Cooper Standard Third Quarter 2023 Earnings Presentation

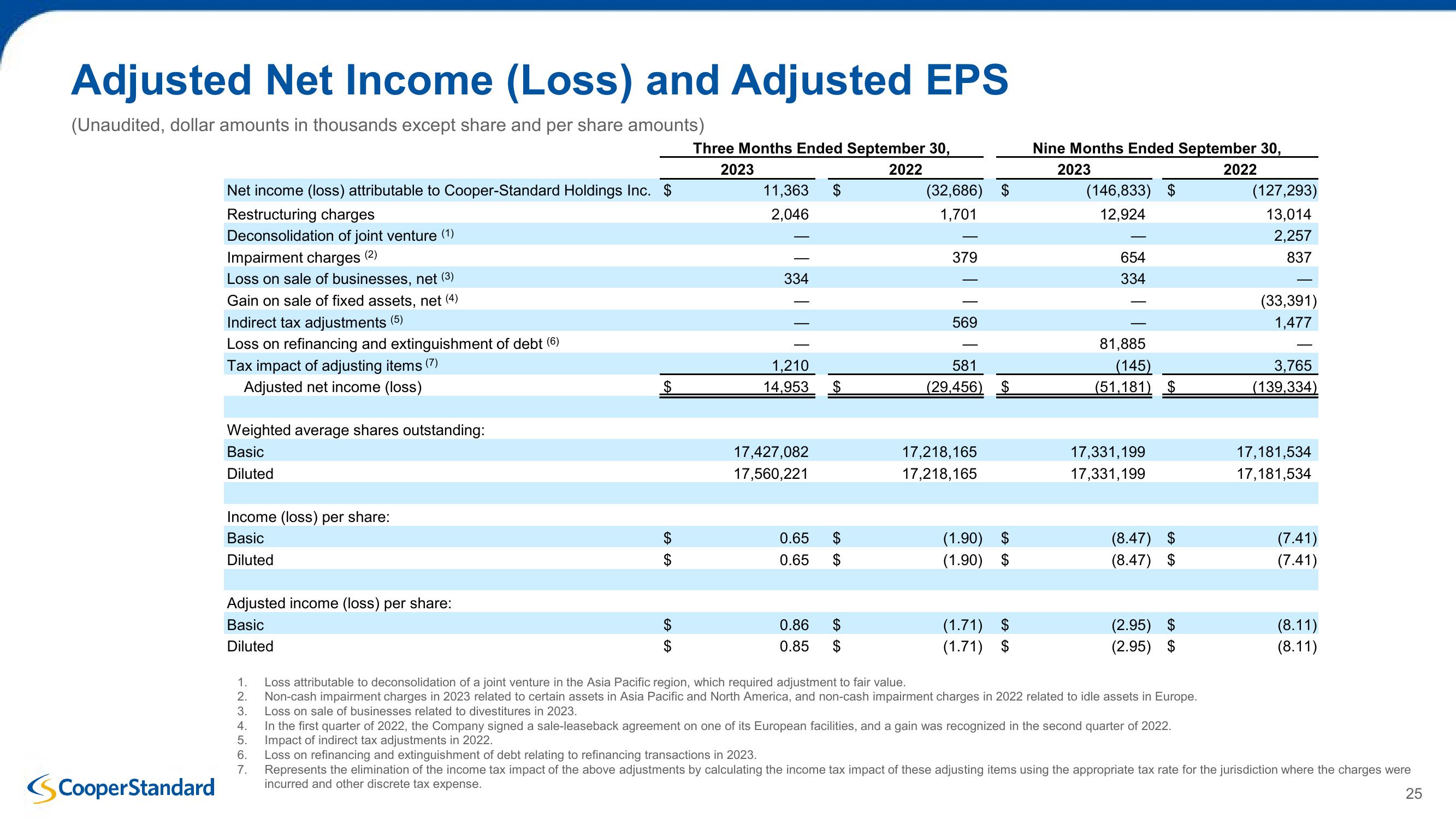

Adjusted Net Income (Loss) and Adjusted EPS

(Unaudited, dollar amounts in thousands except share and per share amounts)

Net income (loss) attributable to Cooper-Standard Holdings Inc. $

Restructuring charges

Deconsolidation of joint venture (1)

Three Months Ended September 30,

2023

11,363 $

2,046

2022

(32,686) $

1,701

Nine Months Ended September 30,

2023

(146,833) $

12,924

2022

(127,293)

13,014

2,257

Impairment charges (2)

Loss on sale of businesses, net (3)

379

334

Gain on sale of fixed assets, net (4)

Indirect tax adjustments (5)

569

654

334

(33,391)

1,477

837

Loss on refinancing and extinguishment of debt (6)

81,885

Tax impact of adjusting items (7)

Adjusted net income (loss)

Weighted average shares outstanding:

Basic

Diluted

1,210

581

(145)

14,953 $

(29,456) $

(51,181) $

3,765

(139,334)

17,427,082

17,560,221

17,218,165

17,218,165

17,331,199

17,331,199

17,181,534

17,181,534

Income (loss) per share:

Basic

Diluted

Adjusted income (loss) per share:

Basic

Diluted

SS

69 69

0.65 $

(1.90) $

(8.47) $

(7.41)

0.65

$

(1.90) $

(8.47) $

(7.41)

0.86

$

0.85

$

(1.71)

(1.71) $

(2.95) $

(8.11)

(2.95) $

(8.11)

Loss attributable to deconsolidation of a joint venture in the Asia Pacific region, which required adjustment to fair value.

Non-cash impairment charges in 2023 related to certain assets in Asia Pacific and North America, and non-cash impairment charges in 2022 related to idle assets in Europe.

Loss on sale of businesses related to divestitures in 2023.

In the first quarter of 2022, the Company signed a sale-leaseback agreement on one of its European facilities, and a gain was recognized in the second quarter of 2022.

Impact of indirect tax adjustments in 2022.

1.

2.

3.

4.

599

5.

6.

Loss on refinancing and extinguishment of debt relating to refinancing transactions in 2023.

7.

CooperStandard

Represents the elimination of the income tax impact of the above adjustments by calculating the income tax impact of these adjusting items using the appropriate tax rate for the jurisdiction where the charges were

incurred and other discrete tax expense.

25View entire presentation