Q4 2020 Investor Presentation

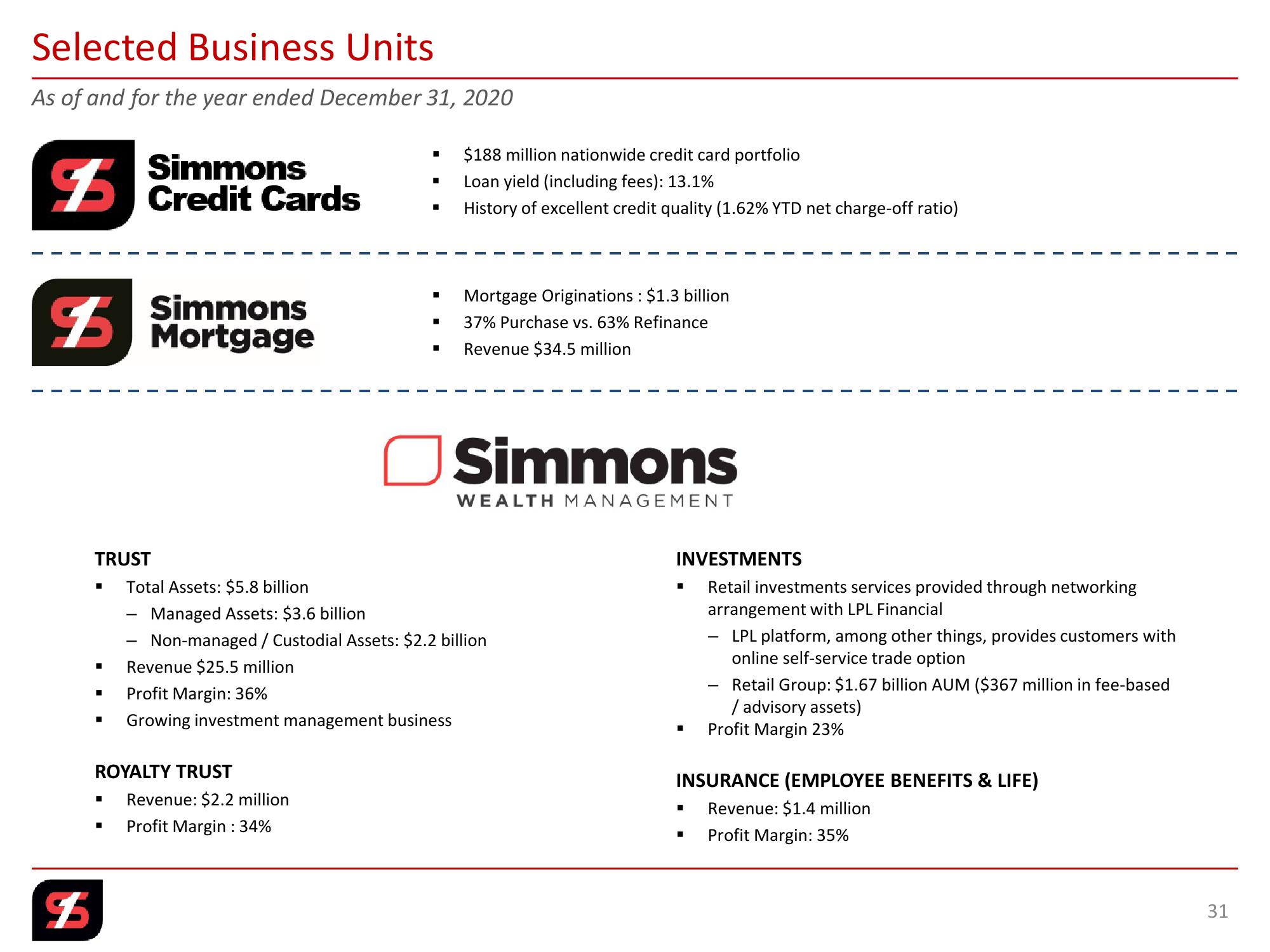

Selected Business Units

As of and for the year ended December 31, 2020

$188 million nationwide credit card portfolio

History of excellent credit quality (1.62% YTD net charge-off ratio)

I

Simmons

Credit Cards

◉

Loan yield (including fees): 13.1%

Mortgage Originations: $1.3 billion

1

Simmons

Mortgage

◉

◉ 37% Purchase vs. 63% Refinance

Revenue $34.5 million

$

☐ Simmons

WEALTH MANAGEMENT

TRUST

■

Total Assets: $5.8 billion

Managed Assets: $3.6 billion

Non-managed / Custodial Assets: $2.2 billion

Revenue $25.5 million

■

Profit Margin: 36%

■

Growing investment management business

ROYALTY TRUST

■

Revenue: $2.2 million

■ Profit Margin : 34%

INVESTMENTS

Retail investments services provided through networking

arrangement with LPL Financial

-

LPL platform, among other things, provides customers with

online self-service trade option

Retail Group: $1.67 billion AUM ($367 million in fee-based

/ advisory assets)

Profit Margin 23%

INSURANCE (EMPLOYEE BENEFITS & LIFE)

Revenue: $1.4 million

Profit Margin: 35%

31View entire presentation