LSE Mergers and Acquisitions Presentation Deck

1

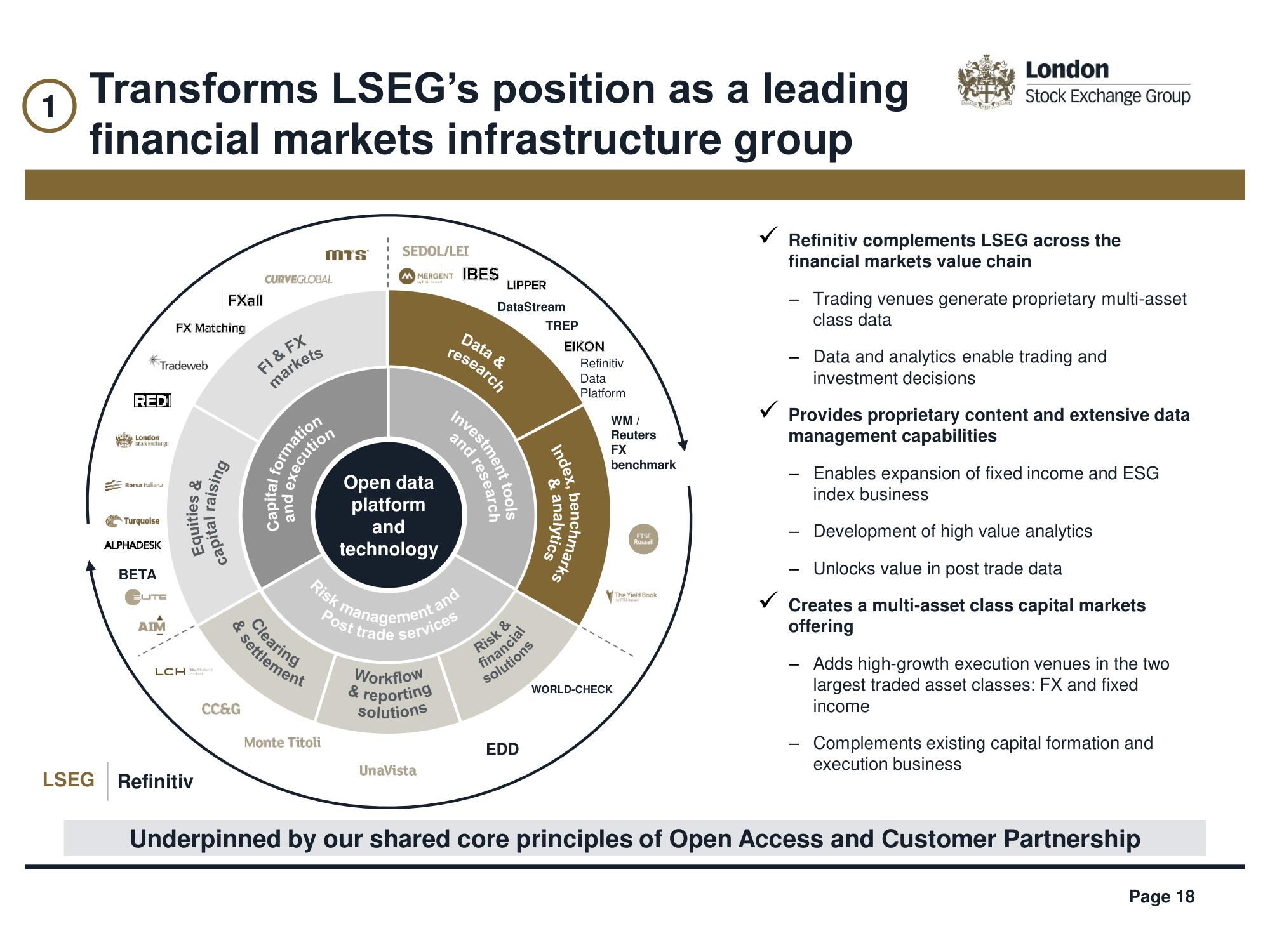

Transforms LSEG's position as a leading

financial markets infrastructure group

LSEG

REDI

Tradeweb

London

Stack and g

Borsa Italiana

Turquoise

ALPHADESK

BETA

LITE

AIM

FX Matching

Equities &

LCH

The

Refinitiv

FXall

raising

capital

&

CC&G

CURVEGLOBAL

FI & FX

markets

Capital

MTS

formation

xecution

Monte Titoli

SEDOL/LET

MMERGENT IBES

y

Open data

platform

and

technology

Clearing

settlement

Post trade services

t and

Workflow

& reporting

solutions

UnaVista

Data &

research

Investmen

and research

tools

LIPPER

DataStream

Risk &

financial

solutions

EDD

TREP

ΕΙΚΟΝ

8

Index, benchmarks

Refinitiv

Data

Platform

WM /

Reuters

FX

benchmark

WORLD-CHECK

FTSE

Russell

The Yield Book

Duke pactin

-

London

Stock Exchange Group

Refinitiv complements LSEG across the

financial markets value chain

Trading venues generate proprietary multi-asset

class data

Data and analytics enable trading and

investment decisions

Provides proprietary content and extensive data

management capabilities

Enables expansion of fixed income and ESG

index business

Development of high value analytics

Unlocks value in post trade data

Creates a multi-asset class capital markets

offering

Adds high-growth execution venues in the two

largest traded asset classes: FX and fixed

income

Complements existing capital formation and

execution business

Underpinned by our shared core principles of Open Access and Customer Partnership

Page 18View entire presentation