Babylon SPAC Presentation Deck

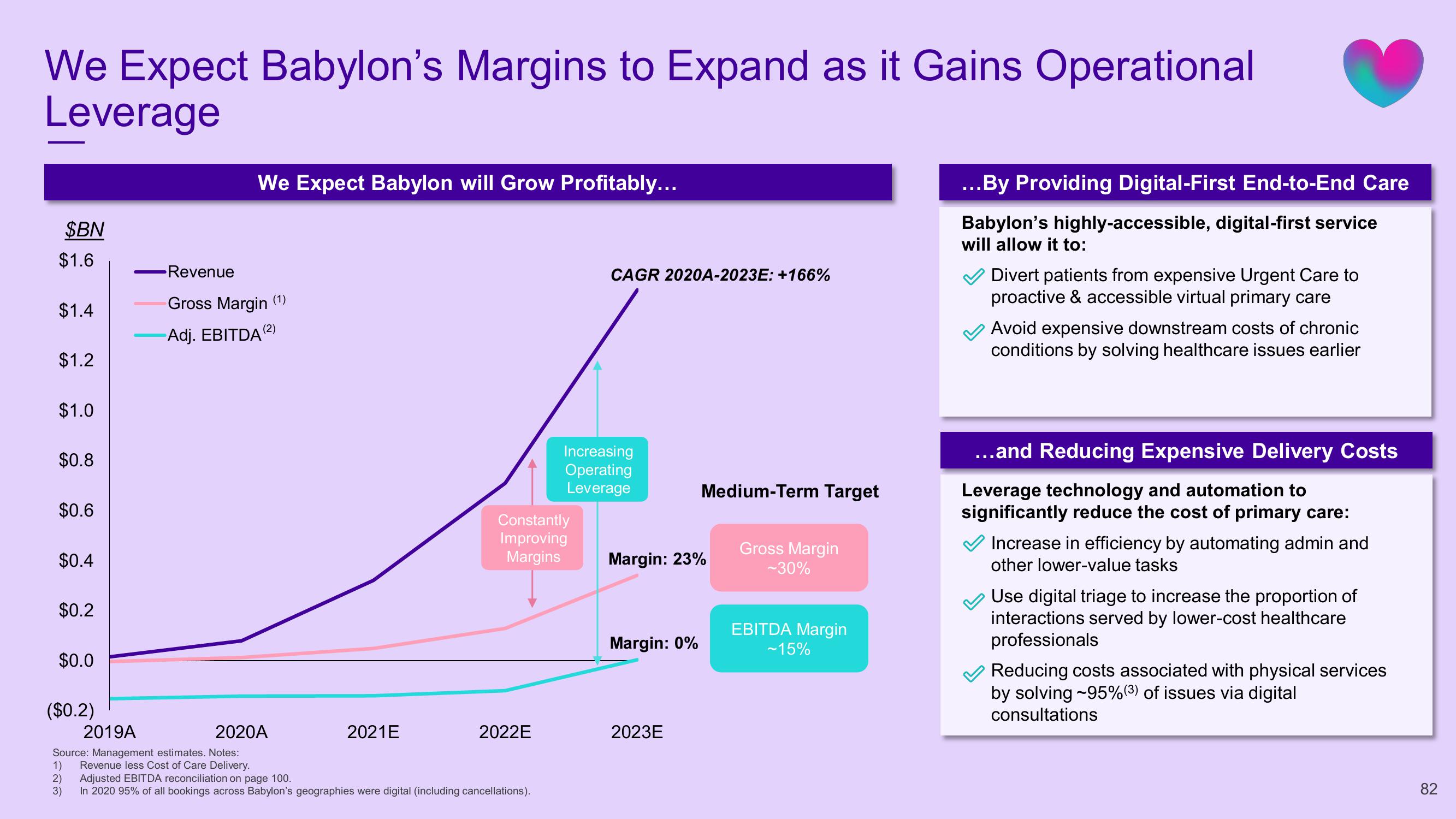

We Expect Babylon's Margins to Expand as it Gains Operational

Leverage

$BN

$1.6

$1.4

$1.2

$1.0

$0.8

$0.6

$0.4

$0.2

$0.0

($0.2)

We Expect Babylon will Grow Profitably...

-Revenue

Gross Margin (1)

Adj. EBITDA (2)

2019A

Source: Management estimates. Notes:

1) Revenue less Cost of Care Delivery.

2)

3)

2020A

2021E

Constantly

Improving

Margins

2022E

Adjusted EBITDA reconciliation on page 100.

In 2020 95% of all bookings across Babylon's geographies were digital (including cancellations).

CAGR 2020A-2023E: +166%

Increasing

Operating

Leverage

Margin: 23%

Margin: 0%

Medium-Term Target

2023E

Gross Margin

-30%

EBITDA Margin

-15%

...By Providing Digital-First End-to-End Care

Babylon's highly-accessible, digital-first service

will allow it to:

Divert patients from expensive Urgent Care to

proactive & accessible virtual primary care

Avoid expensive downstream costs of chronic

conditions by solving healthcare issues earlier

...and Reducing Expensive Delivery Costs

Leverage technology and automation to

significantly reduce the cost of primary care:

Increase in efficiency by automating admin and

other lower-value tasks

Use digital triage to increase the proportion of

interactions served by lower-cost healthcare

professionals

Reducing costs associated with physical services

by solving -95%(³) of issues via digital

consultations

82View entire presentation