Federal Signal Investor Presentation Deck

$ in millions

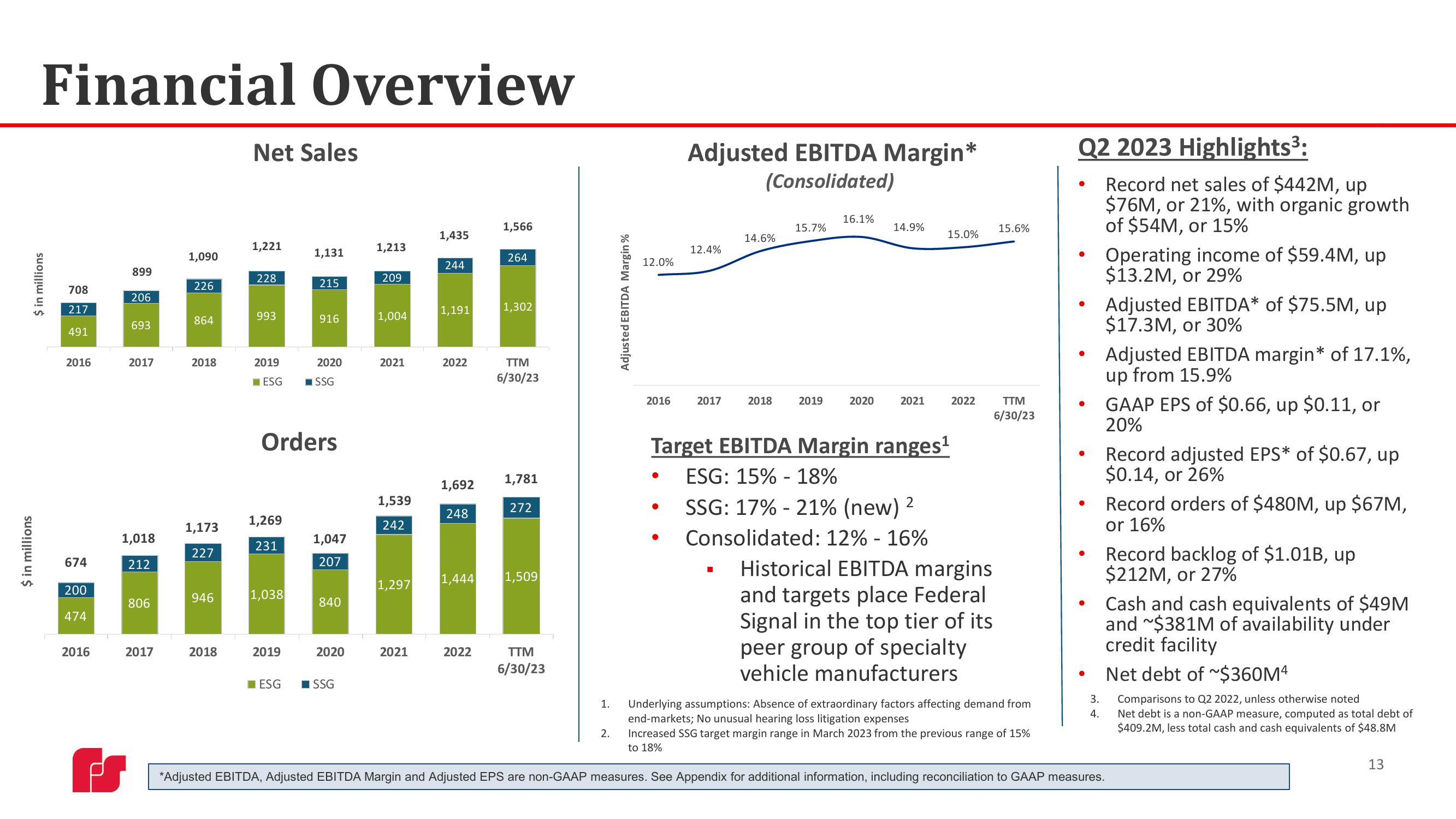

Financial Overview

$ in millions

708

217

491

2016

674

200

474

2016

899

206

693

2017

1,018

212

806

2017

1,090

226

864

2018

1,173

227

946

2018

Net Sales

1,221

228

993

2019

ESG

1,269

231

1,038

2019

1,131

Orders

ESG

215

916

2020

■SSG

1,047

207

840

2020

SSG

1,213

209

1,004

2021

1,539

242

1,297

2021

1,435

244

1,191

2022

1,692

248

1,566

2022

264

1,302

TTM

6/30/23

1,781

272

1,444 1,509

TTM

6/30/23

1.

Adjusted EBITDA Margin%

2.

12.0%

2016

Adjusted EBITDA Margin*

(Consolidated)

●

12.4%

2017

14.6%

2018

15.7%

2019

16.1%

2020

14.9%

2021

Target EBITDA Margin ranges¹

ESG: 15% - 18%

15.0%

2

SSG: 17% -21% (new) ²

2022

Consolidated: 12% -16%

Historical EBITDA margins

and targets place Federal

Signal in the top tier of its

peer group of specialty

vehicle manufacturers

15.6%

TTM

6/30/23

Q2 2023 Highlights³:

Record net sales of $442M, up

$76M, or 21%, with organic growth

of $54M, or 15%

●

●

●

●

3.

4.

Operating income of $59.4M, up

$13.2M, or 29%

Adjusted EBITDA* of $75.5M, up

$17.3M, or 30%

Adjusted EBITDA margin* of 17.1%,

up from 15.9%

GAAP EPS of $0.66, up $0.11, or

20%

Record adjusted EPS* of $0.67, up

$0.14, or 26%

Record orders of $480M, up $67M,

or 16%

Underlying assumptions: Absence of extraordinary factors affecting demand from

end-markets; No unusual hearing loss litigation expenses

Increased SSG target margin range in March 2023 from the previous range of 15%

to 18%

*Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS are non-GAAP measures. See Appendix for additional information, including reconciliation to GAAP measures.

Record backlog of $1.01B, up

$212M, or 27%

Cash and cash equivalents of $49M

and ~$381M of availability under

credit facility

Net debt of ~$360M4

Comparisons to Q2 2022, unless otherwise noted

Net debt is a non-GAAP measure, computed as total debt of

$409.2M, less total cash and cash equivalents of $48.8M

13View entire presentation