Bird Results Presentation Deck

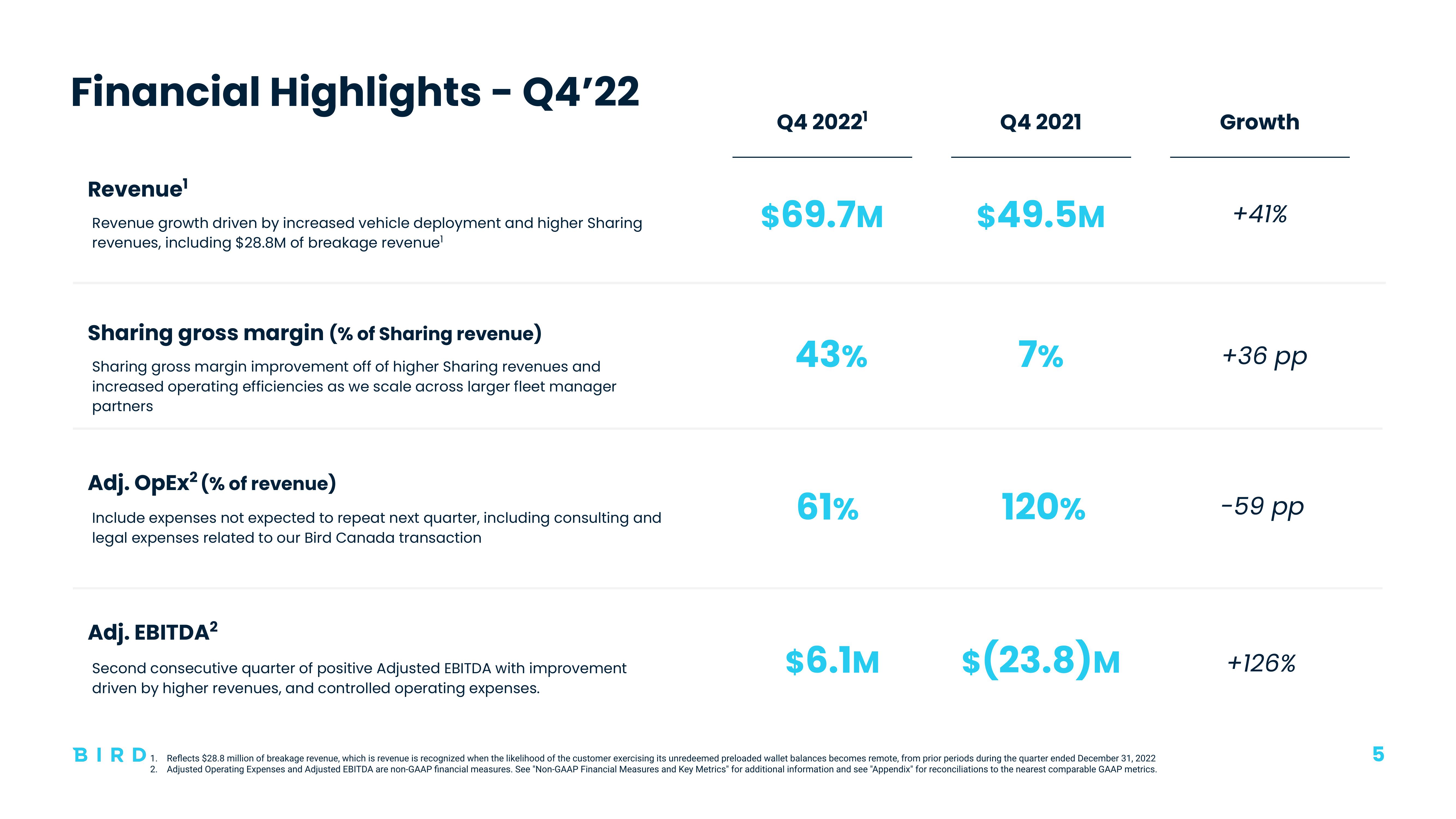

Financial Highlights - Q4'22

Revenue¹

Revenue growth driven by increased vehicle deployment and higher Sharing

revenues, including $28.8M of breakage revenue¹

Sharing gross margin (% of Sharing revenue)

Sharing gross margin improvement off of higher Sharing revenues and

increased operating efficiencies as we scale across larger fleet manager

partners

Adj. OpEx² (% of revenue)

Include expenses not expected to repeat next quarter, including consulting and

legal expenses related to our Bird Canada transaction

Adj. EBITDA²

Second consecutive quarter of positive Adjusted EBITDA with improvement

driven by higher revenues, and controlled operating expenses.

Q4 2022¹

$69.7M

43%

61%

$6.1M

Q4 2021

$49.5M

7%

120%

$(23.8) M

BIRD ₁.

Reflects $28.8 million of breakage revenue, which is revenue is recognized when the likelihood of the customer exercising its unredeemed preloaded wallet balances becomes remote, from prior periods during the quarter ended December 31, 2022

2. Adjusted Operating Expenses and Adjusted EBITDA are non-GAAP financial measures. See "Non-GAAP Financial Measures and Key Metrics" for additional information and see "Appendix" for reconciliations to the nearest comparable GAAP metrics.

Growth

+41%

+36 pp

-59 pp

+126%

01

5View entire presentation