Altus Power SPAC Presentation Deck

Elite Sponsor Support from Blackstone

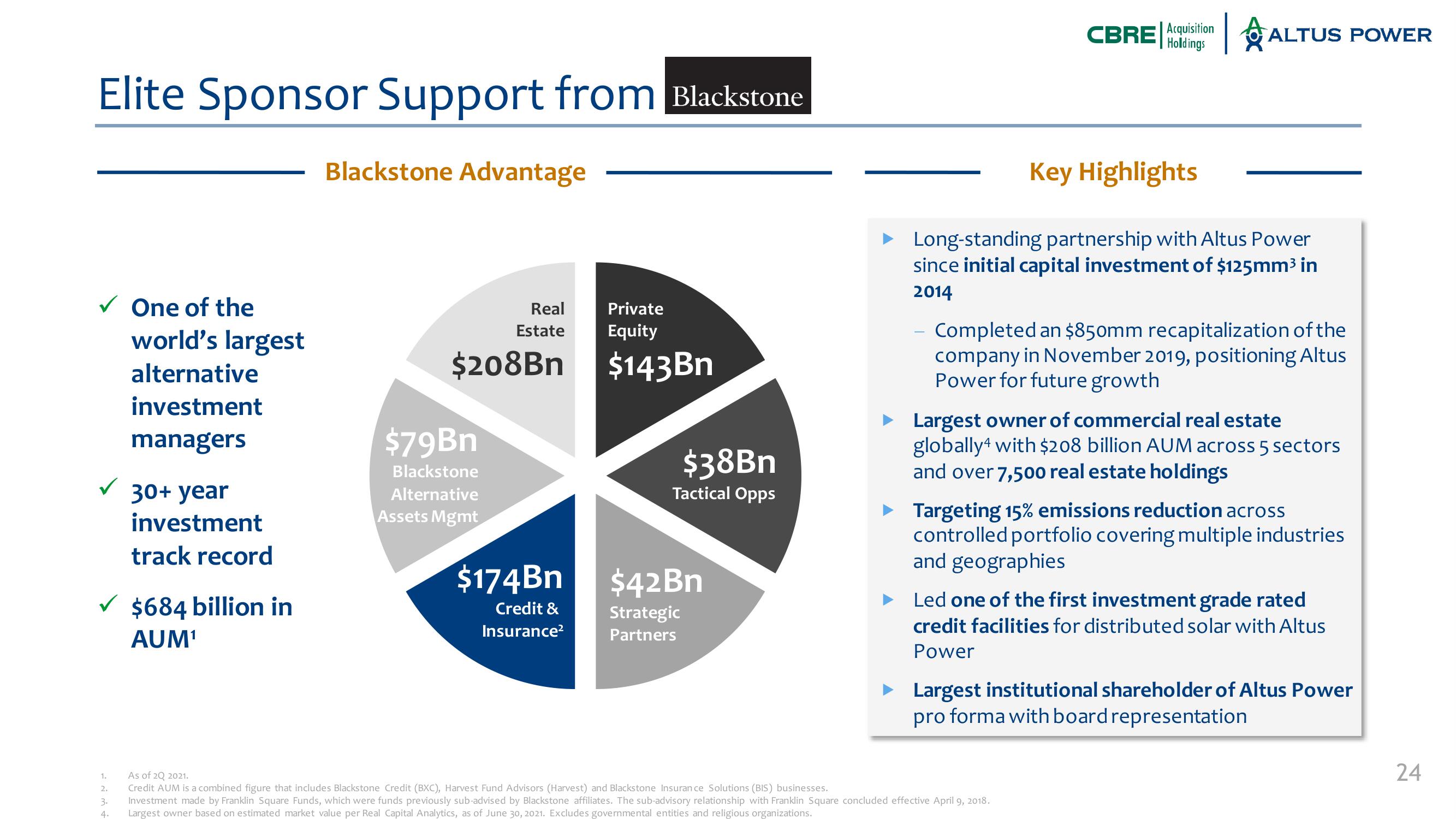

One of the

world's largest

alternative

investment

managers

30+ year

investment

track record

✓ $684 billion in

AUM¹

Blackstone Advantage

Real

Estate

$208Bn

$79Bn

Blackstone

Alternative

Assets Mgmt

$174Bn

Credit &

Insurance²

Private

Equity

$143Bn

$38Bn

Tactical Opps

$42Bn

Strategic

Partners

-

CBRE Acquisition ALTUS POWER

Holdings

► Long-standing partnership with Altus Power

since initial capital investment of $125mm³ in

2014

Key Highlights

Completed an $850mm recapitalization of the

company in November 2019, positioning Altus

Power for future growth

Largest owner of commercial real estate

globally4 with $208 billion AUM across 5 sectors

and over 7,500 real estate holdings

Targeting 15% emissions reduction across

controlled portfolio covering multiple industries

and geographies

Led one of the first investment grade rated

credit facilities for distributed solar with Altus

Power

1.

As of 2Q 2021.

2.

Credit AUM is a combined figure that includes Blackstone Credit (BXC), Harvest Fund Advisors (Harvest) and Blackstone Insurance Solutions (BIS) businesses.

3.

Investment made by Franklin Square Funds, which were funds previously sub-advised by Blackstone affiliates. The sub-advisory relationship with Franklin Square concluded effective April 9, 2018.

4. Largest owner based on estimated market value per Real Capital Analytics, as of June 30, 2021. Excludes governmental entities and religious organizations.

Largest institutional shareholder of Altus Power

pro forma with board representation

24View entire presentation