Allwyn Investor Presentation Deck

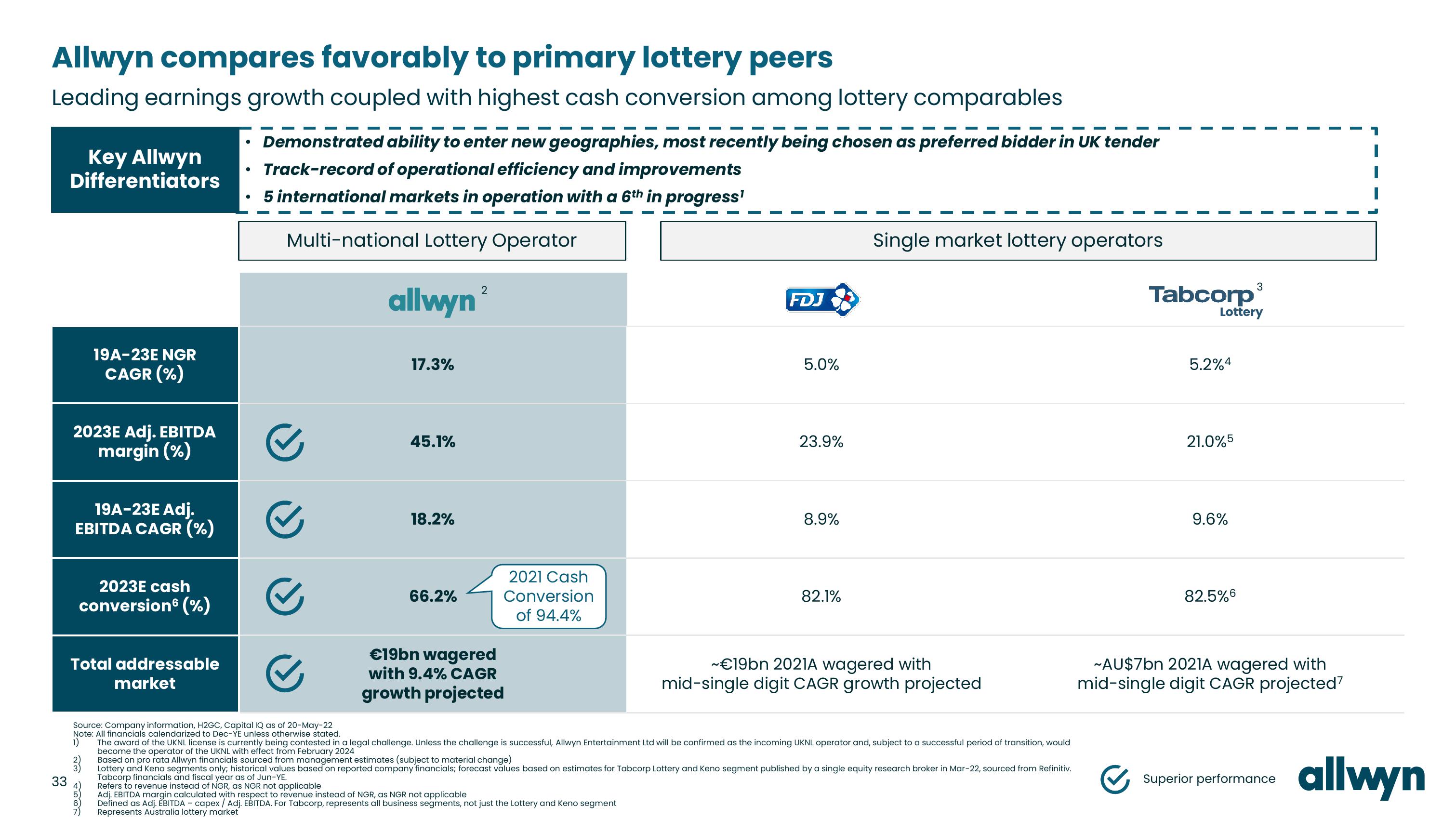

Allwyn compares favorably to primary lottery peers

Leading earnings growth coupled with highest cash conversion among lottery comparables

33

Key Allwyn

Differentiators

19A-23E NGR

CAGR (%)

2023E Adj. EBITDA

margin (%)

19A-23E Adj.

EBITDA CAGR (%)

2023E cash

conversion (%)

Total addressable

market

●

●

Demonstrated ability to enter new geographies, most recently being chosen as preferred bidder in UK tender

Track-record of operational efficiency and improvements

5 international markets in operation with a 6th in progress¹

Multi-national Lottery Operator

✔

✔

✔

✔

allwyn

17.3%

45.1%

18.2%

66.2%

2

2021 Cash

Conversion

of 94.4%

€19bn wagered

with 9.4% CAGR

growth projected

FDJ

5.0%

23.9%

8.9%

82.1%

Single market lottery operators

~€19bn 2021A wagered with

mid-single digit CAGR growth projected

Source: Company information, H2GC, Capital IQ as of 20-May-22

Note: All financials calendarized to Dec-YE unless otherwise stated.

1)

The award of the UKNL license is currently being contested in a legal challenge. Unless the challenge is successful, Allwyn Entertainment Ltd will be confirmed as the incoming UKNL operator and, subject to a successful period of transition, would

become the operator of the UKNL with effect from February 2024

Based on pro rata Allwyn financials sourced from management estimates (subject to material change)

3

Lottery and Keno segments only; historical values based on reported company financials; forecast values based on estimates for Tabcorp Lottery and Keno segment published by a single equity research broker in Mar-22, sourced from Refinitiv.

Tabcorp financials and fiscal year as of Jun-YE.

Refers to revenue instead of NGR, as NGR not applicable

Adj. EBITDA margin calculated with respect to revenue instead of NGR, as NGR not applicable

Defined as Adj. EBITDA - capex / Adj. EBITDA. For Tabcorp, represents all business segments, not just the Lottery and Keno segment

Represents Australia lottery market

Tabcorp

Lottery

5.2%4

21.0%5

9.6%

82.5%6

1

I

~AU$7bn 2021A wagered with

mid-single digit CAGR projected7

✔✔Superior performance allwynView entire presentation