Netstreit Investor Presentation Deck

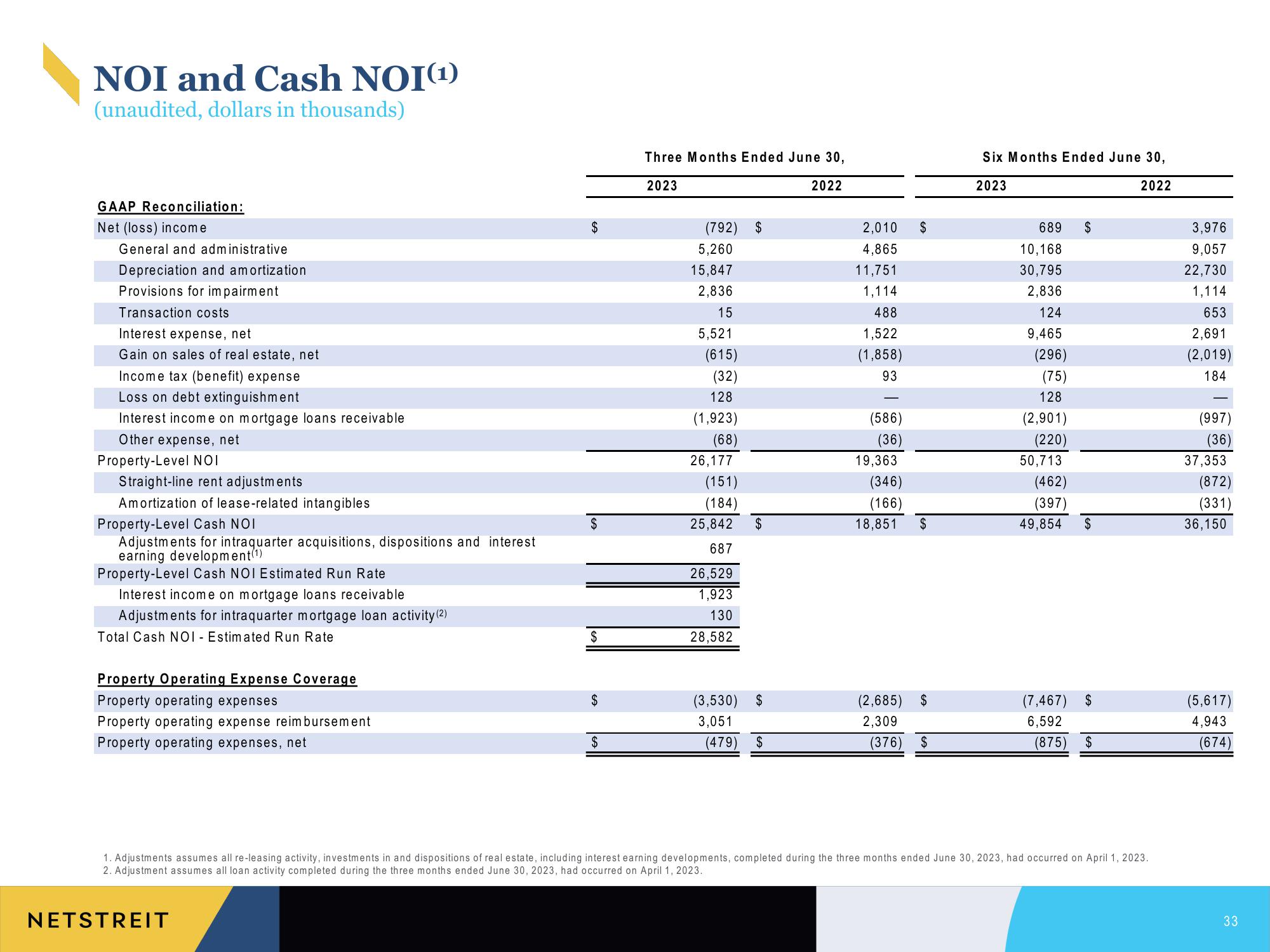

NOI and Cash NOI(¹)

(unaudited, dollars in thousands)

GAAP Reconciliation:

Net (loss) income

General and administrative

Depreciation and amortization

Provisions for impairment

Transaction costs

Interest expense, net

Gain on sales of real estate, net

Income tax (benefit) expense

Loss on debt extinguishment

Interest income on mortgage loans receivable

Other expense, net

Property-Level NOI

Straight-line rent adjustments

Amortization of lease-related intangibles

Property-Level Cash NOI

Adjustments for intraquarter acquisitions, dispositions and interest

earning development(¹)

Property-Level Cash NOI Estimated Run Rate

Interest income on mortgage loans receivable

Adjustments for intraquarter mortgage loan activity (2)

Total Cash NOI - Estimated Run Rate

Property Operating Expense Coverage

Property operating expenses

Property operating expense reimbursement

Property operating expenses, net

$

NETSTREIT

$

$

$

$

Three Months Ended June 30,

2023

2022

(792) $

5,260

15,847

2,836

15

5,521

(615)

(32)

128

(1,923)

(68)

26,177

(151)

(184)

25,842

687

26,529

1,923

130

28,582

$

(3,530) $

3,051

(479)

$

2,010

4,865

11,751

1,114

488

1,522

(1,858)

93

(586)

(36)

19,363

(346)

(166)

18,851

$

$

(2,685) $

2,309

(376) $

Six Months Ended June 30,

2023

2022

689 $

10,168

30,795

2,836

124

9,465

(296)

(75)

128

(2,901)

(220)

50,713

(462)

(397)

49,854

$

(7,467) $

6,592

(875) $

1. Adjustments assumes all re-leasing activity, investments in and dispositions of real estate, including interest earning developments, completed during the three months ended June 30, 2023, had occurred on April 1, 2023.

2. Adjustment assumes all loan activity completed during the three months ended June 30, 2023, had occurred on April 1, 2023.

3,976

9,057

22,730

1,114

653

2,691

(2,019)

184

(997)

(36)

37,353

(872)

(331)

36,150

(5,617)

4,943

(674)

33View entire presentation