Dave Results Presentation Deck

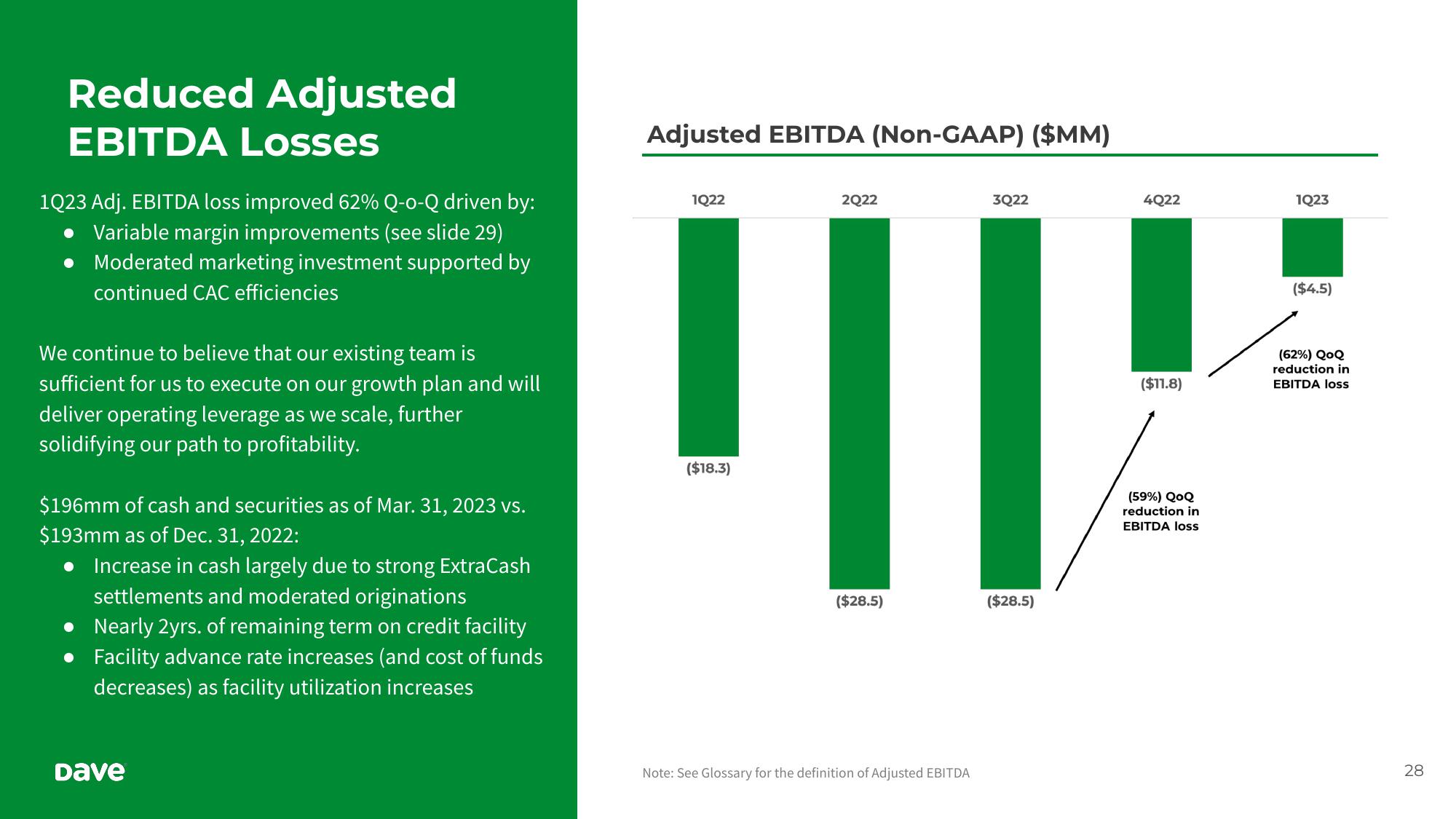

Reduced Adjusted

EBITDA Losses

1Q23 Adj. EBITDA loss improved 62% Q-o-Q driven by:

Variable margin improvements (see slide 29)

Moderated marketing investment supported by

continued CAC efficiencies

We continue to believe that our existing team is

sufficient for us to execute on our growth plan and will

deliver operating leverage as we scale, further

solidifying our path to profitability.

$196mm of cash and securities as of Mar. 31, 2023 vs.

$193mm as of Dec. 31, 2022:

Increase in cash largely due to strong ExtraCash

settlements and moderated originations

Nearly 2yrs. of remaining term on credit facility

• Facility advance rate increases (and cost of funds

decreases) as facility utilization increases

Dave

Adjusted EBITDA (Non-GAAP) ($MM)

1Q22

2Q22

3Q22

'||

($18.3)

($28.5)

Note: See Glossary for the definition of Adjusted EBITDA

($28.5)

4Q22

($11.8)

(59%) QoQ

reduction in

EBITDA loss

1Q23

($4.5)

(62%) QoQ

reduction in

EBITDA loss

28View entire presentation