FAT Brands Investor Presentation Deck

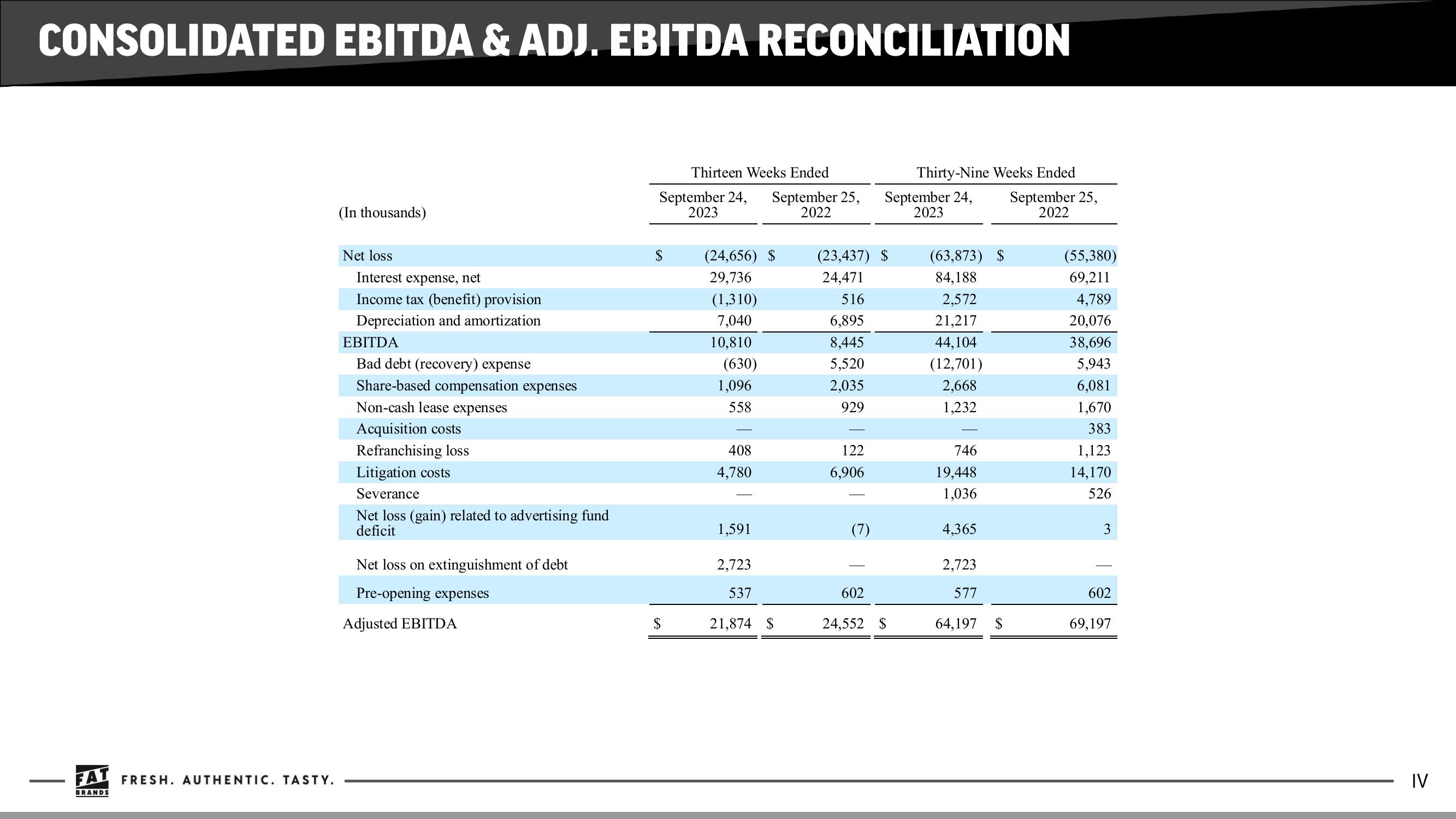

CONSOLIDATED EBITDA & ADJ. EBITDA RECONCILIATION

I

FAT FRESH. AUTHENTIC. TASTY.

BRANDS

(In thousands)

Net loss

Interest expense, net

Income tax (benefit) provision

Depreciation and amortization

EBITDA

Bad debt (recovery) expense

Share-based compensation expenses

Non-cash lease expenses

Acquisition costs

Refranchising loss

Litigation costs

Severance

Net loss (gain) related to advertising fund

deficit

Net loss on extinguishment of debt

Pre-opening expenses

Adjusted EBITDA

Thirteen Weeks Ended

September 24, September 25,

2023

2022

$

$

(24,656) $

29,736

(1,310)

7,040

10,810

(630)

1,096

558

408

4,780

1,591

2,723

537

21,874 $

(23,437) $

24,471

516

6,895

8,445

5,520

2,035

929

122

6,906

(7)

602

September 24,

2023

Thirty-Nine Weeks Ended

September 25,

2022

24,552 $

(63,873) $

84,188

2,572

21,217

44,104

(12,701)

2,668

1,232

746

19,448

1,036

4,365

2,723

577

64,197

$

(55,380)

69,211

4,789

20,076

38,696

5,943

6,081

1,670

383

1,123

14,170

526

3

602

69,197

IVView entire presentation