Third Quarter 2023 Financial Results

THIRD QUARTER FINANCIAL RESULTS

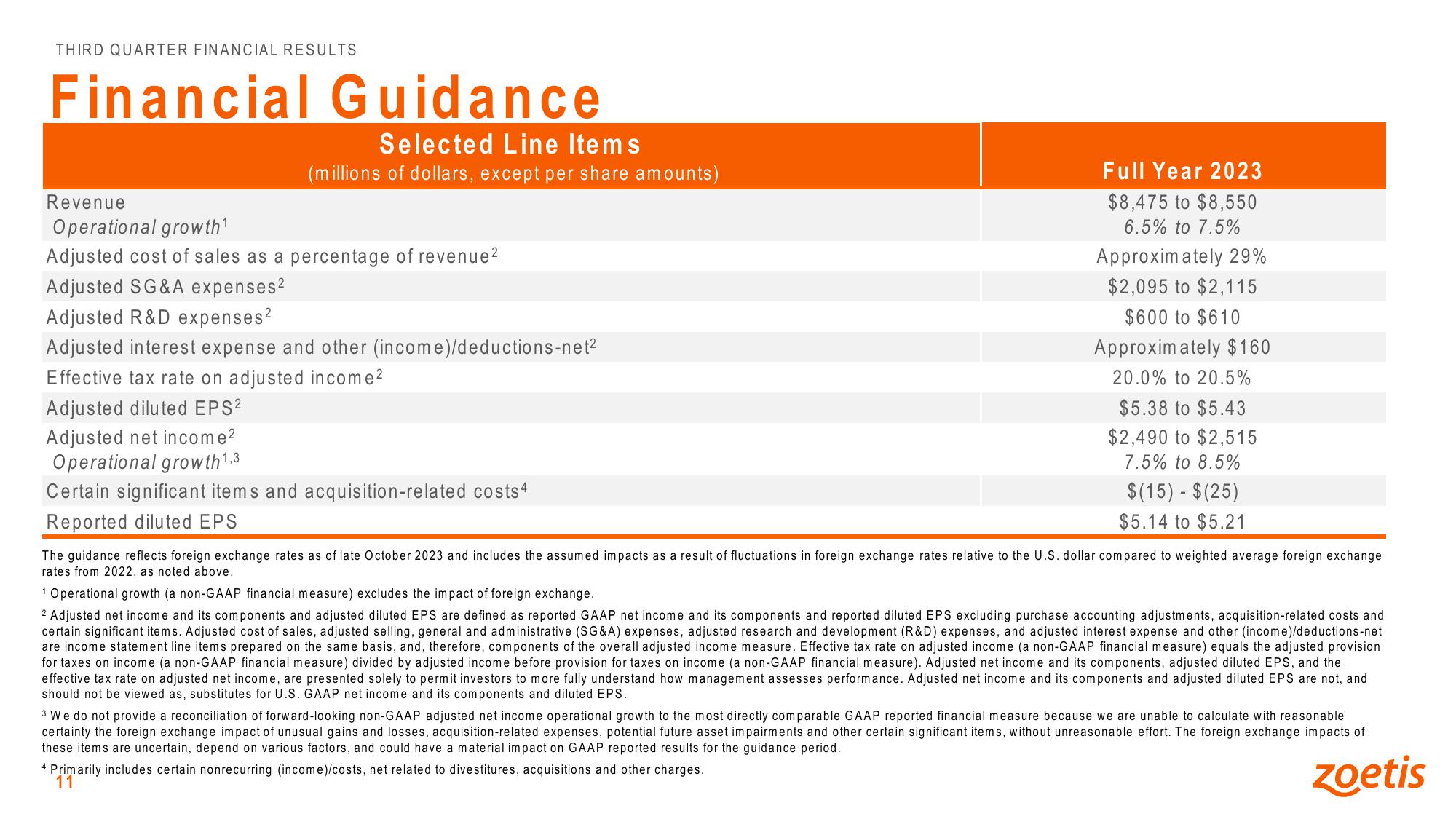

Financial Guidance

Selected Line Items

(millions of dollars, except per share amounts)

Revenue

Operational growth¹

Adjusted cost of sales as a percentage of revenue²

Adjusted SG&A expenses²

Adjusted R&D expenses²

Adjusted interest expense and other (income)/deductions-net²

Effective tax rate on adjusted income²

Adjusted diluted EPS²

Adjusted net income²

Operational growth¹,3

Certain significant items and acquisition-related costs 4

Reported diluted EPS

Full Year 2023

$8,475 to $8,550

6.5% to 7.5%

Approximately 29%

$2,095 to $2,115

$600 to $610

Approximately $160

20.0% to 20.5%

$5.38 to $5.43

$2,490 to $2,515

7.5% to 8.5%

$(15) - $(25)

$5.14 to $5.21

The guidance reflects foreign exchange rates as of late October 2023 and includes the assumed impacts as a result of fluctuations in foreign exchange rates relative to the U.S. dollar compared to weighted average foreign exchange

rates from 2022, as noted above.

¹ Operational growth (a non-GAAP financial measure) excludes the impact of foreign exchange.

2 Adjusted net income and its components and adjusted diluted EPS are defined as reported GAAP net income and its components and reported diluted EPS excluding purchase accounting adjustments, acquisition-related costs and

certain significant items. Adjusted cost of sales, adjusted selling, general and administrative (SG&A) expenses, adjusted research and development (R&D) expenses, and adjusted interest expense and other (income)/deductions-net

are income statement line items prepared on the same basis, and, therefore, components of the overall adjusted income measure. Effective tax rate on adjusted income (a non-GAAP financial measure) equals the adjusted provision

for taxes on income (a non-GAAP financial measure) divided by adjusted income before provision for taxes on income (a non-GAAP financial measure). Adjusted net income and its components, adjusted diluted EPS, and the

effective tax rate on adjusted net income, are presented solely to permit investors to more fully understand how management assesses performance. Adjusted net income and its components and adjusted diluted EPS are not, and

should not be viewed as, substitutes for U.S. GAAP net income and its components and diluted EPS.

4 Primarily includes certain nonrecurring (income)/costs, net related to divestitures, acquisitions and other charges.

11

3 We do not provide a reconciliation of forward-looking non-GAAP adjusted net income operational growth to the most directly comparable GAAP reported financial measure because we are unable to calculate with reasonable

certainty the foreign exchange impact of unusual gains and losses, acquisition-related expenses, potential future asset impairments and other certain significant items, without unreasonable effort. The foreign exchange impacts of

these items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance period.

zoetisView entire presentation