Commercial Metals Company Results Presentation Deck

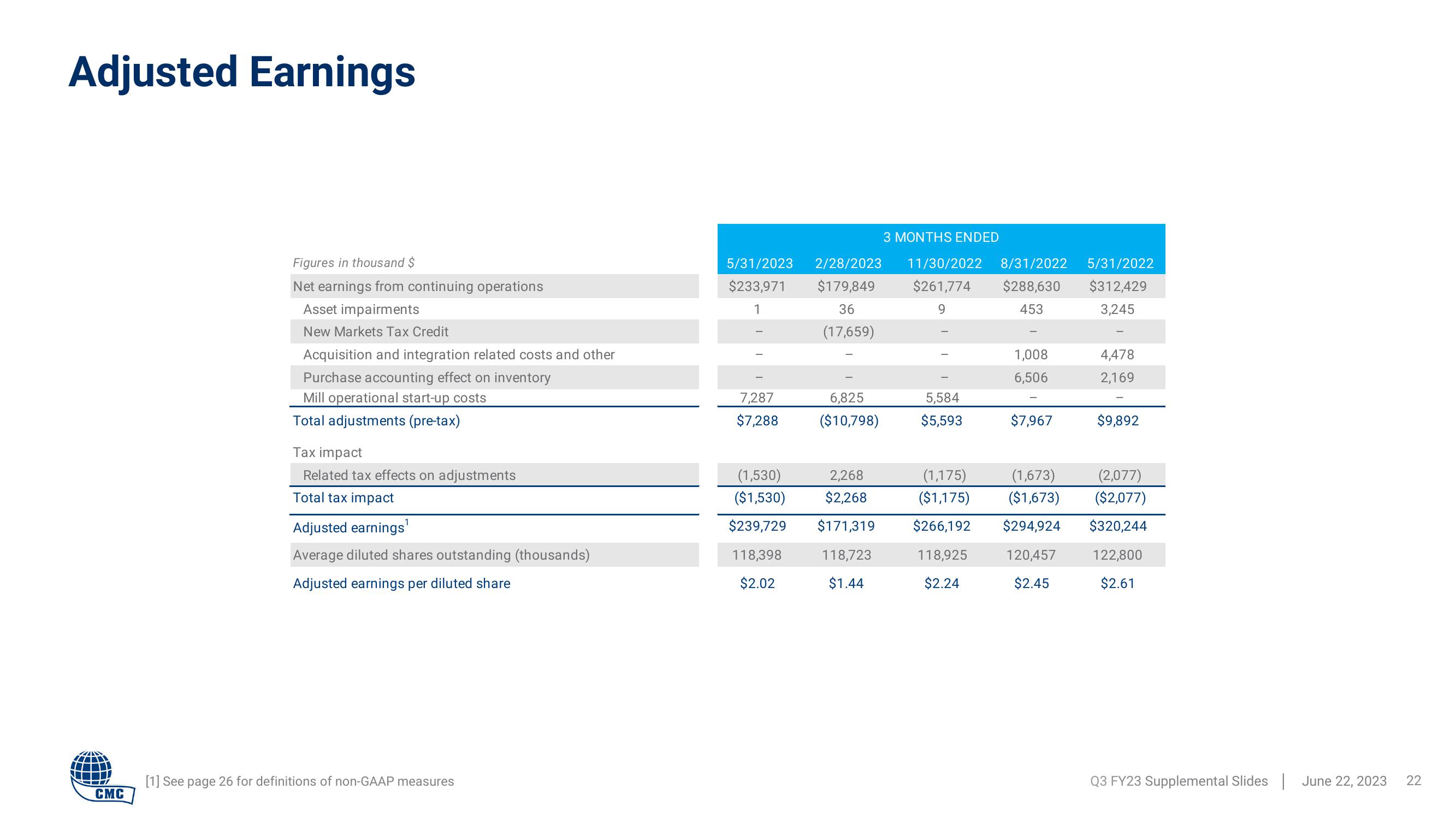

Adjusted Earnings

CMC

Figures in thousand $

Net earnings from continuing operations

Asset impairments

New Markets Tax Credit

Acquisition and integration related costs and other

Purchase accounting effect on inventory

Mill operational start-up costs

Total adjustments (pre-tax)

Tax impact

Related tax effects on adjustments

Total tax impact

Adjusted earnings¹

Average diluted shares outstanding (thousands)

Adjusted earnings per diluted share

[1] See page 26 for definitions of non-GAAP measures

5/31/2023 2/28/2023

$233,971 $179,849

1

36

(17,659)

7,287

$7,288

(1,530)

($1,530)

$239,729

118,398

$2.02

6,825

($10,798)

2,268

$2,268

$171,319

118,723

$1.44

3 MONTHS ENDED

11/30/2022 8/31/2022

$261,774 $288,630

9

453

5,584

$5,593

1,008

6,506

$7,967

(1,175) (1,673)

($1,175) ($1,673)

$266,192 $294,924

118,925 120,457

$2.45

$2.24

5/31/2022

$312,429

3,245

4,478

2,169

$9,892

(2,077)

($2,077)

$320,244

122,800

$2.61

Q3 FY23 Supplemental Slides June 22, 2023

22View entire presentation