Oatly Results Presentation Deck

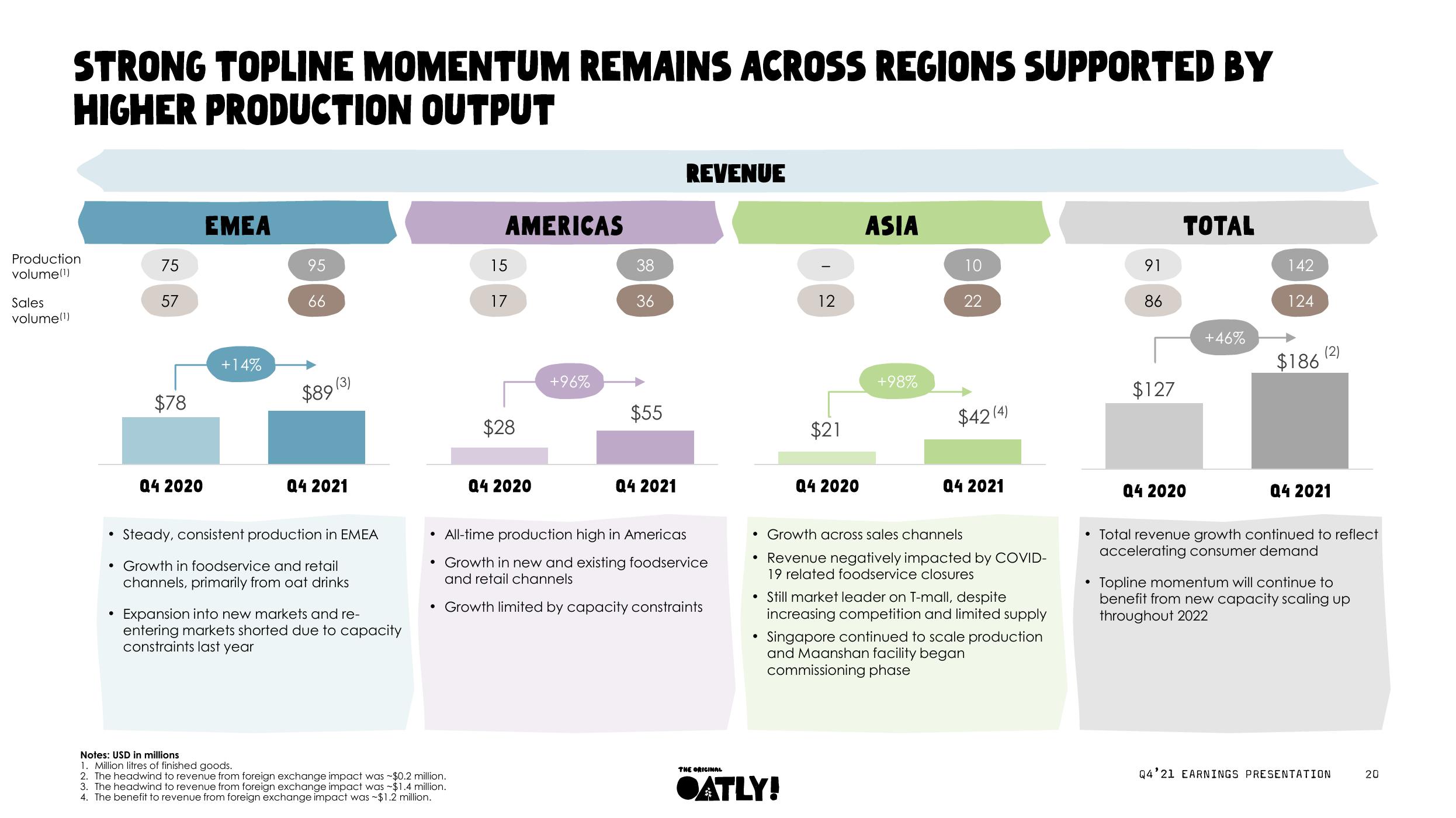

STRONG TOPLINE MOMENTUM REMAINS ACROSS REGIONS SUPPORTED BY

HIGHER PRODUCTION OUTPUT

Production

volume(¹)

Sales

volume(¹)

75

●

57

$78

Q4 2020

EMEA

+14%

95

66

$89 (3)

Q4 2021

Steady, consistent production in EMEA

• Growth in foodservice and retail

channels, primarily from oat drinks

Expansion into new markets and re-

entering markets shorted due to capacity

constraints last year

AMERICAS

Notes: USD in millions

1. Million litres of finished goods.

2. The headwind to revenue from foreign exchange impact was $0.2 million.

3. The headwind to revenue from foreign exchange impact was -$1.4 million.

4. The benefit to revenue from foreign exchange impact was ~$1.2 million.

15

17

$28

Q4 2020

+96%

38

36

$55

Q4 2021

REVENUE

• All-time production high in Americas

• Growth in new and existing foodservice

and retail channels

• Growth limited by capacity constraints

THE ORIGINAL

12

●

$21

Q4 2020

OATLY!

ASIA

+98%

10

22

$42(4)

• Growth across sales channels

• Revenue negatively impacted by COVID-

19 related foodservice closures

Q4 2021

• Still market leader on T-mall, despite

increasing competition and limited supply

Singapore continued to scale production

and Maanshan facility began

commissioning phase

91

86

●

$127

TOTAL

Q4 2020

+46%

142

124

$186

(2)

Q4 2021

• Total revenue growth continued to reflect

accelerating consumer demand

Topline momentum will continue to

benefit from new capacity scaling up

throughout 2022

Q4'21 EARNINGS PRESENTATION

20View entire presentation