Newsight Imaging SPAC

Highlights

Introducing

Newsight

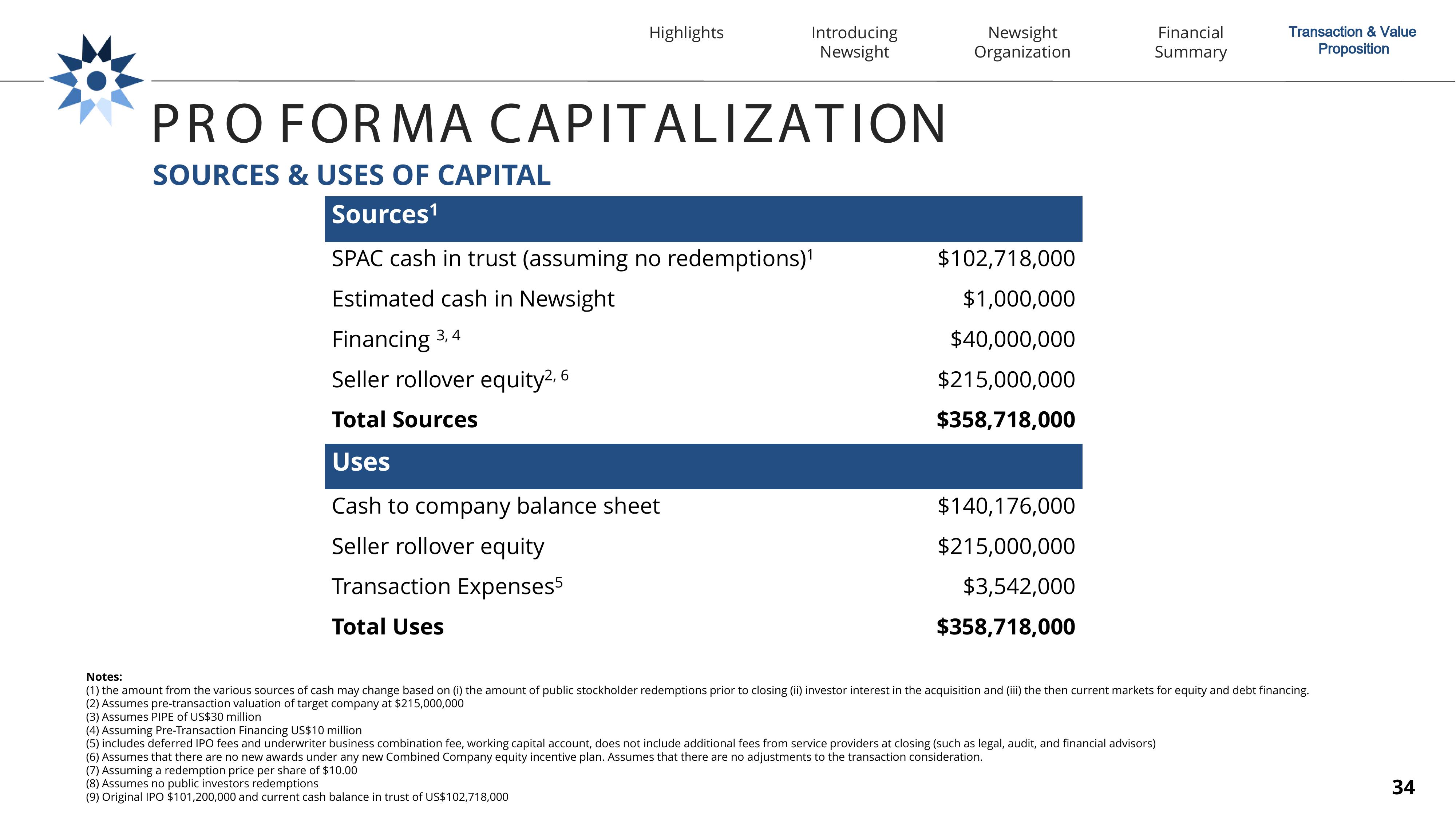

PRO FORMA CAPITALIZATION

SOURCES & USES OF CAPITAL

Sources¹

Total Uses

SPAC cash in trust (assuming no redemptions)¹

Estimated cash in Newsight

Financing 3,4

Seller rollover equity², 6

Total Sources

Uses

Cash to company balance sheet

Seller rollover equity

Transaction Expenses5

Newsight

Organization

$102,718,000

$1,000,000

$40,000,000

$215,000,000

$358,718,000

$140,176,000

$215,000,000

$3,542,000

$358,718,000

Financial

Summary

Notes:

(1) the amount from the various sources of cash may change based on (i) the amount of public stockholder redemptions prior to closing (ii) investor interest in the acquisition and (iii) the then current markets for equity and debt financing.

(2) Assumes pre-transaction valuation of target company at $215,000,000

(3) Assumes PIPE of US$30 million

(4) Assuming Pre-Transaction Financing US$10 million

(5) includes deferred IPO fees and underwriter business combination fee, working capital account, does not include additional fees from service providers at closing (such as legal, audit, and financial advisors)

(6) Assumes that there are no new awards under any new Combined Company equity incentive plan. Assumes that there are no adjustments to the transaction consideration.

(7) Assuming a redemption price per share of $10.00

(8) Assumes no public investors redemptions

(9) Original IPO $101,200,000 and current cash balance in trust of US$102,718,000

Transaction & Value

Proposition

34View entire presentation