Given the complexity, time and risk

associated with turning the business

around, Blackwells believes selling

Peloton today is the best path for

shareholders

10View entire presentation