Ford Investor Conference Presentation Deck

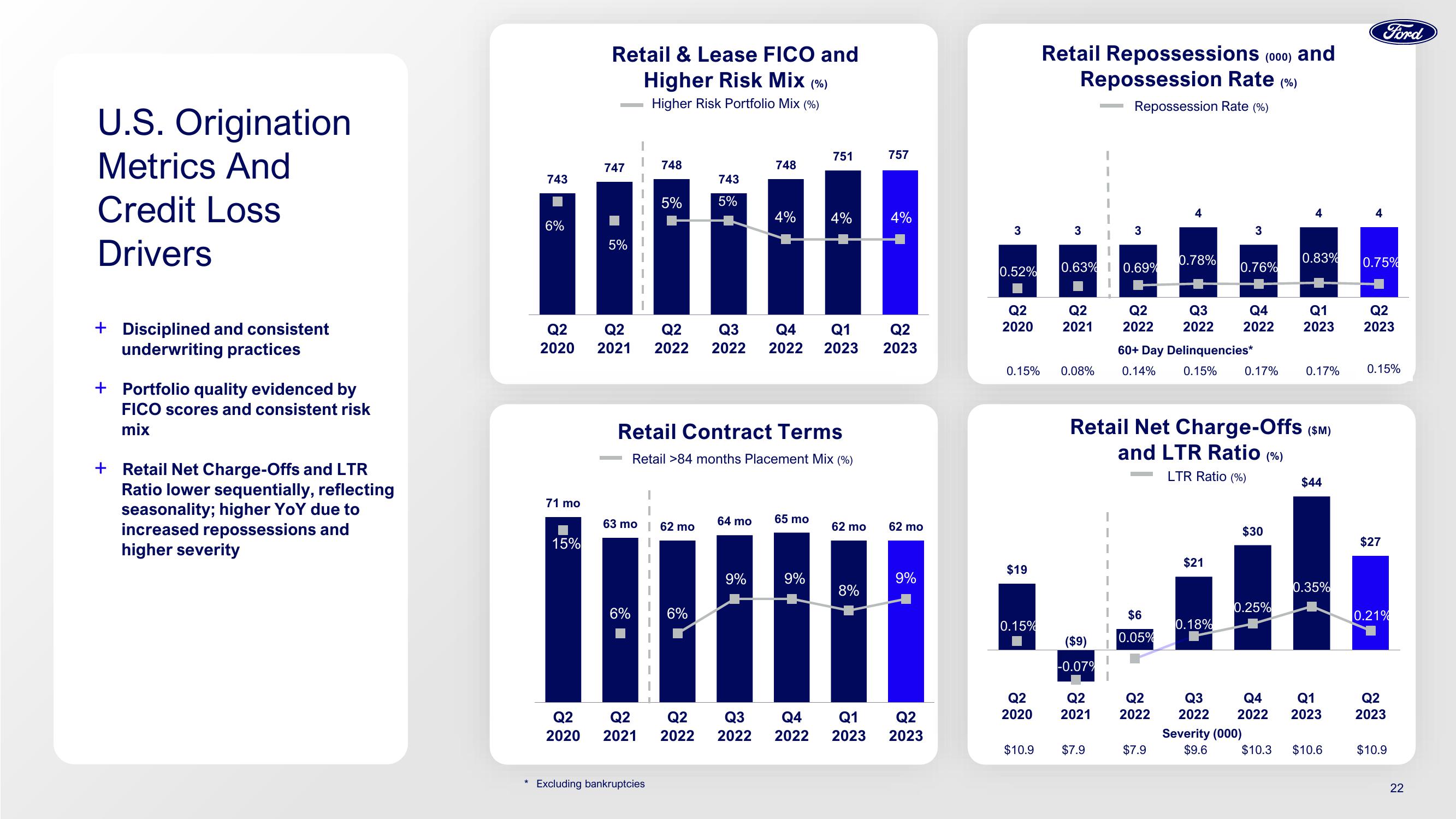

U.S. Origination

Metrics And

Credit Loss

Drivers

+ Disciplined and consistent

underwriting practices

+ Portfolio quality evidenced by

FICO scores and consistent risk

mix

+ Retail Net Charge-Offs and LTR

Ratio lower sequentially, reflecting

seasonality; higher YoY due to

increased repossessions and

higher severity

*

743

6%

Q2

2020

71 mo

15%

Retail & Lease FICO and

Higher Risk Mix (%)

Higher Risk Portfolio Mix (%)

747

5%

748

6%

5%

63 mo | 62 mo

Q2

Q2

2020 2021

Excluding bankruptcies

743

5%

Retail Contract Terms

Retail >84 months Placement Mix (%)

6%

Q2 Q2 Q3 Q4 Q1 Q2

2021 2022 2022 2022 2023 2023

Q2

2022

64 mo

748

9%

4%

Q3

2022

751

65 mo

4%

9%

62 mo

8%

757

Q4 Q1

2022

4%

62 mo

9%

Q2

2023 2023

3 3

0.52%

Q2

2020

$19

Retail Repossessions (000) and

Repossession Rate (%)

Repossession Rate (%)

0.15%

0.15% 0.08%

Q2

2020

Q2

2021

0.63% 0.69%

($9)

-0.07%

I

Q2

2021

3

$10.9 $7.9

$6

0.05%

4

Q2

2022

0.78%

Q2 Q3 Q4

2022 2022 2022

60+ Day Delinquencies*

0.14% 0.15%

$7.9

Retail Net Charge-Offs (SM)

and LTR Ratio

LTR Ratio (%)

$21

3

0.76%

0.18%

0.17%

$30

Q3

2022

Severity (000)

$9.6

(%)

0.25%

Q4

2022

4

$10.3

0.83%

Q1

2023

0.17%

$44

0.35%

Q1

2023

$10.6

4

Ford

0.75%

Q2

2023

0.15%

$27

0.21%

Q2

2023

$10.9

22View entire presentation