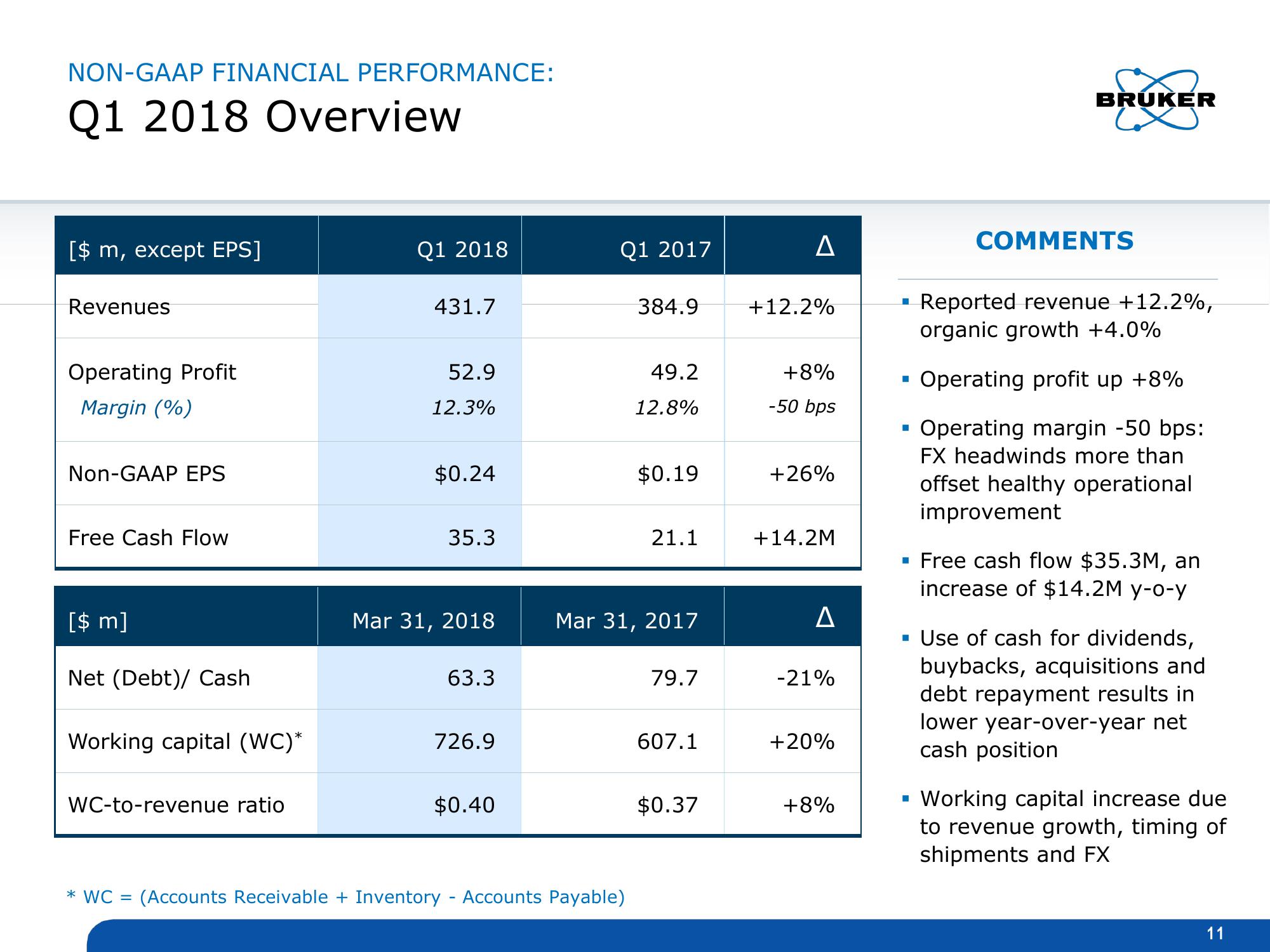

Q1 2018 Earnings Presentation

NON-GAAP FINANCIAL PERFORMANCE:

Q1 2018 Overview

[$ m, except EPS]

Revenues

Operating Profit

Margin (%)

Non-GAAP EPS

Free Cash Flow

[$ m]

Net (Debt)/ Cash

Working capital (WC)*

WC-to-revenue ratio

* WC

Q1 2018

431.7

52.9

12.3%

$0.24

35.3

Mar 31, 2018

63.3

726.9

$0.40

Q1 2017

384.9

(Accounts Receivable + Inventory - Accounts Payable)

49.2

12.8%

$0.19

21.1

Mar 31, 2017

79.7

607.1

$0.37

+12.2%

+8%

-50 bps

+26%

+14.2M

A

-21%

+20%

+8%

■

■

M

BRUKER

COMMENTS

-

Reported revenue +12.2%,

organic growth +4.0%

Operating profit up +8%

Operating margin -50 bps:

FX headwinds more than

offset healthy operational

improvement

▪ Free cash flow $35.3M, an

increase of $14.2M y-o-y

▪ Use of cash for dividends,

buybacks, acquisitions and

debt repayment results in

lower year-over-year net

cash position

Working capital increase due

to revenue growth, timing of

shipments and FX

11View entire presentation