Nerdy Investor Presentation Deck

1.

2.

3.

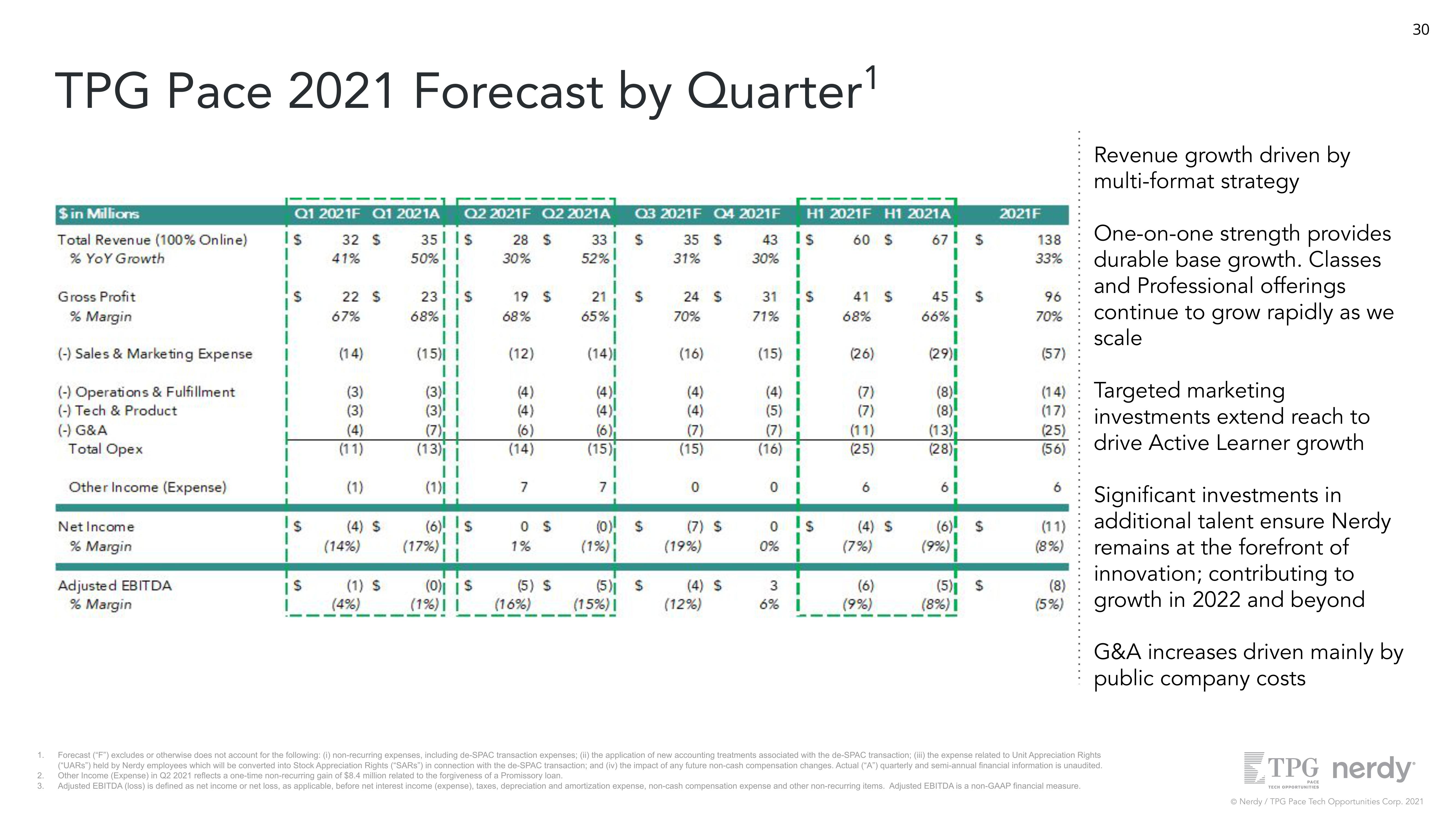

TPG Pace 2021 Forecast by Quarter¹

$ in Millions

Total Revenue (100% Online)

% YoY Growth

Gross Profit

% Margin

(-) Sales & Marketing Expense

(-) Operations & Fulfillment

(-) Tech & Product

(-) G&A

Total Opex

Other Income (Expense)

Net Income

% Margin

Adjusted EBITDA

% Margin

Q1 2021F Q1 2021A

Is

I

$

IS

I

32 S

41%

22 S

67%

(14)

(3)

(3)

(4)

(11)

(1)

(4) S

(14%)

(1) S

(4%)

351 Is

50% I

23

68%

||

||

11

(15) I

(3)!

(3)

(7)

(13) I

||

(1) I

Q2 2021F Q2 2021A Q3 2021F Q4 2021F

28 S

30%

33 $

52% 1

1

35 $

31%

(17%)

(6)! Is

IT

(0)| | S

(1%) | I

19 S

68%

(12)

(4)

4

(6)

(14)

7

0 $

1%

(5) S

(16%)

21

65%

1

(14)|

1

(4)

(4)!

(6)

(15)

71

(1%)

$

$

(5) S

(15%) I

24 S

70%

(16)

(4)

(4)

(7)

(15)

0

(7) S

(19%)

(4) S

(12%)

43

30%

31

71%

(4)

(5)

(7)

(16)

(15) I

0

0

0%

H1 2021F H1 2021A

60 S

Is

m de

I

I

1

S

S

1

3 I

6% I

41 S

68%

(26)

(7)

(7)

(11)

(25)

6

(4) S

(7%)

(6)

(9%)

67 S

I

I

45

66%

1

(29)

I

(8)

(8)

(13)

(28)

I

61

1

10

(6)! S

(9%)

(5) S

(8%) 1

2021F

138

33%

96

70%

(57)

(11)

(8%)

Revenue growth driven by

multi-format strategy

(14) Targeted marketing

(17)

(25)

(56)

(8)

(5%)

One-on-one strength provides

durable base growth. Classes

and Professional offerings

continue to grow rapidly as we

scale

investments extend reach to

drive Active Learner growth

Significant investments in

additional talent ensure Nerdy

remains at the forefront of

innovation; contributing to

growth in 2022 and beyond

G&A increases driven mainly by

public company costs

Forecast ("F") excludes or otherwise does not account for the following: (i) non-recurring expenses, including de-SPAC transaction expenses; (ii) the application of new accounting treatments associated with the de-SPAC transaction; (iii) the expense related to Unit Appreciation Rights

("UARS") held by Nerdy employees which will be converted into Stock Appreciation Rights ("SARS") in connection with the de-SPAC transaction; and (iv) the impact of any future non-cash compensation changes. Actual ("A") quarterly and semi-annual financial information is unaudited.

Other Income (Expense) in Q2 2021 reflects a one-time non-recurring gain of $8.4 million related to the forgiveness of a Promissory loan.

Adjusted EBITDA (loss) is defined as net income or net loss, as applicable, before net interest income (expense), taxes, depreciation and amortization expense, non-cash compensation expense and other non-recurring items. Adjusted EBITDA is a non-GAAP financial measure.

30

STPG nerdy

PACE

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation