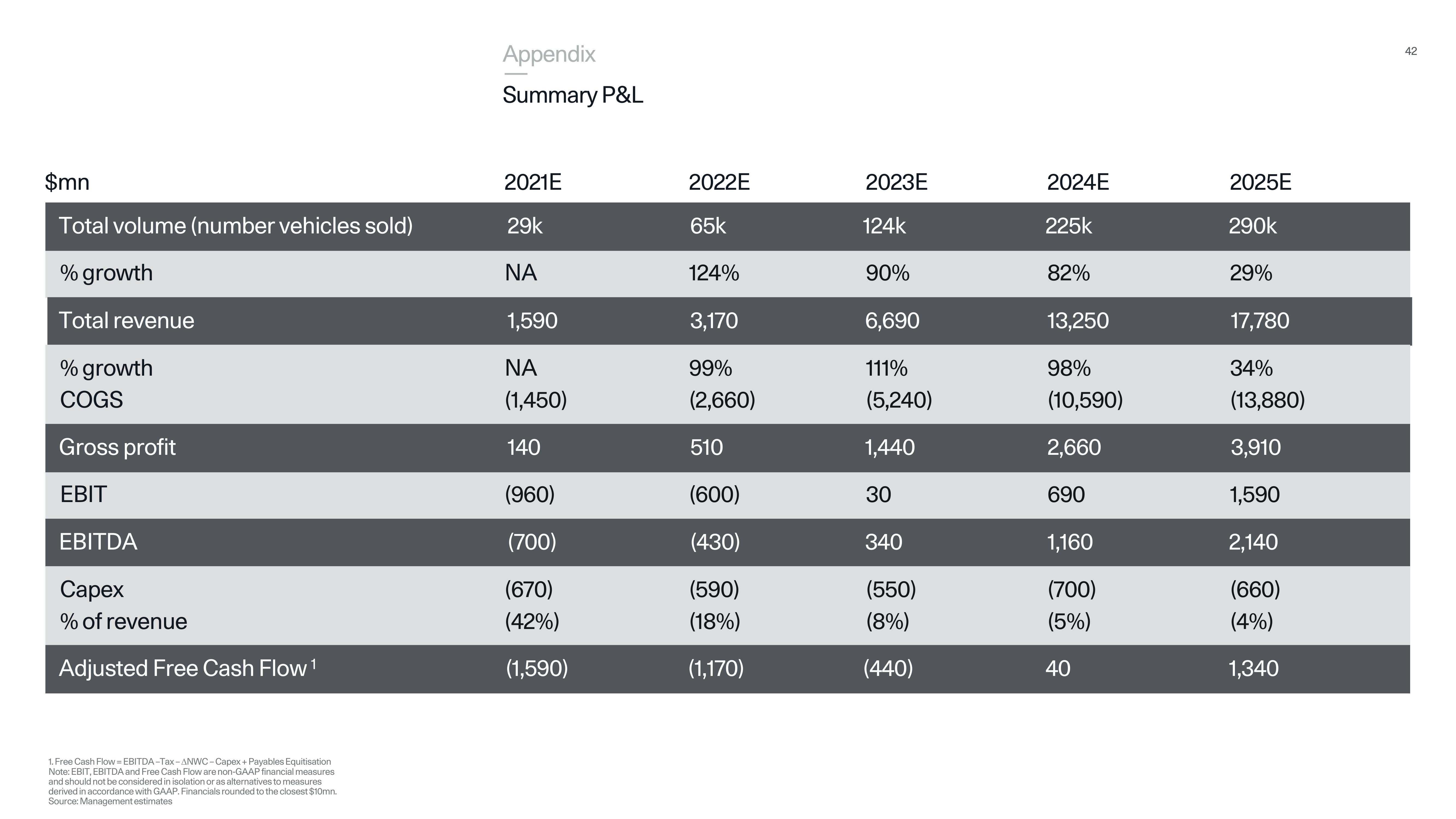

Polestar SPAC Presentation Deck

$mn

Total volume (number vehicles sold)

% growth

Total revenue

% growth

COGS

Gross profit

EBIT

EBITDA

Capex

% of revenue

Adjusted Free Cash Flow ¹

1. Free Cash Flow = EBITDA-Tax-ANWC-Capex + Payables Equitisation

Note: EBIT, EBITDA and Free Cash Flow are non-GAAP financial measures

and should not be considered in isolation or as alternatives to measures

derived in accordance with GAAP. Financials rounded to the closest $10mn.

Source: Management estimates

Appendix

Summary P&L

2021E

29k

ΝΑ

1,590

ΝΑ

(1,450)

140

(960)

(700)

(670)

(42%)

(1,590)

2022E

65k

124%

3,170

99%

(2,660)

510

(600)

(430)

(590)

(18%)

(1,170)

2023E

124k

90%

6,690

111%

(5,240)

1,440

30

340

(550)

(8%)

(440)

2024E

225k

82%

13,250

98%

(10,590)

2,660

690

1,160

(700)

(5%)

40

2025E

290k

29%

17,780

34%

(13,880)

3,910

1,590

2,140

(660)

(4%)

1,340

42View entire presentation